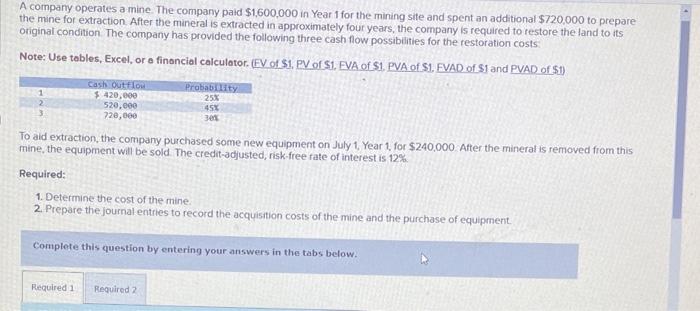

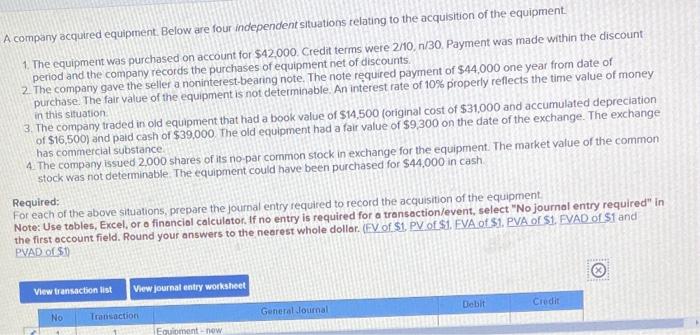

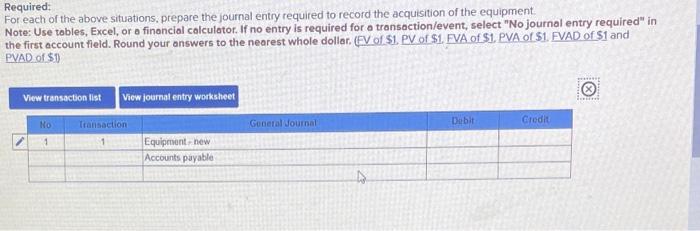

A company operates a mine. The company paid $1,600,000 in Year 1 for the mining site and spent an additional $720,000 to prepare the mine for extraction. After the mineral is extracted in approximately four years, the company is required to restore the land to its original condition. The company has provided the following three cash flow possibilities for the restoration costs: Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, EVA of \$1. PVA of \$1. EVAD of \$1 and PVAD of \$1) To aid extraction, the company purchased some new equipment on July 1, Year 1 , for $240,000. After the mineral is removed from this mine, the equipment will be sold. The credit-adjusted, risk-free fate of interest is 12% Required: 1. Determine the cost of the mine. 2. Prepare the journal entries to record the acquisition costs of the mine and the purchase of equipment. Complete this question by entering your answers in the tabs below. 1. Determine the cost of the mine. 2. Prepare the journal entries to record the acquisition costs of the mine and the purchase of equipment. Complete this question by entering your answers in the tabs below. Determine the cost of the mine. Note: Do not round intermedlate calculations. Round your answer to the nearest whole dollar. Prepare the journal entries to record the acquisition costs of the mine and the purchase of equipment. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest whole dollars. Journal entry worksheet Note: Enter debuts berore creds= A company acquired equipment. Below are four independent situations relating to the acquisition of the equipment. 1. The equipment was purchased on account for $42,000. Credit terms were 2110 , n/30. Payment was made within the discount period and the company records the purchases of equipment net of discounts. 2. The company gave the seller a noninterest-bearing note. The note required payment of $44,000 one year from date of purchase. The fair value of the equipment is not determinable. An interest rate of 10% properly reflects the time value of money in this situation 3. The company traded in old equipment that had a book value of $14,500 (original cost of $31,000 and accumulated depreciation of $16,500) and paid cash of $39,000 The old equipment had a fair value of $9,300 on the date of the exchange. The exchange has commercial substance. 4. The company issued 2.000 shares of its no-par common stock in exchange for the equipment. The market value of the common stock was not determinable. The equipment could have been purchased for $44,000 in cash. Required: For each of the above situations, prepare the journal entry required to record the acquisition of the equipment. Note: Use tobles, Excel, or o financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollor. (EV of \$1. PV of S1. EVA of \$1. PVA of \$1. FVAD of S1 and PVAD of ST) Required: For each of the above situations, prepare the journal entry required to record the acquisition of the equipment: Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar. (FV of \$1. PV of \$1. FVA of \$1. PVA of \$1. FVAD of \$1 and PVAD of \$1)