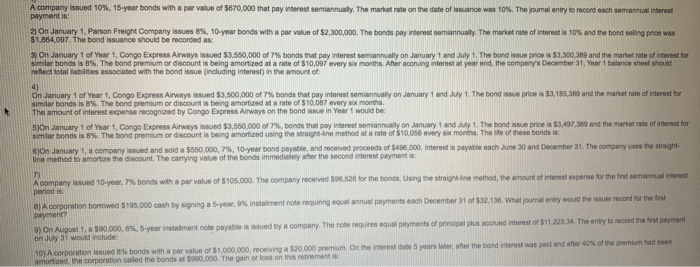

A company issued 10%. 15 year bonds with a par value of $670,000 that pay interest semiannually. The market rate on the date of issuance was 10%. The Journal entry to record each semiannual interest payment is 21 on January 1, Pansion Freight Company issues 8%. 10-year bonds with a par value of $2,300,000. The bonds pay interest semiannually. The market rate of interest is 10% and the bord selling price was $1,864,097. The bond issuance should be recorded as: 31 on January 1 of Year 1. Congo Express Airways issued $3,560,000 of 7% bonds that pay interest semiannually on January 1 and July 1. The bond issue price is $3,300,389 and the market rate of interest for Similar bonds is 8%. The bond premium or discount is being amortized at a rate of $10,097 every six months. After accruing interest a year end, the company's December 31, Year 1 balance sheet should reflect total abilities associated with the bond issue (including interest) in the amount of 4) On January 1 of Year 1, Congo Express Airways issued $3,500,000 of 7% bonds that pay interest semiannually on January 1 and July 1. The bond issue price is $3,185,380 and the market rate of interest for similar bands is 8%. The bond premium or discount is being amortized at a rate of $10,017 every six months The amount of interest expense recognized by Congo Express Airways on the bonds in Year 1 would be: 5)On January 1 of Year 1, Congo Express Airways issued $3,550,000 of 7% bonds that pay interest semiannually on January 1 and July 1. The bond issue price is $3,497,389 and the market rate of interest for similar bonds is 8%. The bond premium or discount is being amortized using the straighine method at a rate of $10.058 every six months. The life of these bonds is: 8)On January 1, a company issued and sold a $550.000,7%, 10-year bond payable, and received proceeds of 5496.000. Interest is payable each June 30 and December 31. The company uses the straight- line method to amortize the discount. The carrying value of the bonds immediately after the second interest payment is A company issued 10-year, 7% bonds with a par value of $105,000. The company received 806,526 for the bonds. Using the straight line method, the amount of interest expense for the first semiannual interest period is A corporation borrowed $195,000 cash by signing a you,9% installment note requiring equal annual payments each December 31 of 532,196. What journal entry would be ser record for the first payment 9) On August 1.500.000,0%, 5-year installment note payable is issued by a company. The note regures equal payments of principal plus accrued interest of $11.223.1. The entry to record the first payment on July 31 would include 10) A corporation issued bonds with a par value of $1.000.000, receiving a $20.000 premium. On the interest date 5 years later, after the band interest was paid and after 40% of the premium had been morted the corporation called the bonds at 5990,000. The gain or loss on this retirements A company issued 10%. 15 year bonds with a par value of $670,000 that pay interest semiannually. The market rate on the date of issuance was 10%. The Journal entry to record each semiannual interest payment is 21 on January 1, Pansion Freight Company issues 8%. 10-year bonds with a par value of $2,300,000. The bonds pay interest semiannually. The market rate of interest is 10% and the bord selling price was $1,864,097. The bond issuance should be recorded as: 31 on January 1 of Year 1. Congo Express Airways issued $3,560,000 of 7% bonds that pay interest semiannually on January 1 and July 1. The bond issue price is $3,300,389 and the market rate of interest for Similar bonds is 8%. The bond premium or discount is being amortized at a rate of $10,097 every six months. After accruing interest a year end, the company's December 31, Year 1 balance sheet should reflect total abilities associated with the bond issue (including interest) in the amount of 4) On January 1 of Year 1, Congo Express Airways issued $3,500,000 of 7% bonds that pay interest semiannually on January 1 and July 1. The bond issue price is $3,185,380 and the market rate of interest for similar bands is 8%. The bond premium or discount is being amortized at a rate of $10,017 every six months The amount of interest expense recognized by Congo Express Airways on the bonds in Year 1 would be: 5)On January 1 of Year 1, Congo Express Airways issued $3,550,000 of 7% bonds that pay interest semiannually on January 1 and July 1. The bond issue price is $3,497,389 and the market rate of interest for similar bonds is 8%. The bond premium or discount is being amortized using the straighine method at a rate of $10.058 every six months. The life of these bonds is: 8)On January 1, a company issued and sold a $550.000,7%, 10-year bond payable, and received proceeds of 5496.000. Interest is payable each June 30 and December 31. The company uses the straight- line method to amortize the discount. The carrying value of the bonds immediately after the second interest payment is A company issued 10-year, 7% bonds with a par value of $105,000. The company received 806,526 for the bonds. Using the straight line method, the amount of interest expense for the first semiannual interest period is A corporation borrowed $195,000 cash by signing a you,9% installment note requiring equal annual payments each December 31 of 532,196. What journal entry would be ser record for the first payment 9) On August 1.500.000,0%, 5-year installment note payable is issued by a company. The note regures equal payments of principal plus accrued interest of $11.223.1. The entry to record the first payment on July 31 would include 10) A corporation issued bonds with a par value of $1.000.000, receiving a $20.000 premium. On the interest date 5 years later, after the band interest was paid and after 40% of the premium had been morted the corporation called the bonds at 5990,000. The gain or loss on this retirements