Answered step by step

Verified Expert Solution

Question

1 Approved Answer

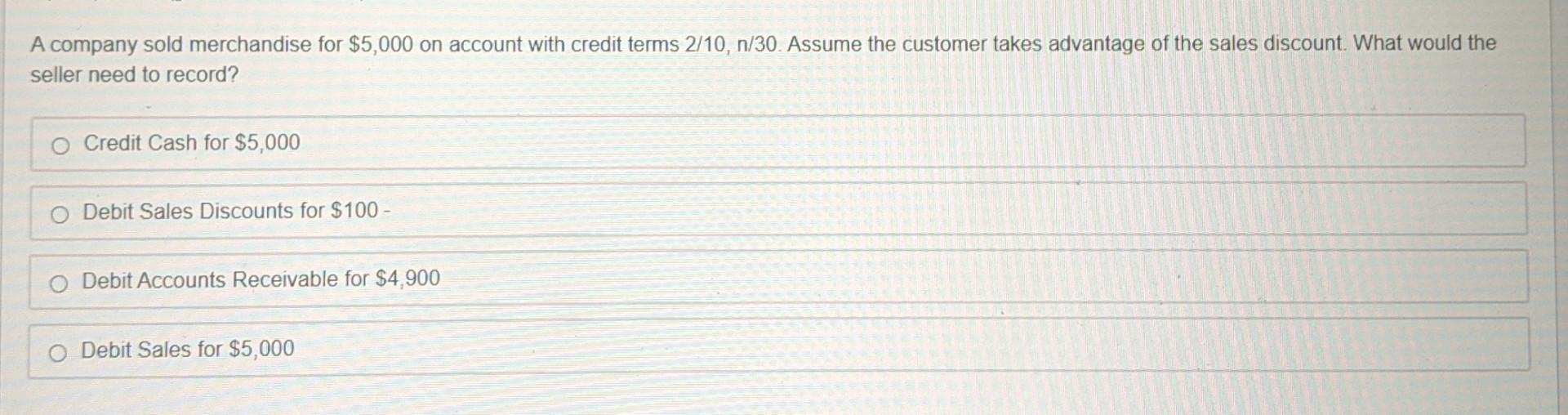

A company sold merchandise for $5,000 on account with credit terms 2/10, n/30. Assume the customer takes advantage of the sales discount. What would the

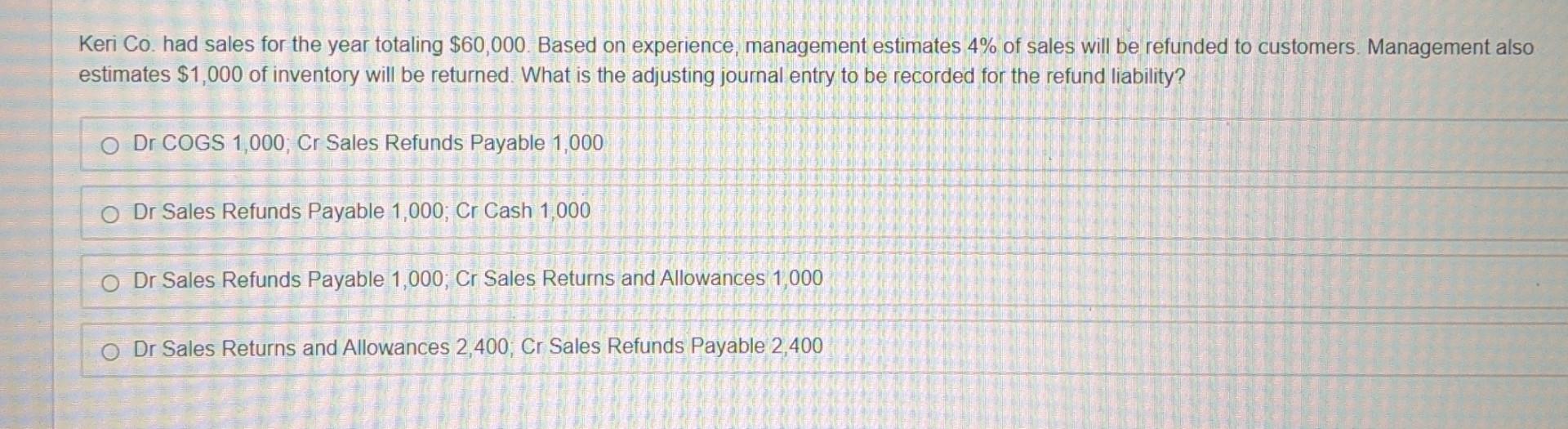

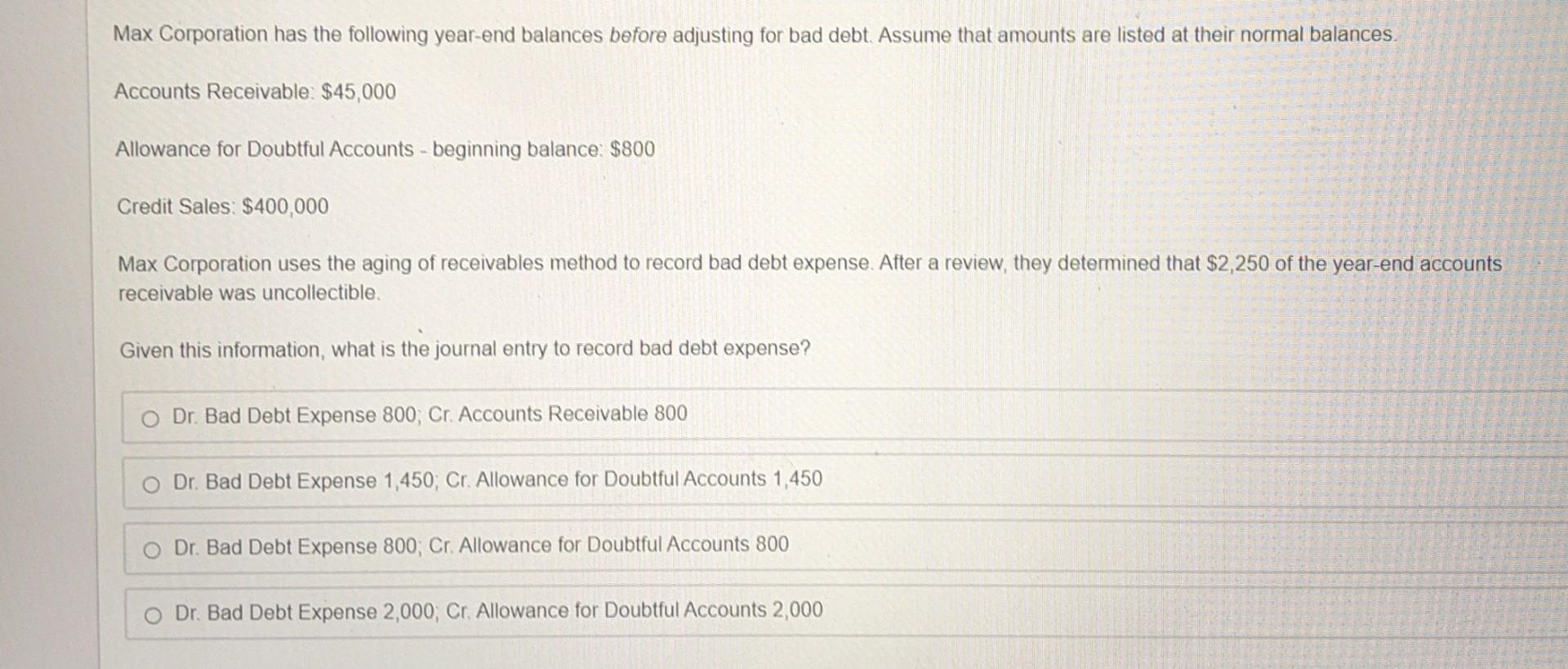

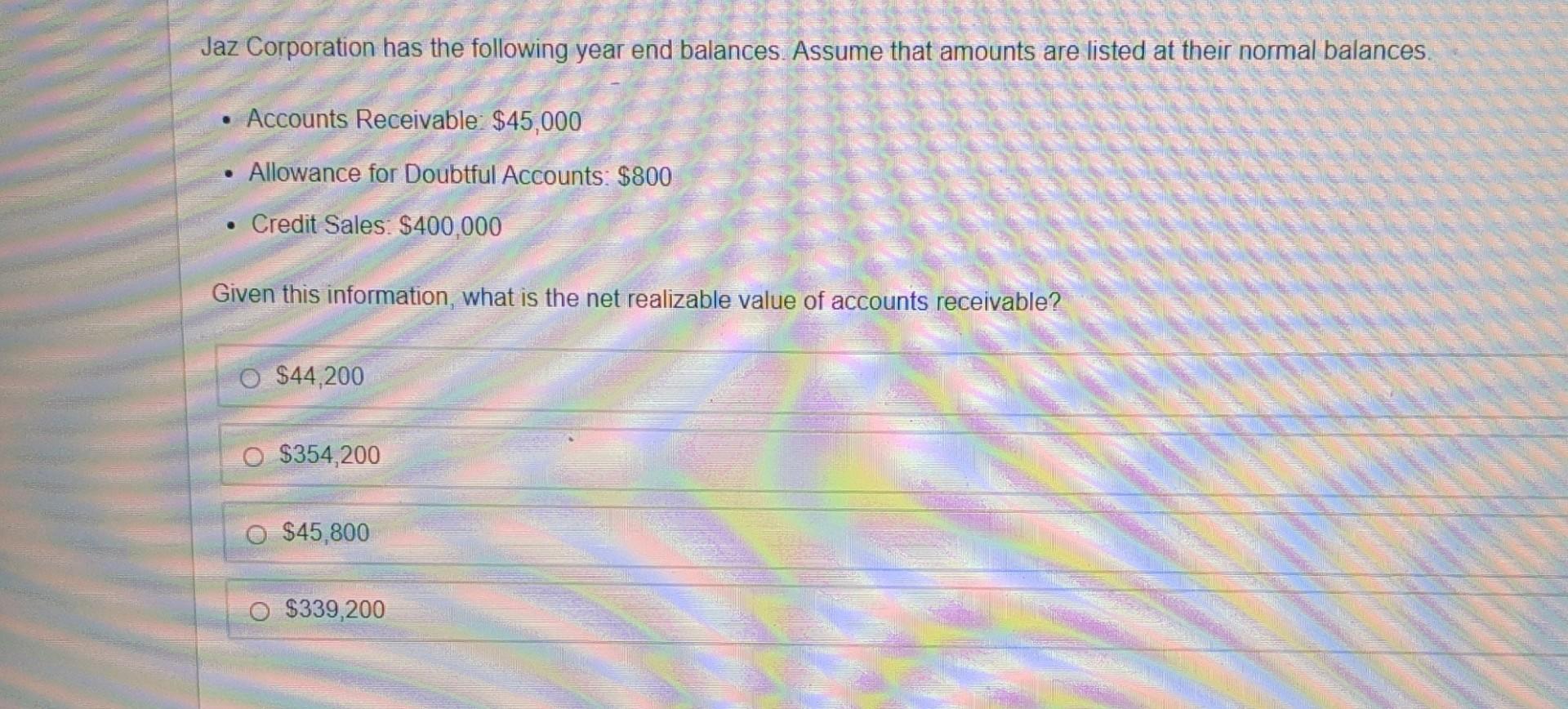

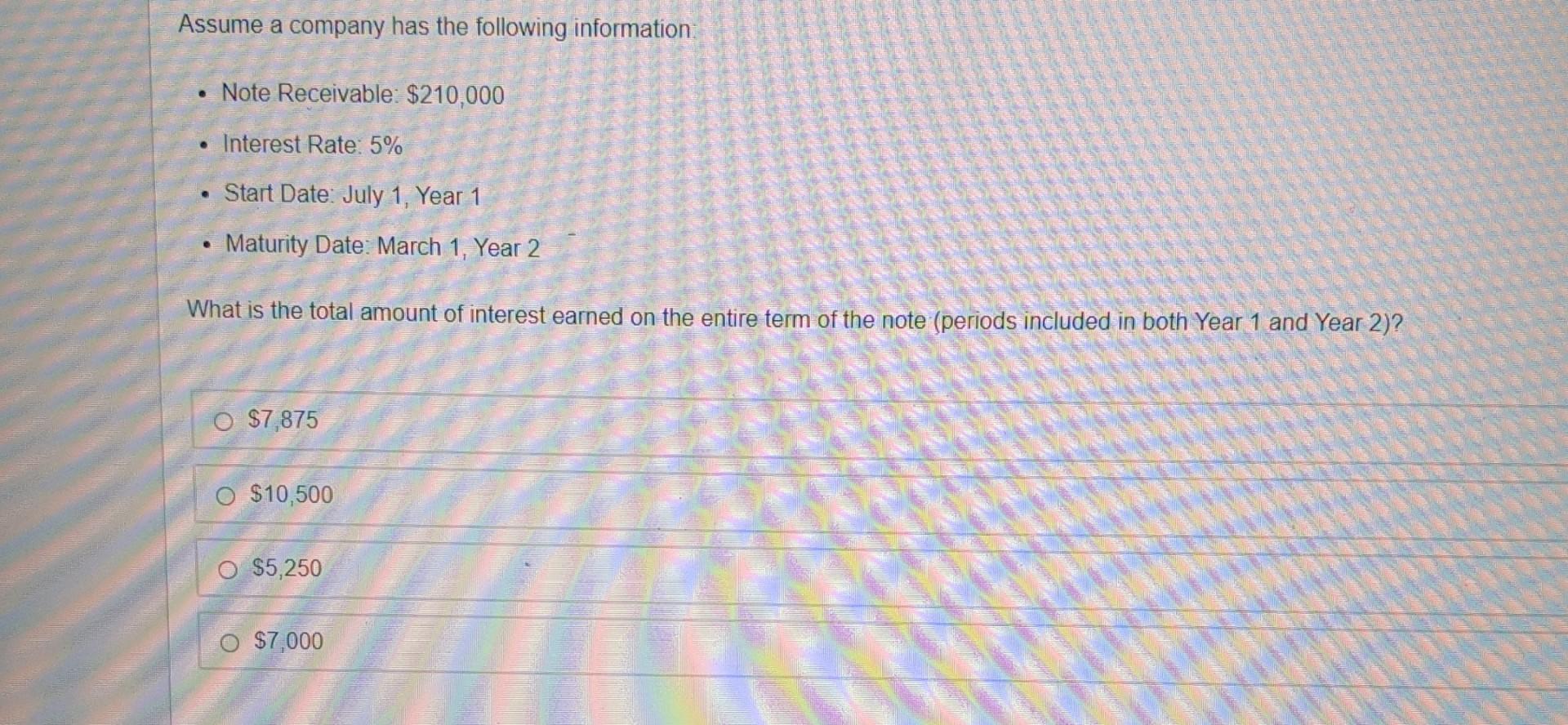

A company sold merchandise for $5,000 on account with credit terms 2/10, n/30. Assume the customer takes advantage of the sales discount. What would the seller need to record? Credit Cash for $5,000 O Debit Sales Discounts for $100 - O Debit Accounts Receivable for $4,900 O Debit Sales for $5,000 Keri Co. had sales for the year totaling $60,000. Based on experience, management estimates 4% of sales will be refunded to customers. Management also estimates $1,000 of inventory will be returned. What is the adjusting journal entry to be recorded for the refund liability? O Dr COGS 1,000, Cr Sales Refunds Payable 1,000 O Dr Sales Refunds Payable 1,000; Cr Cash 1,000 O Dr Sales Refunds Payable 1,000; Cr Sales Returns and Allowances 1000 O Dr Sales Returns and Allowances 2,400; Cr Sales Refunds Payable 2,400 OBE Nikon Mit Max Corporation has the following year-end balances before adjusting for bad debt. Assume that amounts are listed at their normal balances Accounts Receivable: $45,000 Allowance for Doubtful Accounts - beginning balance: $800 Credit Sales: $400,000 Max Corporation uses the aging of receivables method to record bad debt expense. After a review, they determined that $2,250 of the year-end accounts receivable was uncollectible. Given this information, what is the journal entry to record bad debt expense? Dr. Bad Debt Expense 800, Cr. Accounts Receivable 800 O Dr. Bad Debt Expense 1,450, Cr Allowance for Doubtful Accounts 1,450 O Dr. Bad Debt Expense 800; Cr. Allowance for Doubtful Accounts 800 O Dr. Bad Debt Expense 2,000, Cr. Allowance for Doubtful Accounts 2,000 Jaz Corporation has the following year end balances. Assume that amounts are listed at their normal balances. . Accounts Receivable: $45,000 . Allowance for Doubtful Accounts: $800 Credit Sales: $400,000 Given this information, what is the net realizable value of accounts receivable? 0 $44,200 O $354,200 $45,800 O $339,200 Assume a company has the following information Note Receivable: $210,000 Interest Rate: 5% Start Date: July 1, Year 1 Maturity Date: March 1, Year 2 What is the total amount of interest earned on the entire term of the note (periods included in both Year 1 and Year 2)? $7,875 $10,500 O $5,250 O $7,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started