Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company manufactures three products (A, B and C) and the profit per unit sold is 3, 5 and 6 respectively. Each product has

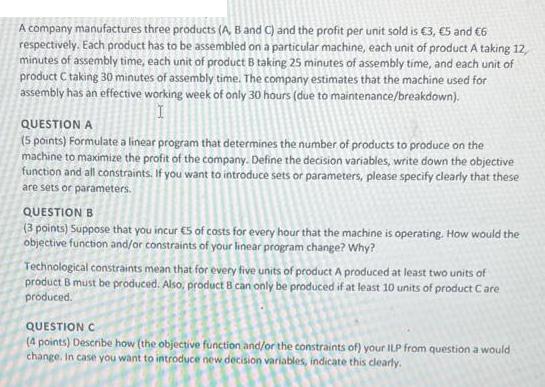

A company manufactures three products (A, B and C) and the profit per unit sold is 3, 5 and 6 respectively. Each product has to be assembled on a particular machine, each unit of product A taking 12, minutes of assembly time, each unit of product B taking 25 minutes of assembly time, and each unit of product C taking 30 minutes of assembly time. The company estimates that the machine used for assembly has an effective working week of only 30 hours (due to maintenance/breakdown). I QUESTION A (5 points) Formulate a linear program that determines the number of products to produce on the machine to maximize the profit of the company. Define the decision variables, write down the objective function and all constraints. If you want to introduce sets or parameters, please specify clearly that these are sets or parameters. QUESTION B (3 points) Suppose that you incur 5 of costs for every hour that the machine is operating. How would the objective function and/or constraints of your linear program change? Why? Technological constraints mean that for every five units of product A produced at least two units of product B must be produced. Also, product 8 can only be produced if at least 10 units of product Care produced. QUESTION C (4 points) Describe how (the objective function and/or the constraints of) your ILP from question a would change. In case you want to introduce new decision variables, indicate this clearly.

Step by Step Solution

★★★★★

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION A Decision Variables Let xA be the number of units of product A to produce xB be the number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started