Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company owns some beachfront property and it is now going to develop this property into a resort. However, the future demand for a

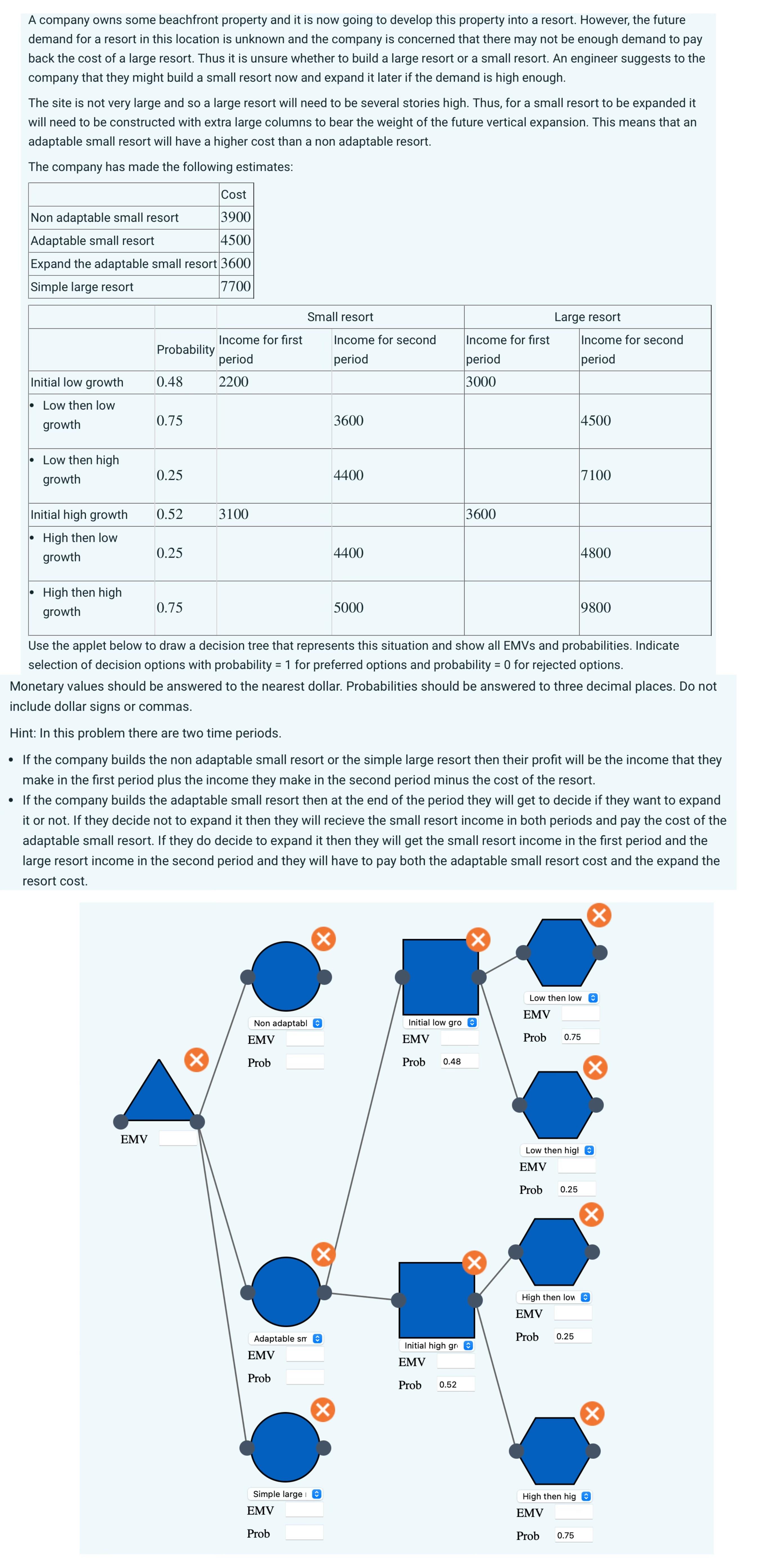

A company owns some beachfront property and it is now going to develop this property into a resort. However, the future demand for a resort in this location is unknown and the company is concerned that there may not be enough demand to pay back the cost of a large resort. Thus it is unsure whether to build a large resort or a small resort. An engineer suggests to the company that they might build a small resort now and expand it later if the demand is high enough. The site is not very large and so a large resort will need to be several stories high. Thus, for a small resort to be expanded it will need to be constructed with extra large columns to bear the weight of the future vertical expansion. This means that an adaptable small resort will have a higher cost than a non adaptable resort. The company has made the following estimates: Cost Non adaptable small resort 3900 Adaptable small resort 4500 Expand the adaptable small resort 3600 Simple large resort 7700 Small resort Large resort Income for first Income for second Income for first Income for second Probability period period period period Initial low growth 0.48 2200 3000 Low then low growth 0.75 3600 4500 Low then high growth 0.25 4400 7100 Initial high growth 0.52 3100 3600 High then low growth 0.25 4400 4800 High then high growth 0.75 5000 9800 Use the applet below to draw a decision tree that represents this situation and show all EMVS and probabilities. Indicate selection of decision options with probability = 1 for preferred options and probability = 0 for rejected options. Monetary values should be answered to the nearest dollar. Probabilities should be answered to three decimal places. Do not include dollar signs or commas. Hint: In this problem there are two time periods. If the company builds the non adaptable small resort or the simple large resort then their profit will be the income that they make in the first period plus the income they make in the second period minus the cost of the resort. If the company builds the adaptable small resort then at the end of the period they will get to decide if they want to expand it or not. If they decide not to expand it then they will recieve the small resort income in both periods and pay the cost of the adaptable small resort. If they do decide to expand it then they will get the small resort income in the first period and the large resort income in the second period and they will have to pay both the adaptable small resort cost and the expand the resort cost. EMV Low then low EMV Non adaptabl EMV Initial low gro EMV Prob 0.75 Prob Prob 0.48 Low then high EMV Prob 0.25 High then low EMV Adaptable sm EMV Prob 0.25 Initial high gr EMV Prob Prob 0.52 Simple large EMV Prob High then hig EMV Prob 0.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started