Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company sold $200,000 bonds and set up a sinking fund that was earning 8.5% compounded semi-annually to retire the bonds in four years .

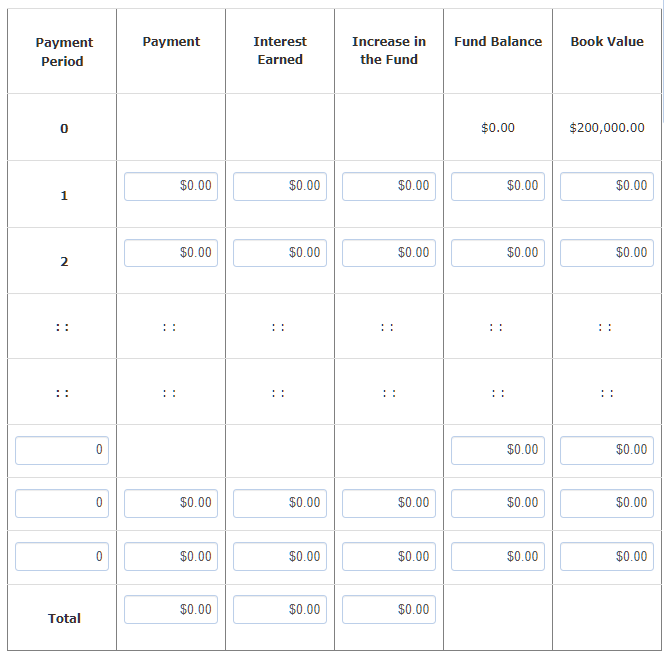

A company sold $200,000 bonds and set up a sinking fund that was earning 8.5% compounded semi-annually to retire the bonds in four years. If it made equal deposits into the fund at the beginning of every six months, construct a partial sinking fund schedule showing the details for the first two and last two payments and the totals of the schedule.

Round the payment up to the next cent. Round all other values to the nearest cent.

Answer only if you know the solution. Don't copy the answers from another post! Show solution.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started