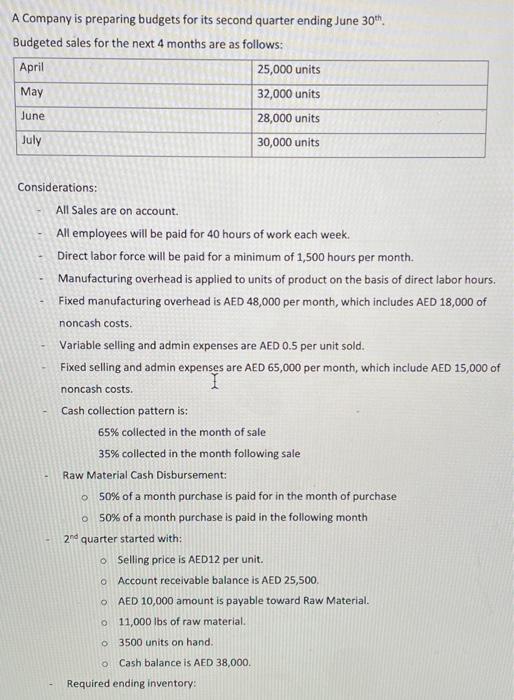

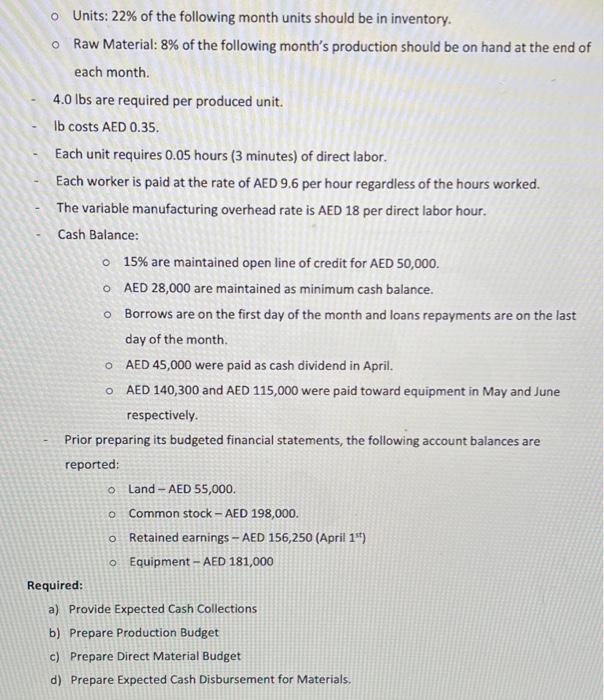

A Company is preparing budgets for its second quarter ending June 30th Budgeted sales for the next 4 months are as follows: April 25,000 units May 32,000 units June 28,000 units July 30,000 units Considerations: All Sales are on account. All employees will be paid for 40 hours of work each week. Direct labor force will be paid for a minimum of 1,500 hours per month Manufacturing overhead is applied to units of product on the basis of direct labor hours. Fixed manufacturing overhead is AED 48,000 per month, which includes AED 18,000 of noncash costs. Variable selling and admin expenses are AED 0.5 per unit sold. Fixed selling and admin expenses are AED 65,000 per month, which include AED 15,000 of noncash costs. Cash collection pattern is: 65% collected in the month of sale 35% collected in the month following sale Raw Material Cash Disbursement: 50% of a month purchase is paid for in the month of purchase 50% of a month purchase is paid in the following month 2nd quarter started with: o Selling price is AED12 per unit. Account receivable balance is AED 25,500 o AED 10,000 amount is payable toward Raw Material. o 0 0 11,000 lbs of raw material. O 3500 units on hand. O Cash balance is AED 38,000. Required ending inventory: o Units: 22% of the following month units should be in inventory. o Raw Material: 8% of the following month's production should be on hand at the end of each month. 4.0 lbs are required per produced unit. Ib costs AED 0.35. Each unit requires 0.05 hours (3 minutes) of direct labor. Each worker is paid at the rate of AED 9.6 per hour regardless of the hours worked. The variable manufacturing overhead rate is AED 18 per direct labor hour. Cash Balance: 15% are maintained open line of credit for AED 50,000. O AED 28,000 are maintained as minimum cash balance. o Borrows are on the first day of the month and loans repayments are on the last day of the month AED 45,000 were paid as cash dividend in April. AED 140,300 and AED 115,000 were paid toward equipment in May and June respectively. Prior preparing its budgeted financial statements, the following account balances are reported: o Land - AED 55,000. o Common stock - AED 198,000. Retained earnings - AED 156,250 (April 15) o Equipment - AED 181,000 Required: a) Provide Expected Cash Collections b) Prepare Production Budget c) Prepare Direct Material Budget d) Prepare Expected Cash Disbursement for Materials, O O