Question

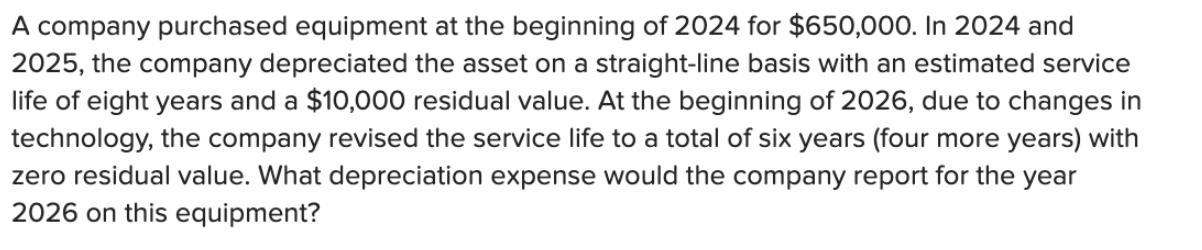

A company purchased equipment at the beginning of 2024 for $650,000. In 2024 and 2025, the company depreciated the asset on a straight-line basis

A company purchased equipment at the beginning of 2024 for $650,000. In 2024 and 2025, the company depreciated the asset on a straight-line basis with an estimated service life of eight years and a $10,000 residual value. At the beginning of 2026, due to changes in technology, the company revised the service life to a total of six years (four more years) with zero residual value. What depreciation expense would the company report for the year 2026 on this equipment?

Step by Step Solution

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help you with that The company purchased equipment at the beginning of 2024 for 650000 In ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

18th Edition

1119790972, 9781119790976

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App