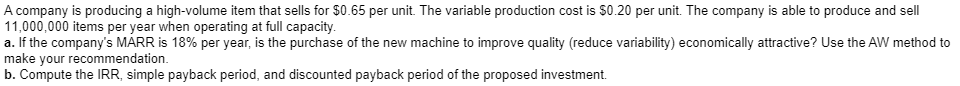

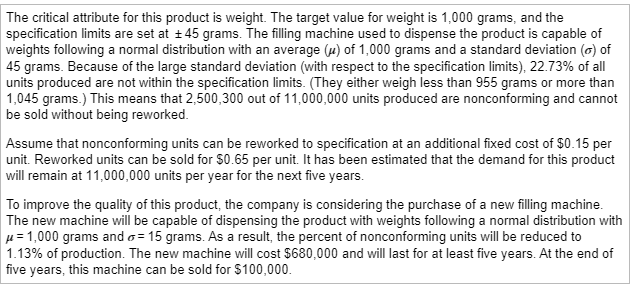

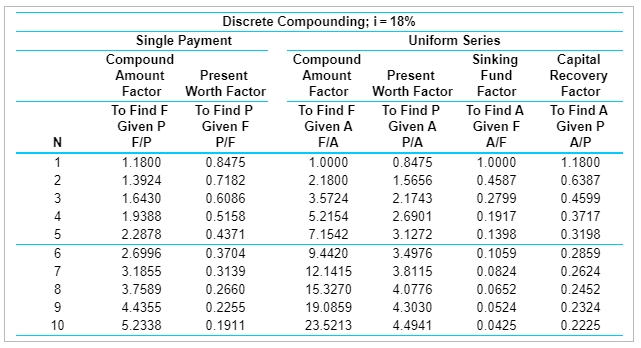

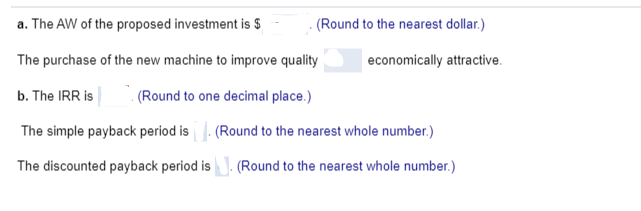

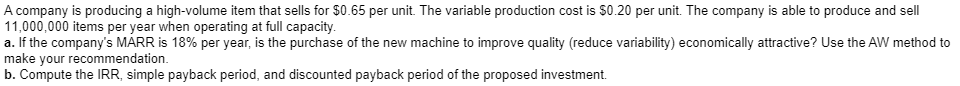

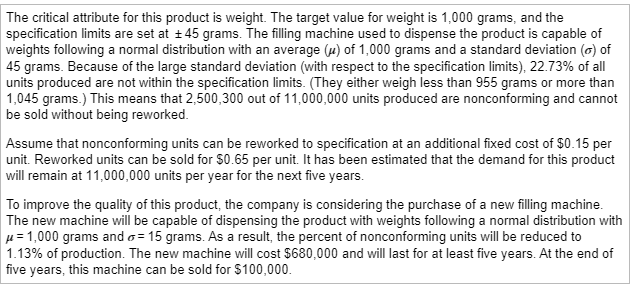

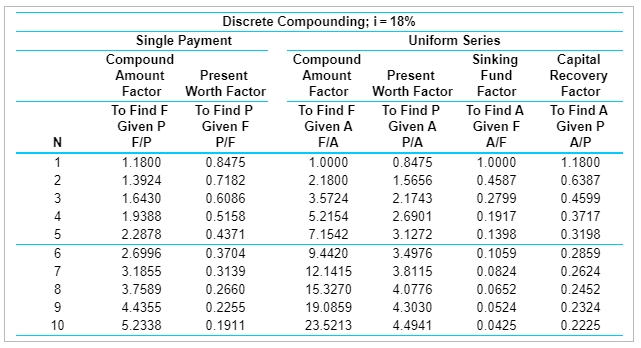

A company is producing a high-volume item that sells for $0.65 per unit. The variable production cost is $0.20 per unit. The company is able to produce and sell 11,000,000 items per year when operating at full capacity. a. If the company's MARR is 18% per year, is the purchase of the new machine to improve quality (reduce variability) economically attractive? Use the AW method to make your recommendation. b. Compute the IRR, simple payback period, and discounted payback period of the proposed investment. The critical attribute for this product is weight. The target value for weight is 1,000 grams, and the specification limits are set at +45 grams. The filling machine used to dispense the product is capable of weights following a normal distribution with an average (u) of 1,000 grams and a standard deviation () of 45 grams. Because of the large standard deviation (with respect to the specification limits), 22.73% of all units produced are not within the specification limits. (They either weigh less than 955 grams or more than 1,045 grams.) This means that 2,500,300 out of 11,000,000 units produced are nonconforming and cannot be sold without being reworked. Assume that nonconforming units can be reworked to specification at an additional fixed cost of $0.15 per unit. Reworked units can be sold for $0.65 per unit. It has been estimated that the demand for this product will remain at 11,000,000 units per year for the next five years. To improve the quality of this product, the company is considering the purchase of a new filling machine. The new machine will be capable of dispensing the product with weights following a normal distribution with u = 1,000 grams and o= 15 grams. As a result, the percent of nonconforming units will be reduced to 1.13% of production. The new machine will cost $680,000 and will last for at least five years. At the end of five years, this machine can be sold for $100,000 N Discrete Compounding; i = 18% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P PIE FIA PIA A/F 1.1800 0.8475 1.0000 0.8475 1.0000 1.3924 0.7182 2.1800 1.5656 0.4587 1.6430 0.6086 3.5724 2.1743 0.2799 1.9388 0.5158 5.2154 2.6901 0.1917 2.2878 0.4371 7.1542 3.1272 0.1398 2.6996 0.3704 9.4420 3.4976 0.1059 3.1855 0.3139 12.1415 3.8115 0.0824 3.7589 0.2660 15.3270 4.0776 0.0652 4.4355 0.2255 19.0859 4.3030 0.0524 5.2338 0.1911 23.5213 4.4941 0.0425 2 3 4 5 Capital Recovery Factor To Find A Given P A/P 1.1800 0.6387 0.4599 0.3717 0.3198 0.2859 0.2624 0.2452 0.2324 0.2225 7 8 9 10 a. The AW of the proposed investment is $ (Round to the nearest dollar.) The purchase of the new machine to improve quality economically attractive b. The IRR is (Round to one decimal place.) The simple payback period is (Round to the nearest whole number.) The discounted payback period is J. (Round to the nearest whole number.)