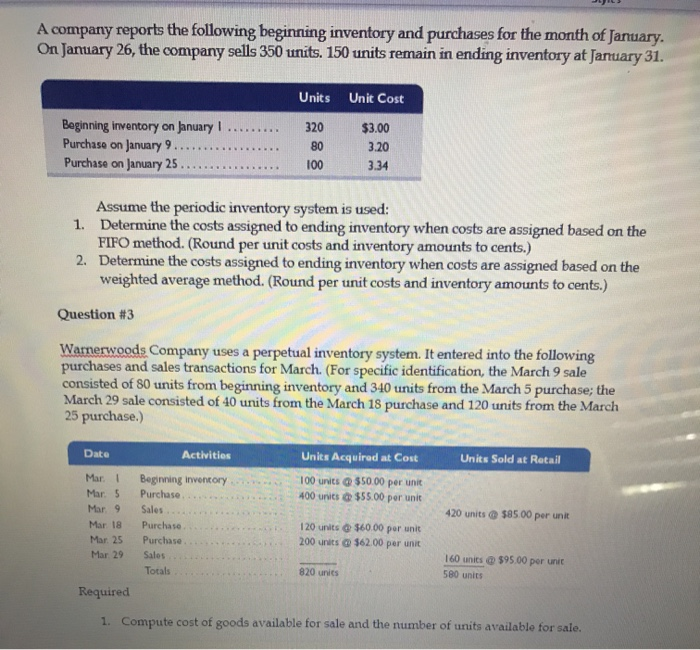

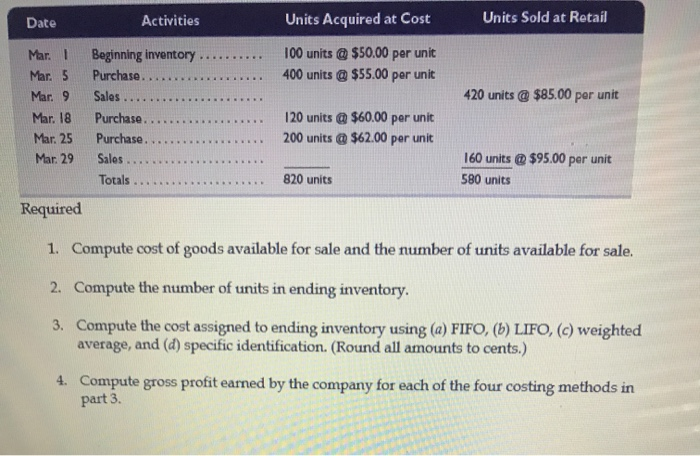

A company reports the following beginning inventory and purchases for the month of January. On January 26, the company sells 350 units. 150 units remain in ending inventory at January 31. Units Unit Cost 320 Beginning inventory on January 1... Purchase on January 9.................. Purchase on January 25. 80 $3.00 3.20 3.34 Assume the periodic inventory system is used: 1. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. (Round per unit costs and inventory amounts to cents.) 2. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.) Question #3 Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. (For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase.) Date Activities Units Acquired at Cost Units Sold at Retail 100 units @ $50.00 per unit 400 units @ $55.00 per unit Mari Mar. 5 Mar 9 Mar 18 Mar 25 Mar 29 420 units @ $8500 per unk Beginning inventory Purchase ........ Sales Purchase Purchase Sales Totals 120 units @ $60.00 per unit 200 units @ $62.00 per unit 160 units @ $95.00 per unit 500 units 820 units Required 1. Compute cost of goods available for sale and the number of units available for sale Date Activities Units Acquired at Cost Units Sold at Retail 100 units @ $50.00 per unit 400 units @ $55.00 per unit 420 units @ $85.00 per unit Mar.! Mar. 5 Mar. 9 Mar. 18 Mar. 25 Mar. 29 Beginning inventory. Purchase..... Sales ... Purchase ..... Purchase. Sales ..... Totals .. 120 units @ $60.00 per unit 200 units @ $62.00 per unit 160 units @ $95.00 per unit 580 units 820 units Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to cents.) 4. Compute gross profit earned by the company for each of the four costing methods in part 3