Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company purchased a machine at the cost of $765,900 on April 1 of year 1. On the same day, the business paid the shipping

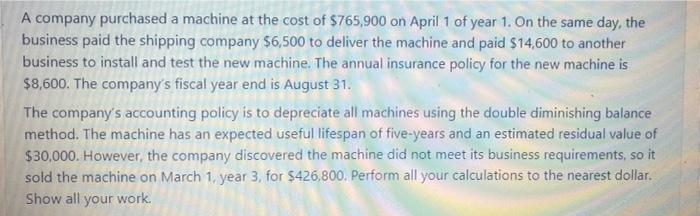

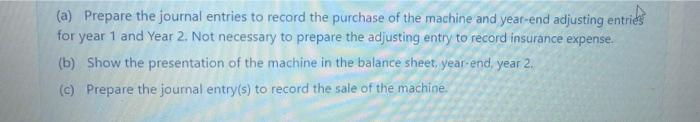

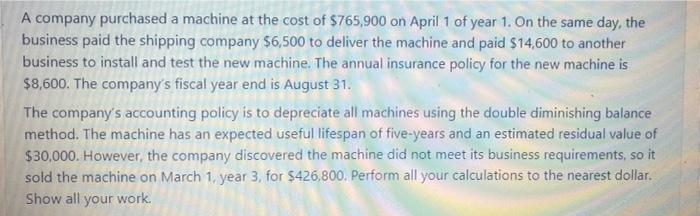

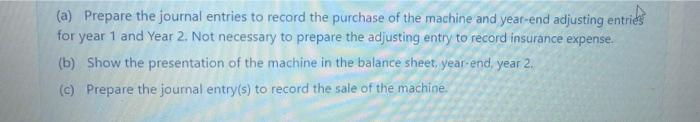

A company purchased a machine at the cost of $765,900 on April 1 of year 1. On the same day, the business paid the shipping company $6,500 to deliver the machine and paid $14,600 to another business to install and test the new machine. The annual insurance policy for the new machine is $8,600. The company's fiscal year end is August 31. The company's accounting policy is to depreciate all machines using the double diminishing balance method. The machine has an expected useful lifespan of five-years and an estimated residual value of $30,000. However, the company discovered the machine did not meet its business requirements, so it sold the machine on March 1 year 3, for $426,800. Perform all your calculations to the nearest dollar. Show all your work (a) Prepare the journal entries to record the purchase of the machine and year-end adjusting entries for year 1 and Year 2. Not necessary to prepare the adjusting entry to record insurance expense. (b) Show the presentation of the machine in the balance sheet, year-end, year 2. (c) Prepare the journal entry(s) to record the sale of the machine

A company purchased a machine at the cost of $765,900 on April 1 of year 1. On the same day, the business paid the shipping company $6,500 to deliver the machine and paid $14,600 to another business to install and test the new machine. The annual insurance policy for the new machine is $8,600. The company's fiscal year end is August 31. The company's accounting policy is to depreciate all machines using the double diminishing balance method. The machine has an expected useful lifespan of five-years and an estimated residual value of $30,000. However, the company discovered the machine did not meet its business requirements, so it sold the machine on March 1 year 3, for $426,800. Perform all your calculations to the nearest dollar. Show all your work (a) Prepare the journal entries to record the purchase of the machine and year-end adjusting entries for year 1 and Year 2. Not necessary to prepare the adjusting entry to record insurance expense. (b) Show the presentation of the machine in the balance sheet, year-end, year 2. (c) Prepare the journal entry(s) to record the sale of the machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started