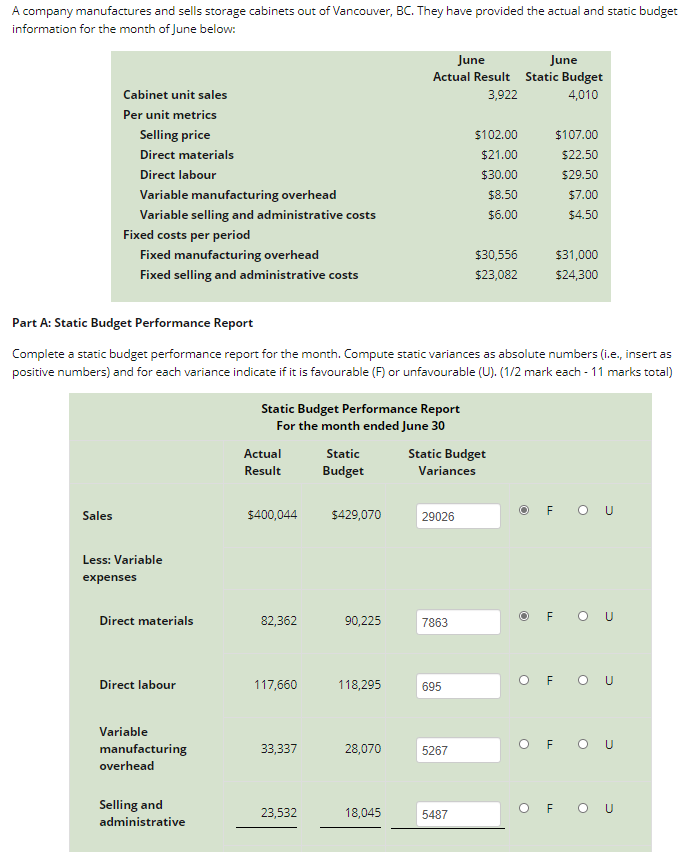

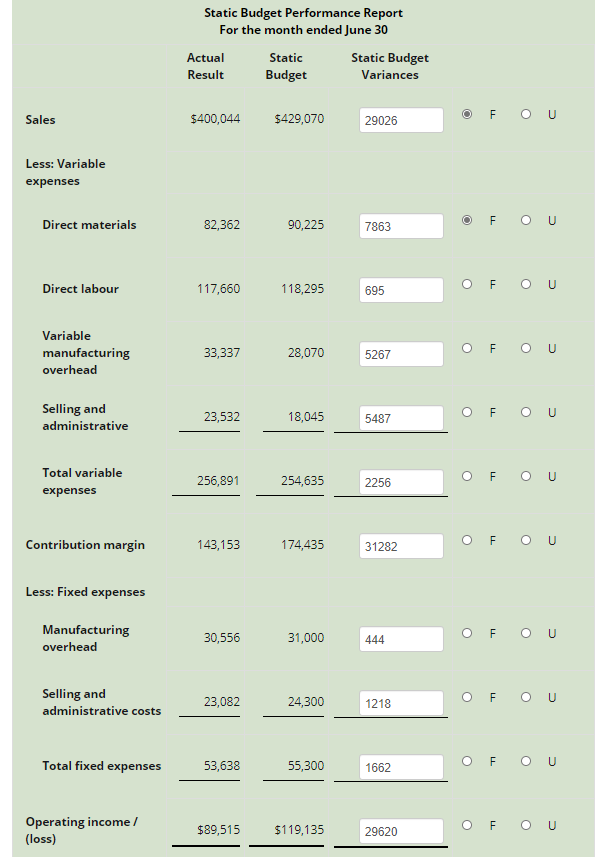

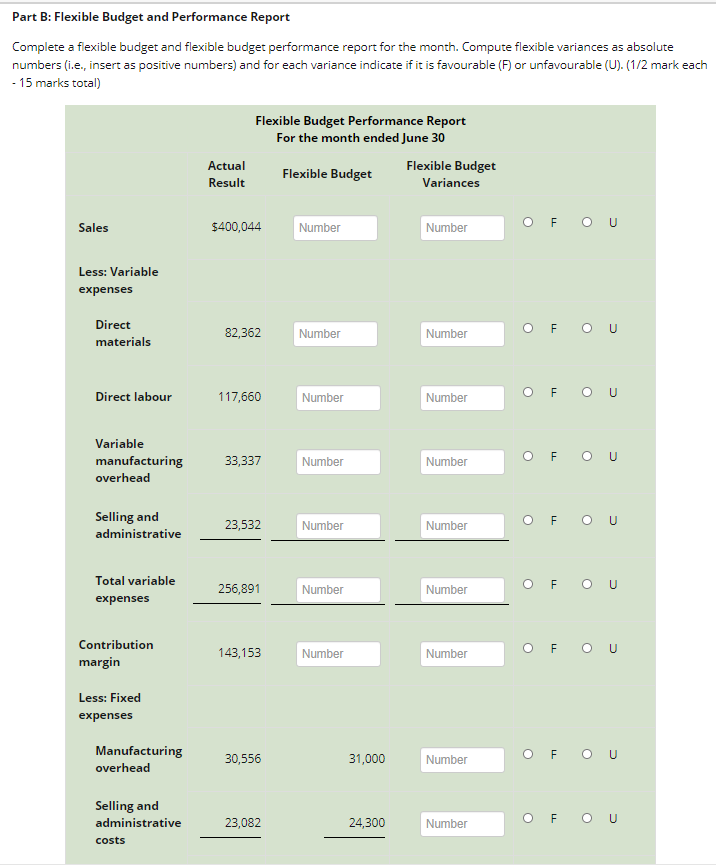

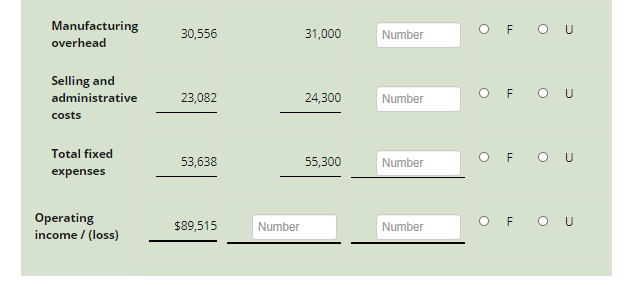

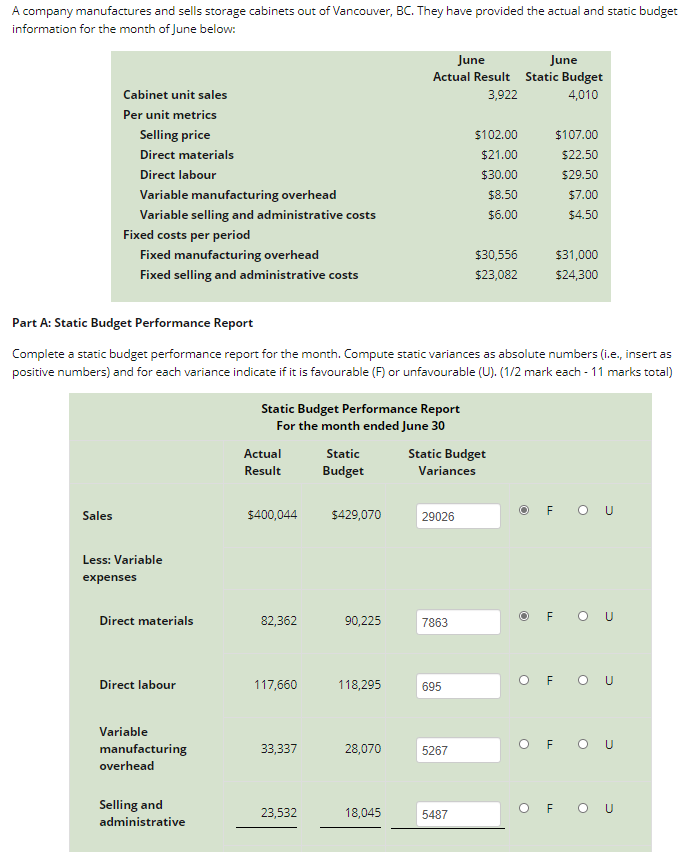

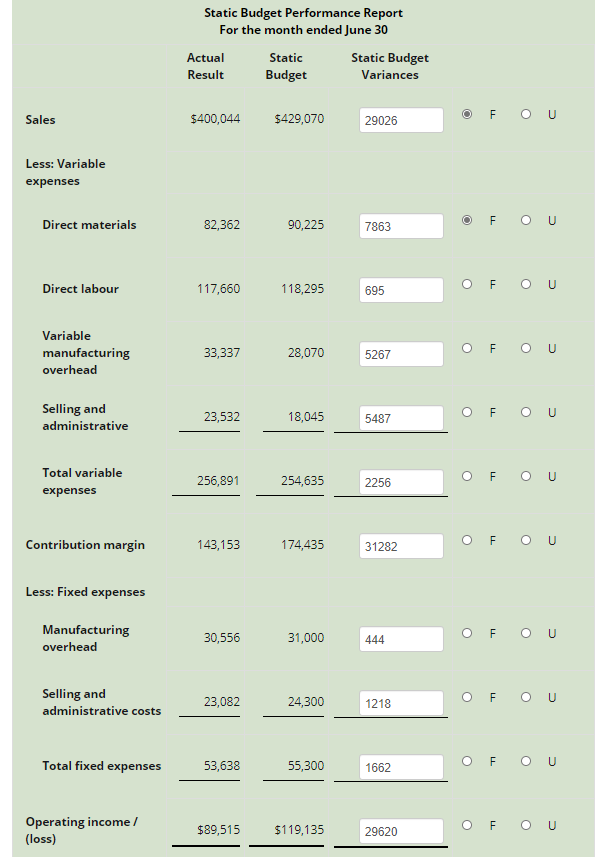

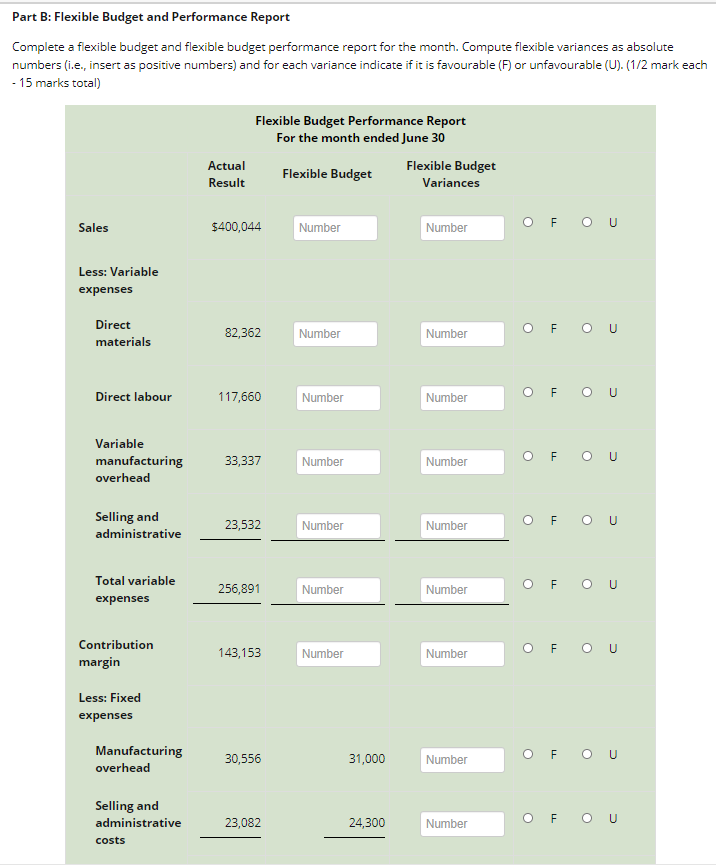

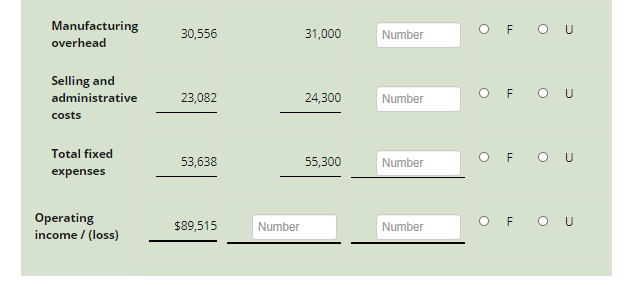

A company manufactures and sells storage cabinets out of Vancouver, BC. They have provided the actual and static budget information for the month of June below: June June Actual Result Static Budget Cabinet unit sales 3,922 4,010 Per unit metrics Selling price $102.00 $107.00 Direct materials $22.50 Direct labour $30.00 $29.50 Variable manufacturing overhead $8.50 $7.00 Variable selling and administrative costs $6.00 $4.50 Fixed costs per period Fixed manufacturing overhead $30,556 $31,000 Fixed selling and administrative costs $23,082 $24,300 $21.00 Part A: Static Budget Performance Report Complete a static budget performance report for the month. Compute static variances as absolute numbers (i.e., insert as positive numbers) and for each variance indicate if it is favourable (F) or unfavourable (U). (1/2 mark each - 11 marks total) Static Budget Performance Report For the month ended June 30 Actual Static Static Budget Result Budget Variances Sales $400,044 $429,070 29026 F OU Less: Variable expenses Direct materials 82,362 90,225 O F ou 7863 Direct labour 117,660 118,295 695 OF OU Variable manufacturing overhead 33,337 28,070 5267 OF OU Selling and administrative 23,532 18,045 5487 OF OU Static Budget Performance Report For the month ended June 30 Actual Static Static Budget Result Budget Variances o Sales $400,044 $429,070 29026 F Less: Variable expenses Direct materials 82,362 90,225 7863 FOU Direct labour 117,660 118,295 695 OF OU Variable manufacturing overhead 33,337 28,070 5267 OF OU Selling and administrative 23,532 18,045 5487 OF OU Total variable expenses 256,891 254,635 2256 OF OU Contribution margin 143,153 174,435 31282 OF OU Less: Fixed expenses Manufacturing overhead 30,556 31,000 444 OF OU Selling and administrative costs 23,082 24,300 1218 OF OU Total fixed expenses 53,638 55,300 OF OU 1662 Operating income (loss) $89,515 $119,135 29620 OF OU Part B: Flexible Budget and Performance Report Complete a flexible budget and flexible budget performance report for the month. Compute flexible variances as absolute numbers (i.e., insert as positive numbers) and for each variance indicate if it is favourable (F) or unfavourable (U). (1/2 mark each - 15 marks total) Flexible Budget Performance Report For the month ended June 30 Flexible Budget Flexible Budget Variances Actual Result Sales $400,044 Number Number OF OU Less: Variable expenses Direct materials 82,362 Number Number OF OU Direct labour 117,660 Number Number OF OU Variable manufacturing overhead 33,337 Number Number OF OU Selling and administrative 23,532 Number Number o F ou Total variable expenses 256,891 Number Number . Fou Contribution margin 143,153 Number Number OF OU Less: Fixed expenses Manufacturing overhead 30,556 31,000 Number OF OU Selling and administrative costs 23,082 24,300 Number OF OU Manufacturing overhead 30,556 31,000 Number OF OU Selling and administrative costs 23,082 24,300 Number OF OU Total fixed expenses 53,638 55,300 Number OF OU Operating income / (loss) $89,515 Number Number OF OU