Answered step by step

Verified Expert Solution

Question

1 Approved Answer

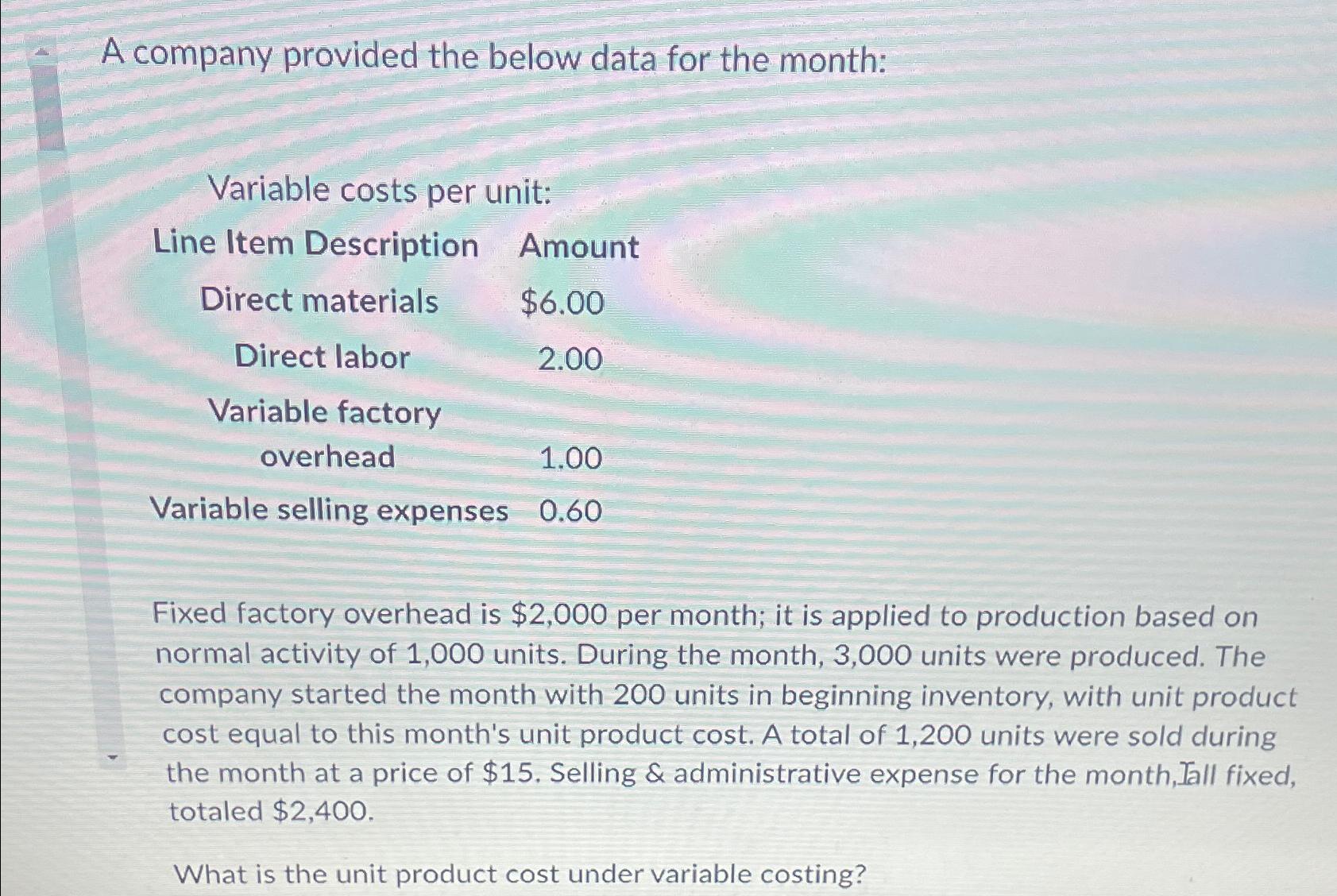

A company provided the below data for the month: Variable costs per unit: Line Item Description Amount Direct materials $6.00 Direct labor 2.00 Variable

A company provided the below data for the month: Variable costs per unit: Line Item Description Amount Direct materials $6.00 Direct labor 2.00 Variable factory overhead 1.00 Variable selling expenses 0.60 Fixed factory overhead is $2,000 per month; it is applied to production based on normal activity of 1,000 units. During the month, 3,000 units were produced. The company started the month with 200 units in beginning inventory, with unit product cost equal to this month's unit product cost. A total of 1,200 units were sold during the month at a price of $15. Selling & administrative expense for the month, Jall fixed, totaled $2,400. What is the unit product cost under variable costing?

Step by Step Solution

★★★★★

3.57 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the unit product cost under variable costing we need to consider only the variable costs incurred in the production of each unit Fixed costs are treated as period costs and are not included in the unit product cost under variable costing Given data Variable costs per unit Direct materials 600 Direct labor 200 Variable factory overhead 100 Variable selling expenses 060 Fixed factory overhead 2000 per month Normal activity level 1000 units Actual production during the month 3000 units Beginning inventory 200 units Units sold during the month 1200 units Selling administrative expense 2400 First lets calculate the total variable cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started