Answered step by step

Verified Expert Solution

Question

1 Approved Answer

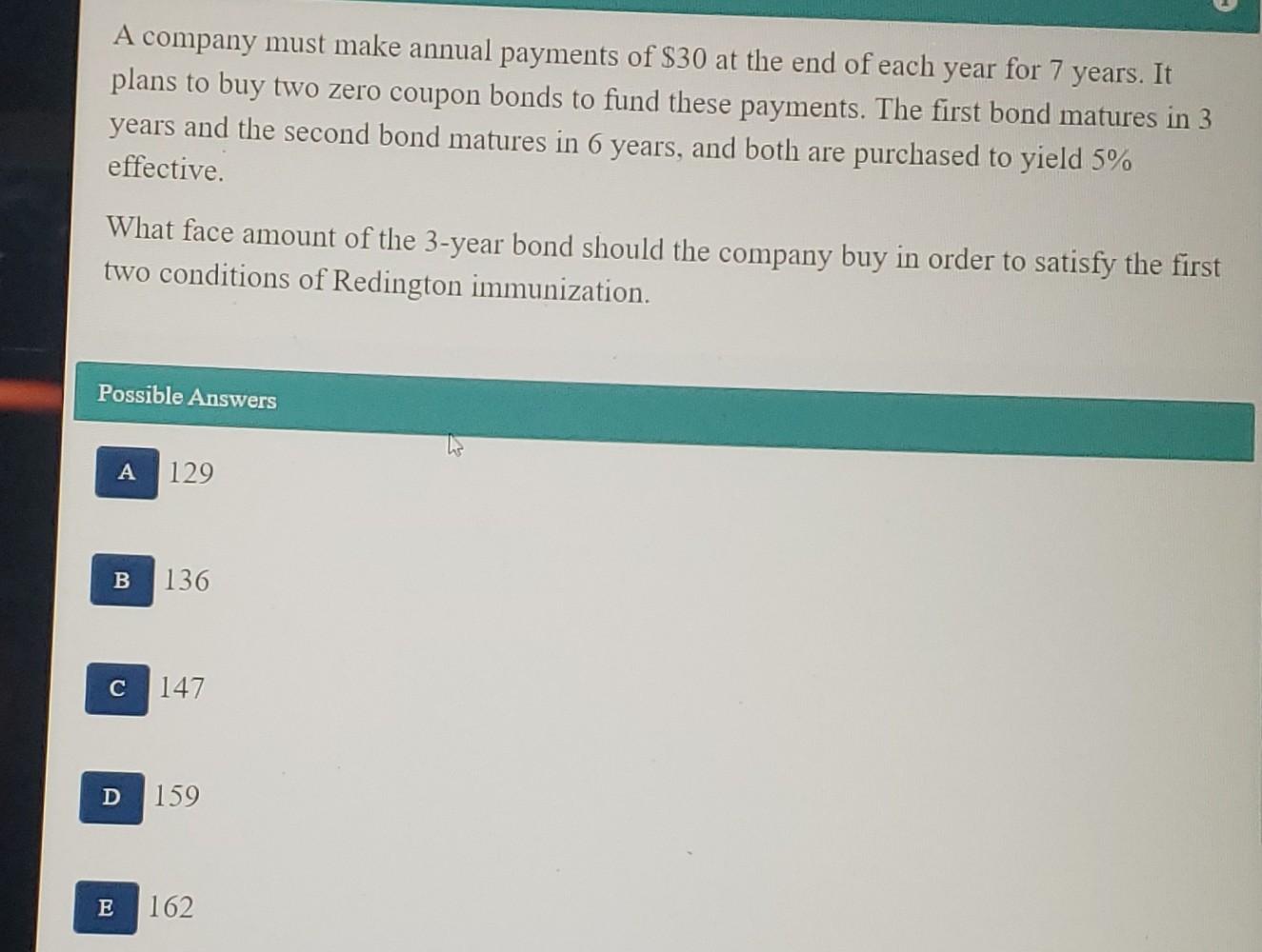

A company must make annual payments of $30 at the end of each year for 7 years. It plans to buy two zero coupon bonds

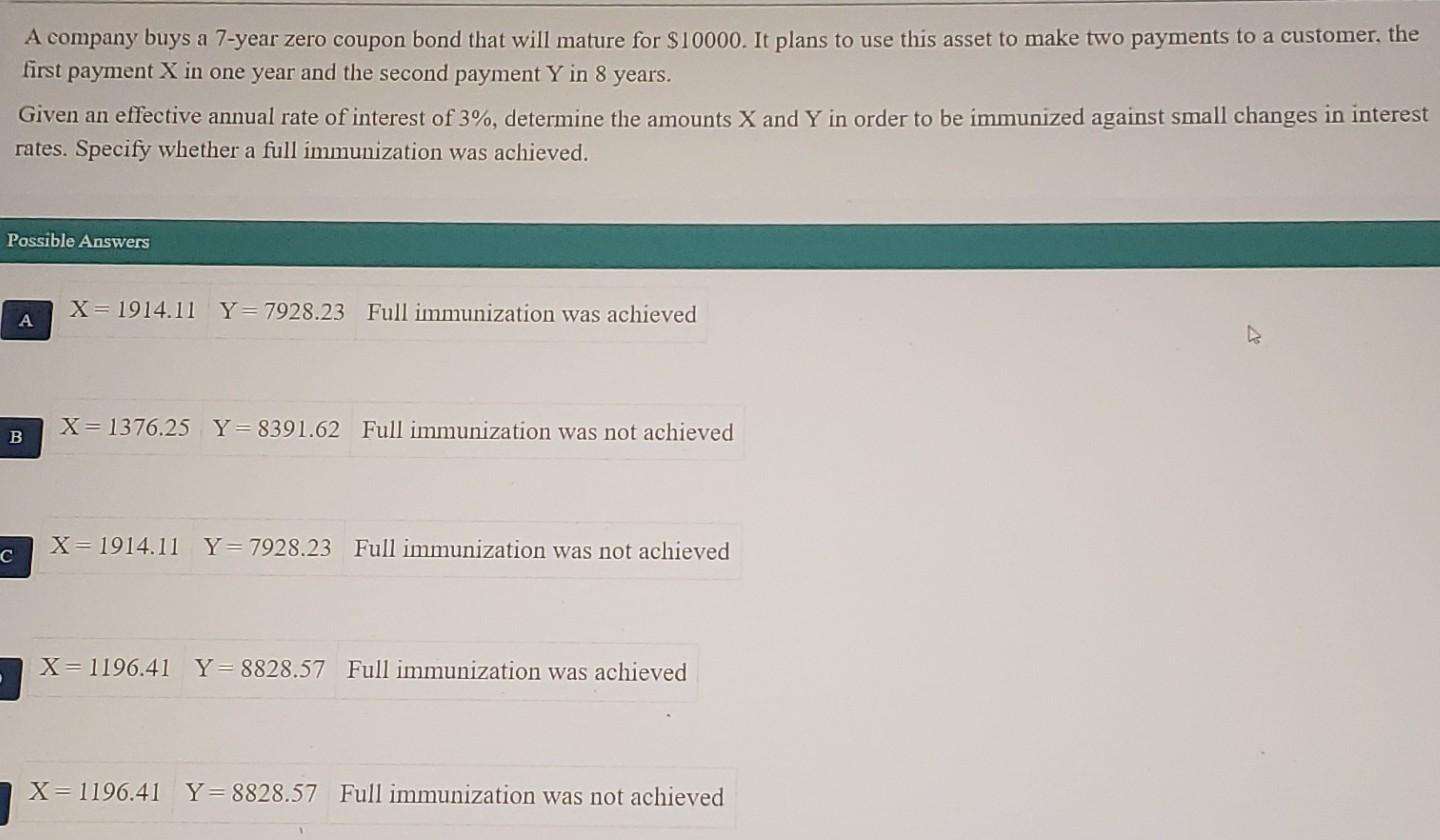

A company must make annual payments of $30 at the end of each year for 7 years. It plans to buy two zero coupon bonds to fund these payments. The first bond matures in 3 years and the second bond matures in 6 years, and both are purchased to yield 5% effective. What face amount of the 3-year bond should the company buy in order to satisfy the first two conditions of Redington immunization. Possible Answers 129 136 147 159 162 A company buys a 7-year zero coupon bond that will mature for $10000. It plans to use this asset to make two payments to a customer, the first payment X in one year and the second payment Y in 8 years. Given an effective annual rate of interest of 3%, determine the amounts X and Y in order to be immunized against small changes in interest rates. Specify whether a full immunization was achieved. Possible Answers X=1914.11Y=7928.23 Full immunization was achieved X=1376.25Y=8391.62 Full immunization was not achieved X=1914.11Y=7928.23 Full immunization was not achieved X=1196.41Y=8828.57 Full immunization was achieved X=1196.41Y=8828.57 Full immunization was not achieved

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started