Answered step by step

Verified Expert Solution

Question

1 Approved Answer

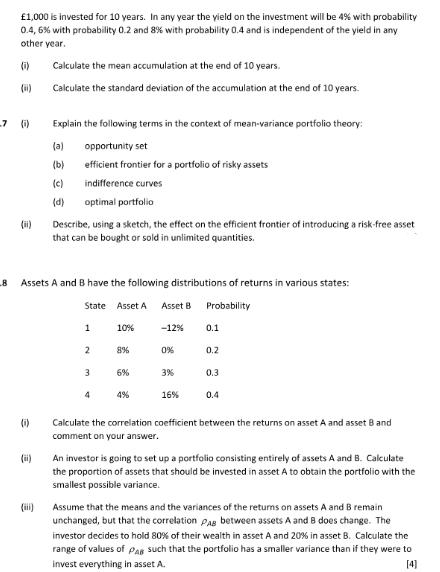

1,000 is invested for 10 years. In any year the yield on the investment will be 4% with probability 0.4, 6% with probability 0.2

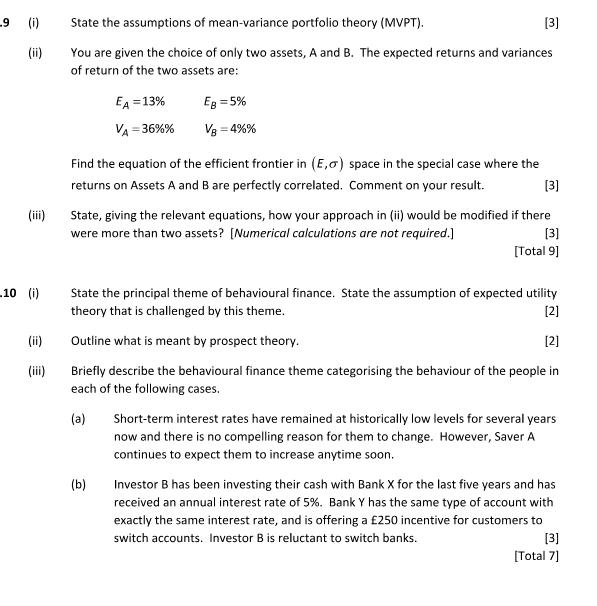

1,000 is invested for 10 years. In any year the yield on the investment will be 4% with probability 0.4, 6% with probability 0.2 and 8% with probability 0.4 and is independent of the yield in any other year. (0) (i) 8 -7 (0) Explain the following terms in the context of mean-variance portfolio theory: (a) opportunity set (b) efficient frontier for a portfolio of risky assets (c) indifference curves (d) optimal portfolio (ii) Calculate the mean accumulation at the end of 10 years. Calculate the standard deviation of the accumulation at the end of 10 years. (i) Assets A and B have the following distributions of returns in various states: State Asset A Asset B Probability 10% -12% (ii) Describe, using a sketch, the effect on the efficient frontier of introducing a risk-free asset that can be bought or sold in unlimited quantities. 1 2 3 4 8% 6% 4% 0% 3% 16% 0.1 0.2 0.3 0.4 Calculate the correlation coefficient between the returns on asset A and asset B and comment on your answer. An investor is going to set up a portfolio consisting entirely of assets A and B. Calculate the proportion of assets that should be invested in asset A to obtain the portfolio with the smallest possible variance. Assume that the means and the variances of the returns on assets A and B remain unchanged, but that the correlation Pag between assets A and B does change. The investor decides to hold 80% of their wealth in asset A and 20% in asset B. Calculate the range of values of PAR such that the portfolio has a smaller variance than if they were to invest everything in asset A. [4] .9 (1) (ii) (iii) 10 (i) (ii) (iii) State the assumptions of mean-variance portfolio theory (MVPT). You are given the choice of only two assets, A and B. The expected returns and variances of return of the two assets are: EA = 13% VA=36%% [3] Eg=5% VB = 4%% Find the equation of the efficient frontier in (E,o) space in the special case where the returns on Assets A and B are perfectly correlated. Comment on your result. [3] (b) State, giving the relevant equations, how your approach in (ii) would be modified if there were more than two assets? [Numerical calculations are not required.] [3] [Total 9] State the principal theme of behavioural finance. State the assumption of expected utility theory that is challenged by this theme. [2] Outline what is meant by prospect theory. [2] Briefly describe the behavioural finance theme categorising the behaviour of the people in each of the following cases. (a) Short-term interest rates have remained at historically low levels for several years now and there is no compelling reason for them to change. However, Saver A continues to expect them to increase anytime soon. Investor B has been investing their cash with Bank X for the last five years and has received an annual interest rate of 5%. Bank Y has the same type of account with exactly the same interest rate, and is offering a 250 incentive for customers to switch accounts. Investor B is reluctant to switch banks. [3] [Total 7]

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the mean accumulation at the end of 10 years we can use the following formula Mean Accumulation Initial Investment 1 Mean YieldNumber of Years The mean yield is the weighted average of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started