Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company wants to determine its marketing costs for budgeting purposes. Activity measures and costs incurred for four months of the current year are

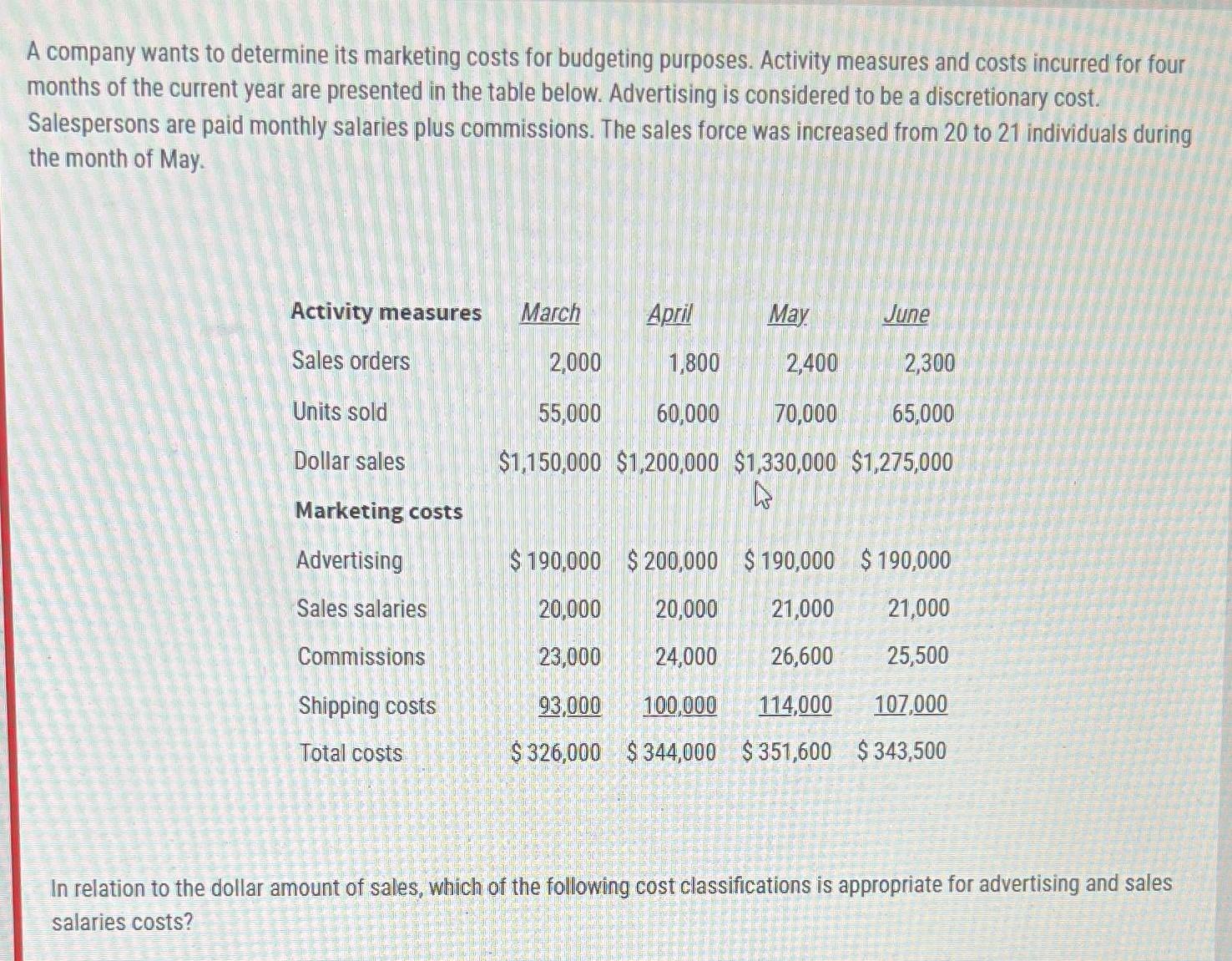

A company wants to determine its marketing costs for budgeting purposes. Activity measures and costs incurred for four months of the current year are presented in the table below. Advertising is considered to be a discretionary cost. Salespersons are paid monthly salaries plus commissions. The sales force was increased from 20 to 21 individuals during the month of May. Activity measures March April May June Sales orders 2,000 1,800 2,400 2,300 Units sold 55,000 60,000 70,000 65,000 Dollar sales Marketing costs Advertising Sales salaries $1,150,000 $1,200,000 $1,330,000 $1,275,000 $ 190,000 $200,000 $190,000 $190,000 20,000 20,000 21,000 21,000 23,000 24,000 26,600 25,500 Commissions Shipping costs 93,000 100,000 114,000 107,000 Total costs $ 326,000 $344,000 $ 351,600 $343,500 In relation to the dollar amount of sales, which of the following cost classifications is appropriate for advertising and sales salaries costs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the appropriate cost classification for advertising and sales salaries costs in relatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started