Answered step by step

Verified Expert Solution

Question

1 Approved Answer

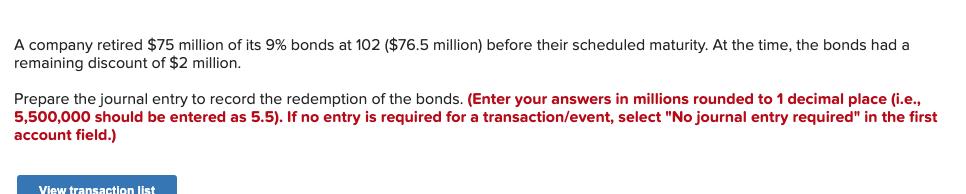

A company retired $75 million of its 9% bonds at 102 ($76.5 million) before their scheduled maturity. At the time, the bonds had a

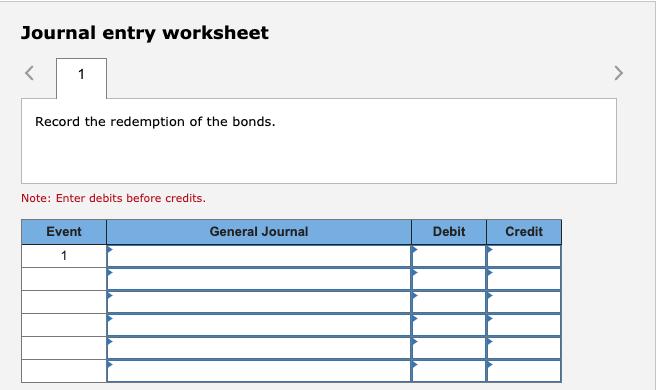

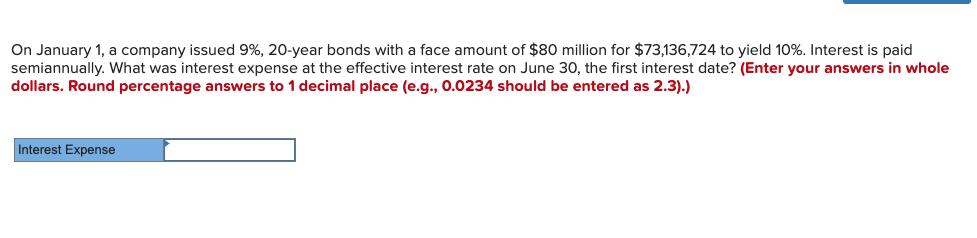

A company retired $75 million of its 9% bonds at 102 ($76.5 million) before their scheduled maturity. At the time, the bonds had a remaining discount of $2 million. Prepare the journal entry to record the redemption of the bonds. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Yiew transaction list Journal entry worksheet 1 Record the redemption of the bonds. Note: Enter debits before credits. Event Genera ournal Debit Credit On January 1, a company issued 9%, 20-year bonds with a face amount of $80 million for $73,136,724 to yield 10%. Interest is paid semiannually. What was interest expense at the effective interest rate on June 30, the first interest date? (Enter your answers in whole dollars. Round percentage answers to 1 decimal place (e.g., O.0234 should be entered as 2.3).) Interest Expense

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Event General Journal Debitmillion Creditmillion ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started