Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company produces and sells widgets. Each widget uses 5 units of component A. The company currently makes component A. The assembly department installs component

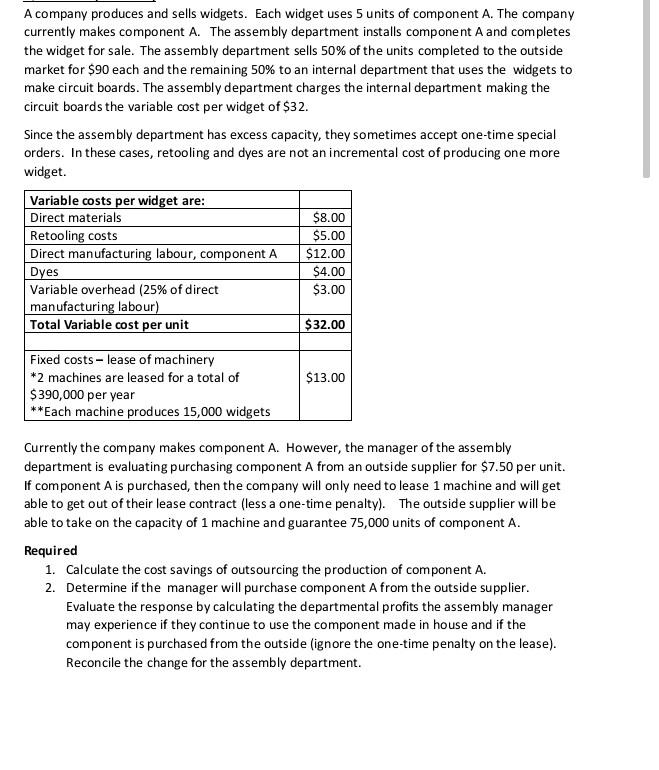

A company produces and sells widgets. Each widget uses 5 units of component A. The company currently makes component A. The assembly department installs component A and completes the widget for sale. The assembly department sells 50% of the units completed to the outside market for $90 each and the remaining 50% to an internal department that uses the widgets to make circuit boards. The assembly department charges the internal department making the circuit boards the variable cost per widget of $32. Since the assembly department has excess capacity, they sometimes accept one-time special orders. In these cases, retooling and dyes are not an incremental cost of producing one more widget. Currently the company makes component A. However, the manager of the assembly department is evaluating purchasing component A from an outside supplier for $7.50 per unit. If component A is purchased, then the company will only need to lease 1 machine and will get able to get out of their lease contract (less a one-time penalty). The outside supplier will be able to take on the capacity of 1 machine and guarantee 75,000 units of component A. Required 1. Calculate the cost savings of outsourcing the production of component A. 2. Determine if the manager will purchase component A from the outside supplier. Evaluate the response by calculating the departmental profits the assembly manager may experience if they continue to use the component made in house and if the component is purchased from the outside (ignore the one-time penalty on the lease). Reconcile the change for the assembly department. 3. Evaluate the impact of purchasing the component A on the company's overall profitability. Will this maximize shareholder value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started