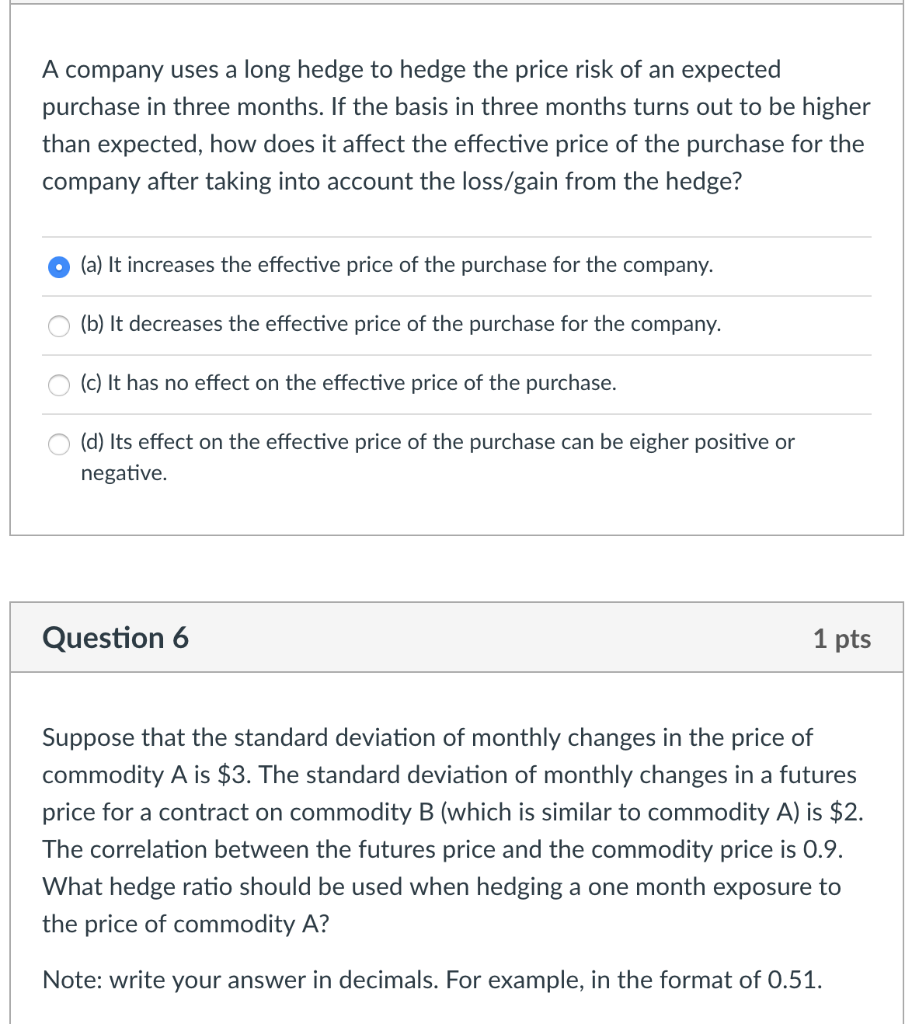

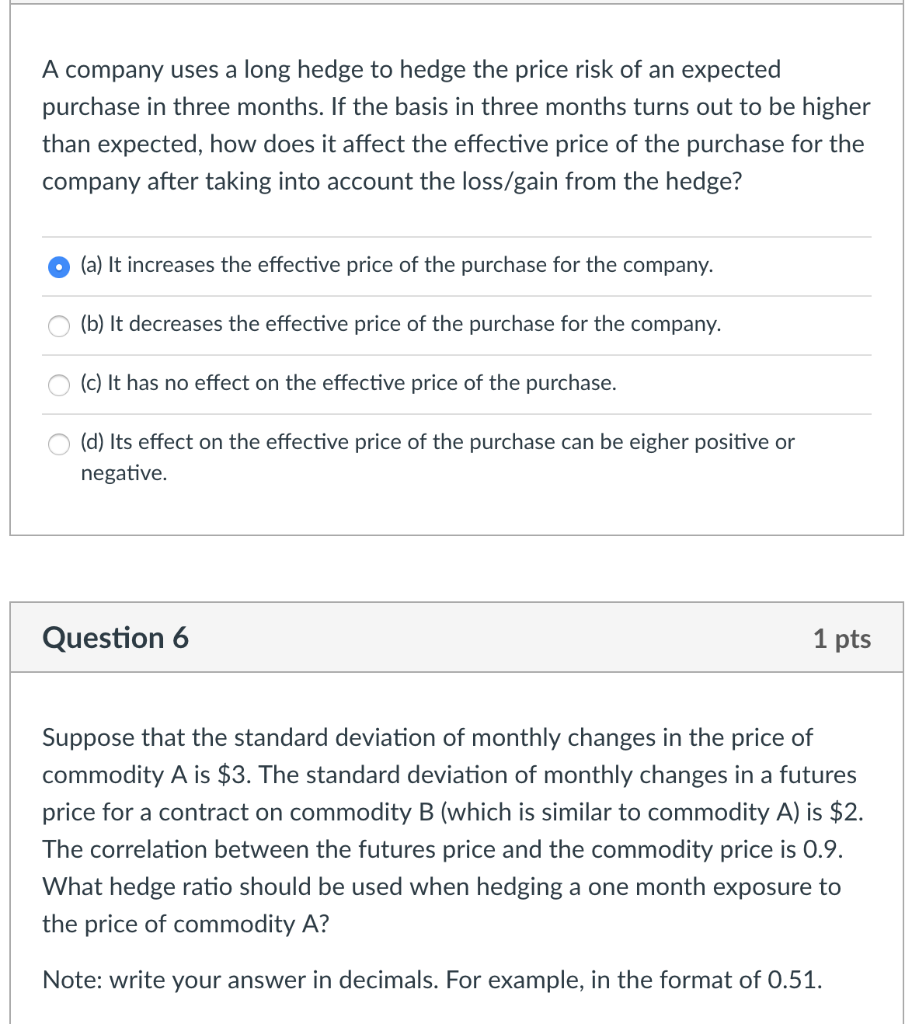

A company uses a long hedge to hedge the price risk of an expected purchase in three months. If the basis in three months turns out to be higher than expected, how does it affect the effective price of the purchase for the company after taking into account the loss/gain from the hedge? (a) It increases the effective price of the purchase for the company. O (b) It decreases the effective price of the purchase for the company. O(c) It has no effect on the effective price of the purchase (d) Its effect on the effective price of the purchase can be eigher positive or negative. Question 6 1 pts Suppose that the standard deviation of monthly changes in the price of commodity A is $3. The standard deviation of monthly changes in a futures price for a contract on commodity B (which is similar to commodity A) is $2 The correlation between the futures price and the commodity price is 0.9. What hedge ratio should be used when hedging a one month exposure to the price of commodity A? Note: write your answer in decimals. For example, in the format of 0.51. A company uses a long hedge to hedge the price risk of an expected purchase in three months. If the basis in three months turns out to be higher than expected, how does it affect the effective price of the purchase for the company after taking into account the loss/gain from the hedge? (a) It increases the effective price of the purchase for the company. O (b) It decreases the effective price of the purchase for the company. O(c) It has no effect on the effective price of the purchase (d) Its effect on the effective price of the purchase can be eigher positive or negative. Question 6 1 pts Suppose that the standard deviation of monthly changes in the price of commodity A is $3. The standard deviation of monthly changes in a futures price for a contract on commodity B (which is similar to commodity A) is $2 The correlation between the futures price and the commodity price is 0.9. What hedge ratio should be used when hedging a one month exposure to the price of commodity A? Note: write your answer in decimals. For example, in the format of 0.51