Question

A company purchases a drug weekly. The drug has to be restocked weekly bc it has 1 wk shelf life. If the order is placed

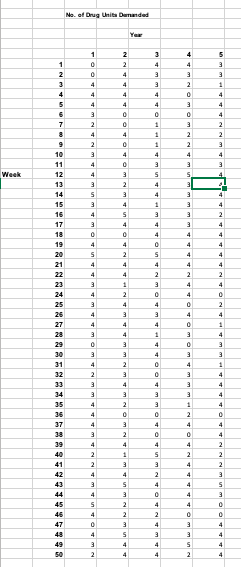

A company purchases a drug weekly. The drug has to be restocked weekly bc it has 1 wk shelf life. If the order is placed 1 wk ahead it costs the company 1,000 USD per drug unit. If the weekly drug demand is greater than supply, the drug is rush-ordered. This costs the company 5,000 USD per drug unit. Attached file has the no. of units of the drug demanded every wk in past 5 yrs. Assume fifty wks in a yr, no trend, & no seasonality of demand.

Chegg does not allow tabular form, too long.

1. Using data, estimate probabilities of the no. of drug units demanded using the "countif" function. 2. using answer to "1" find optimal no. of drug units company should order every week to minimize expected cost using Monte Carlo Simulation (5000 repetition per simulation).

3. generate the 95% c.i. for avg wkly cost associated with the optimal no. of drug units.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started