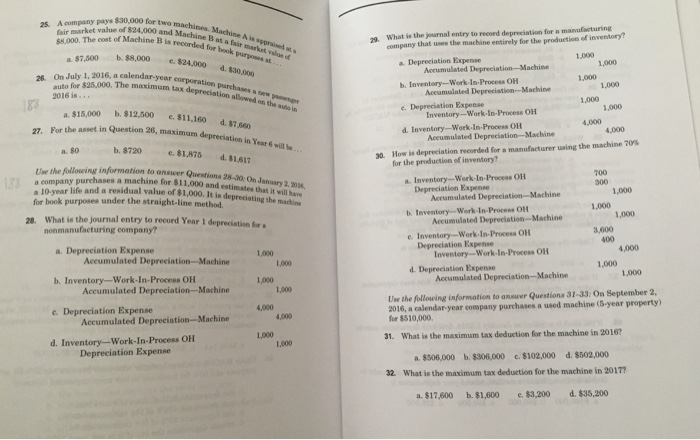

A company pays $30,000 for two machines. Machine A is at a fair market value of $24,000 and Machine B at a fair market value of $80,000. The cost of Machine B is recorded for book purposes at. a. $7, 600 b. $8,000 c. $24,000 d. $30,000 On July 1, 2016, a calendar-year corporation purchases a new auto for $25,000. The maximum tax depreciation allowed on the auto in 2016 is.... a. $15,000 b. $12, 500 c. $11, 160 d. $7, 660 For the asset in Question 26, maximum depreciation in Year 6 will be........ a. $0 b. $720 c. $1, 875 d. $1.617 Use the following information to answer Question 28-30: On January 2, 20%, a company purchases a machine for $11,000 and estimates that it will have a 10-year life and a residual value of $1,000. It is depreciating the machine for book purpose under the straight-line method. What is the journal entry to record Year 1 depreciation for a nonmanufacturing company? a. Depreciation Expense 1,000 Accumulated Depreciation - Machine 1,000 b. Inventory-Work-In-Process OH 1,000 Accumulated Depreciation - Machine 1,000 c. Depreciation Expense 4,000 Accumulated Depreciation - Machine 4,000 d. Inventory-Work -In-Process OH 1,000 Depreciation Expense 1,000 What is the journal entry to record depreciation for a manufacturing company that uses the machine entirely for the production of inventory? a. Depreciation Expense 1,000 Accumulated Depreciation - Machine 1,000 b. Inventory-Work-In-Process OH 1,000 Accumulated Depreciation - Machine 1,000 c. Depreciation Expense 1,000 Inventory-Work-In-Process OH 1,000 d. Inventory-Work-In-Process OH 4,000 Accumulated Depreciation - Machine 4,000 How is depreciation recorded for a manufacturer using the machine 70% for the production of inventory? a. Inventory-Work-In-Process OH 700 Depreciation Expense 300 Accumulated Depreciation - Machine 1,000 b. Inventory-Work-In-Process OH 1,000 Accumulated Depreciation - Machine 1,000 c. Inventory-Work-In-Process OH 3, 600 Depreciation Expense 400 Inventory-Work-In-Process OH 4,000 d. Depreciation Expense 1,000 Accumulated Depreciation - Machine 1,000 Use the following information to answer Question 31-33: On September 2, 2016, a calendar-year company purchases a used machine (5 year property) for $51,000. What is the maximum tax deduction for the machine in 2016? a. $506,000 b.$306,000 c.$102,000 d. $502,000 What is the maximum tax deduction for the machine in 2017? a $17, 600 b. $1, 600 c. $3, 200 d. $35, 200