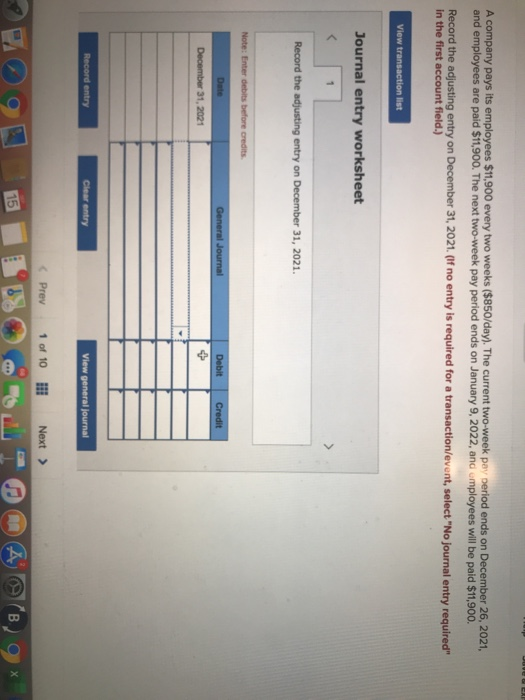

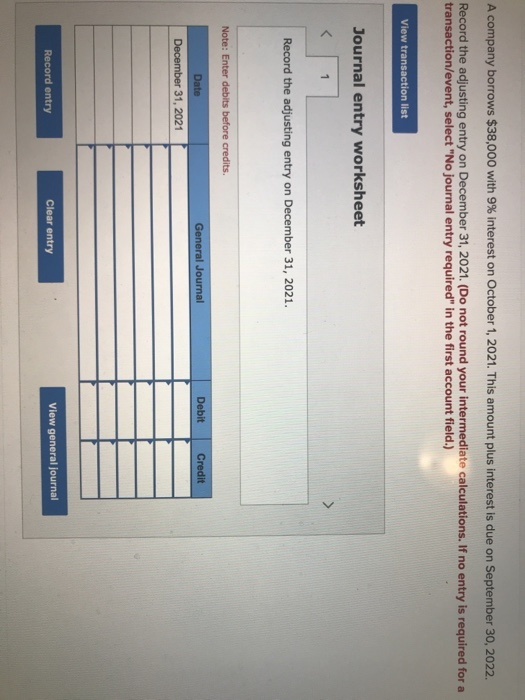

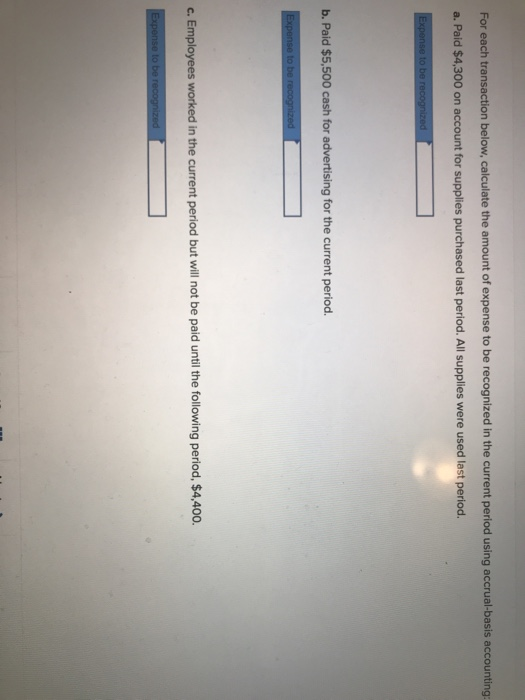

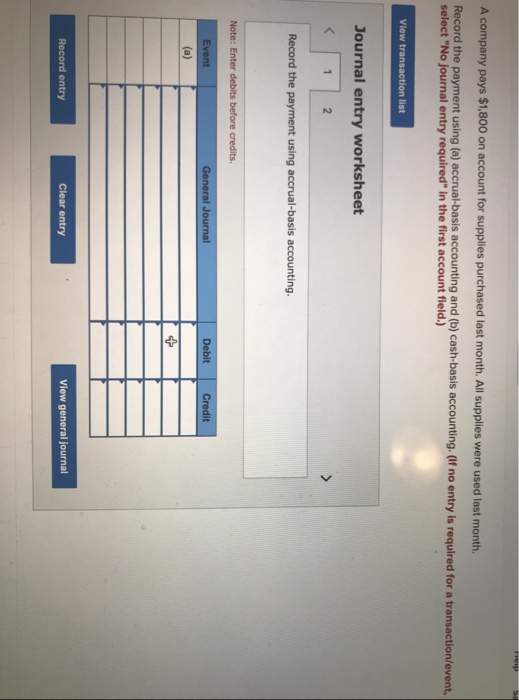

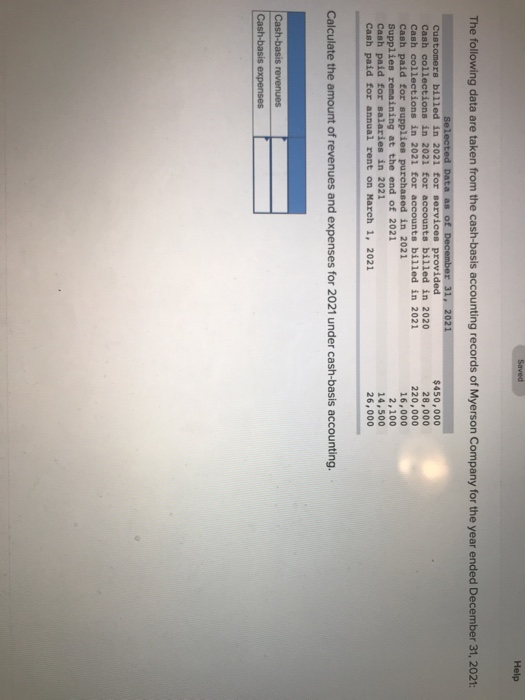

A company pays its employees 511,900 every two weeks (5850/day). The current two-week pay period ends on December 26, 2021 and employees are paid $11.900. The next two-week pay period ends on January 9, 2022, and employees will be paid $11.900. Record the adjusting entry on December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry on December 31, 2021. Note: Enter debits before credits Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general Journal 09 1 596.10 M ) (B) 9: A company borrows $38,000 with 9% interest on October 1, 2021. This amount plus interest is due on September 30, 2022. Record the adjusting entry on December 31, 2021. (Do not round your intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry on December 31, 2021. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2021 Record entry Clear entry View general journal For each transaction below, calculate the amount of expense to be recognized in the current period using accrual-basis accounting: a. Paid $4,300 on account for supplies purchased last period. All supplies were used last period. Expense to be recognized b. Paid $5,500 cash for advertising for the current period. Expense to be recognized c. Employees worked in the current period but will not be paid until the following period, $4,400. Expense to be recognized A company pays $1,800 on account for supplies purchased last month. All supplies were used last month. Record the payment using (a) accrual-basis accounting and (b) cash-basis accounting. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the payment using accrual-basis accounting. Note: Enter debits before credits. Event General Journal Debit Credit (a) Record entry Clear entry View general Journal Saved Help The following data are taken from the cash-basis accounting records of Myerson Company for the year ended December 31, 2021: Selected Data as of December 31, 2021 Customers billed in 2021 for services provided Cash collections in 2021 for accounts billed in 2020 Cash collections in 2021 for accounts billed in 2021 Cash paid for supplies purchased in 2021 Supplies remaining at the end of 2021 Cash paid for salaries in 2021 Cash paid for annual rent on March 1, 2021 $450,000 28,000 220,000 16,000 2,100 14,500 26,000 Calculate the amount of revenues and expenses for 2021 under cash-basis accounting, Cash-basis revenues Cash-basis expenses