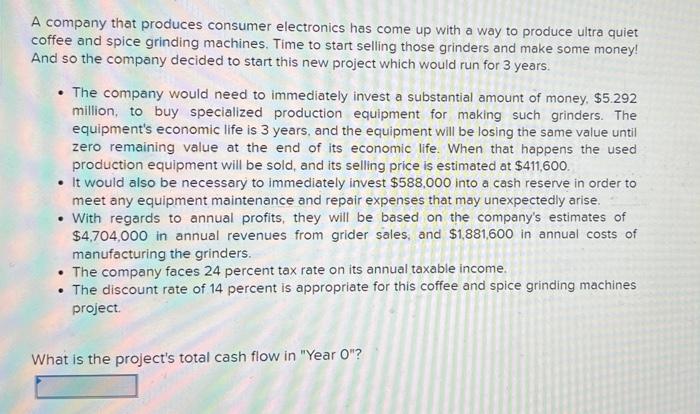

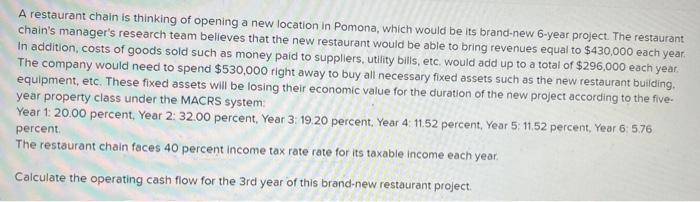

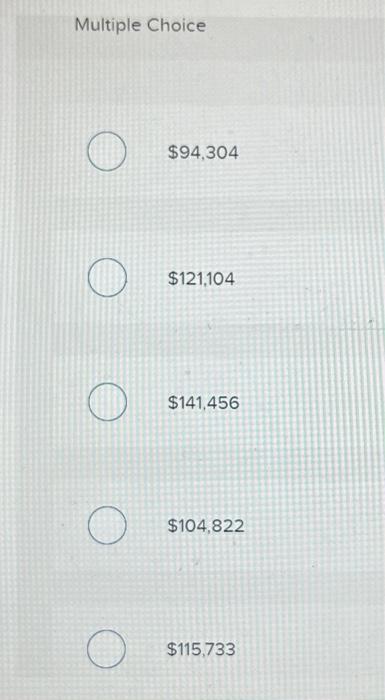

A company that produces consumer electronics has come up with a way to produce ultra quiet coffee and spice grinding machines. Time to start selling those grinders and make some money! And so the company decided to start this new project which would run for 3 years. The company would need to immediately invest a substantial amount of money, $5.292 million, to buy specialized production equipment for making such grinders. The equipment's economic life is 3 years, and the equipment will be losing the same value until zero remaining value at the end of its economic life. When that happens the used production equipment will be sold, and its selling price is estimated at $411,600. . It would also be necessary to immediately invest $588,000 into a cash reserve in order to meet any equipment maintenance and repair expenses that may unexpectedly arise. With regards to annual profits, they will be based on the company's estimates of $4,704,000 in annual revenues from grider sales, and $1,881,600 in annual costs of manufacturing the grinders. The company faces 24 percent tax rate on its annual taxable income. . The discount rate of 14 percent is appropriate for this coffee and spice grinding machines project What is the project's total cash flow in "Year O"? A restaurant chain is thinking of opening a new location in Pomona, which would be its brand-new 6-year project. The restaurant chain's manager's research team believes that the new restaurant would be able to bring revenues equal to $430,000 each year, In addition, costs of goods sold such as money paid to suppliers, utility bills, etc. would add up to a total of $296,000 each year, The company would need to spend $530,000 right away to buy all necessary fixed assets such as the new restaurant building, equipment, etc. These fixed assets will be losing their economic value for the duration of the new project according to the five- year property class under the MACRS system: Year 1: 20.00 percent, Year 2:32.00 percent, Year 3: 19.20 percent Year 4: 11.52 percent, Year 5: 11.52 percent, Year 6: 576 percent The restaurant chain faces 40 percent income tax rate rate for its taxable income each year. Calculate the operating cash flow for the 3rd year of this brand-new restaurant project. Multiple Choice O $94,304 O $121,104 O O $141,456 O $104,822 O $115,733