Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company wants to decide which project to undertake out of two projects A and B. For this purpose, it wants to evaluate each

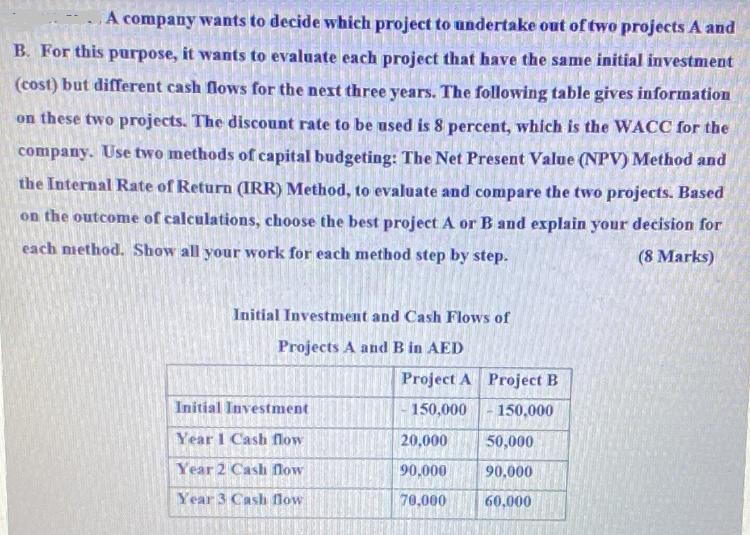

A company wants to decide which project to undertake out of two projects A and B. For this purpose, it wants to evaluate each project that have the same initial investment (cost) but different cash flows for the next three years. The following table gives information on these two projects. The discount rate to be used is 8 percent, which is the WACC for the company. Use two methods of capital budgeting: The Net Present Value (NPV) Method and the Internal Rate of Return (IRR) Method, to evaluate and compare the two projects. Based on the outcome of calculations, choose the best project A or B and explain your decision for each method. Show all your work for each method step by step. (8 Marks) Initial Investment and Cash Flows of Projects A and B in AED Initial Investment SALUT Year 1 Cash flow Year 2 Cash flow Year 3 Cash flow Project A - 150,000 20,000 90.000 70,000 Project B 150,000 50,000 90.000 60,000

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To evaluate the two projects A and B we will use the Net Present Value NPV method and the I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started