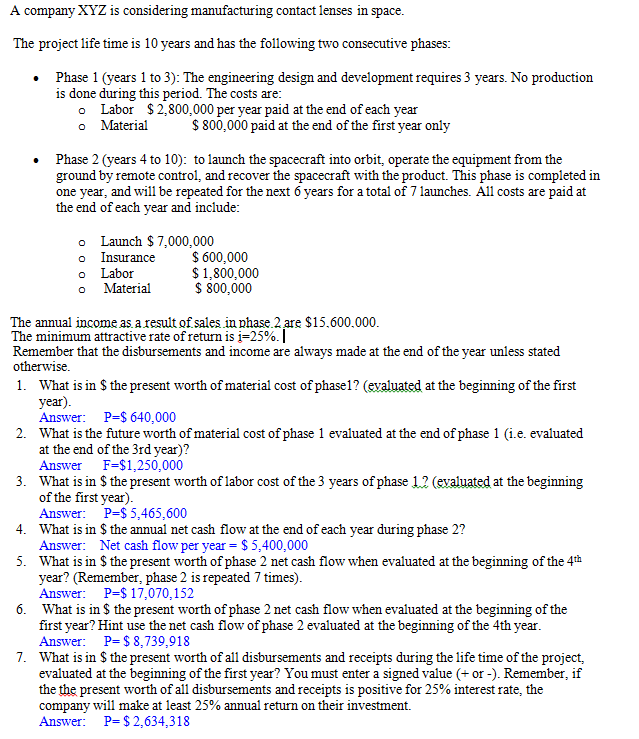

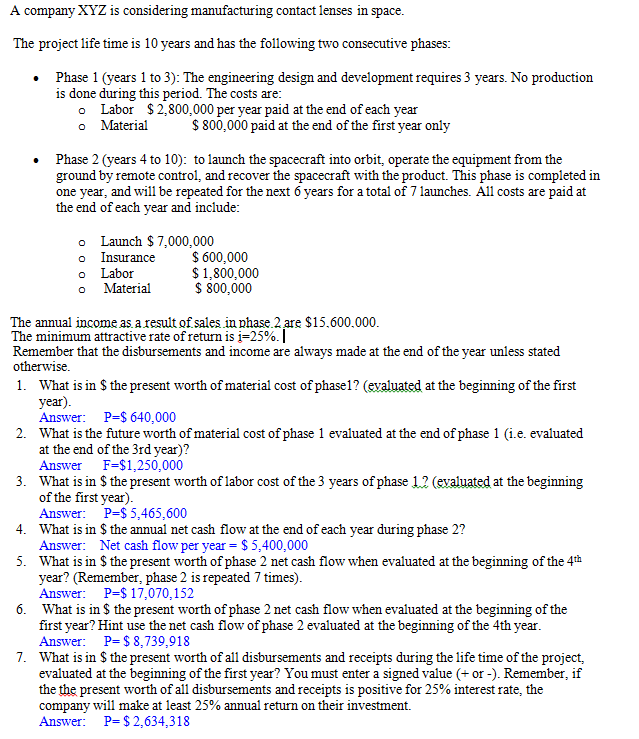

A company XYZ is considering manufacturing contact lenses in space. The project life time is 10 years and has the following two consecutive phases: Phase 1 (years 1 to 3): The engineering design and development requires 3 years. No production is done during this period. The costs are: Labor $ 2,800,000 per year paid at the end of each year Material $ 800,000 paid at the end of the first year only Phase 2 (years 4 to 10): to launch the spacecraft into orbit, operate the equipment from the ground by remote control, and recover the spacecraft with the product. This phase is completed in one year, and will be repeated for the next 6 years for a total of 7 launches. All costs are paid at the end of each year and include: Launch $ 7,000,000 Insurance $ 600,000 Labor $ 1,800,000 Material $ S00,000 The annual income as. a. result of. sales in chase. 2.are $15,600,000. The minimum attractive rate of return is i=25%. Remember that the disbursements and income are always made at the end of the year unless stated otherwise. What is in S the present worth of material cost of phase 1 ? (evaluated at the beginning of the first year). Answer: P=$ 640,000 What is the future worth of material cost of phase 1 evaluated at the end of phase 1 (i.e. evaluated at the end of the 3rd year)? Answer F=$ 1,250,000 What is in S the present worth of labor cost of the 3 years of phase 12 devaluated at the beginning of the first year). Answer: P=$ 5,465,600 4. What is in $ the annual net cash flow at the end of each year during phase 2? Answer: Net cash flow per year = $ 5,400,000 What is in $ the present worth of phase 2 net cash flow when evaluated at the beginning of the 4th year? (Remember, phase 2 is repeated 7 times). Answer: P=S 17,070,152 What is in $ the present worth of phase 2 net cash flow when evaluated at the beginning of the first year? Hint use the net cash flow of phase 2 evaluated at the beginning of the 4th year. Answer: P=$S, 739,9 IS 7. What is in S the present worth of all disbursements and receipts during the life time of the project, evaluated at the beginning of the first year? You must enter a signed value (+ or -). Remember, if the the present worth of all disbursements and receipts is positive for 25% interest rate, the company will make at least 25% annual return on their investment. Answer: P=$2,634,31S A company XYZ is considering manufacturing contact lenses in space. The project life time is 10 years and has the following two consecutive phases: Phase 1 (years 1 to 3): The engineering design and development requires 3 years. No production is done during this period. The costs are: Labor $ 2,800,000 per year paid at the end of each year Material $ 800,000 paid at the end of the first year only Phase 2 (years 4 to 10): to launch the spacecraft into orbit, operate the equipment from the ground by remote control, and recover the spacecraft with the product. This phase is completed in one year, and will be repeated for the next 6 years for a total of 7 launches. All costs are paid at the end of each year and include: Launch $ 7,000,000 Insurance $ 600,000 Labor $ 1,800,000 Material $ S00,000 The annual income as. a. result of. sales in chase. 2.are $15,600,000. The minimum attractive rate of return is i=25%. Remember that the disbursements and income are always made at the end of the year unless stated otherwise. What is in S the present worth of material cost of phase 1 ? (evaluated at the beginning of the first year). Answer: P=$ 640,000 What is the future worth of material cost of phase 1 evaluated at the end of phase 1 (i.e. evaluated at the end of the 3rd year)? Answer F=$ 1,250,000 What is in S the present worth of labor cost of the 3 years of phase 12 devaluated at the beginning of the first year). Answer: P=$ 5,465,600 4. What is in $ the annual net cash flow at the end of each year during phase 2? Answer: Net cash flow per year = $ 5,400,000 What is in $ the present worth of phase 2 net cash flow when evaluated at the beginning of the 4th year? (Remember, phase 2 is repeated 7 times). Answer: P=S 17,070,152 What is in $ the present worth of phase 2 net cash flow when evaluated at the beginning of the first year? Hint use the net cash flow of phase 2 evaluated at the beginning of the 4th year. Answer: P=$S, 739,9 IS 7. What is in S the present worth of all disbursements and receipts during the life time of the project, evaluated at the beginning of the first year? You must enter a signed value (+ or -). Remember, if the the present worth of all disbursements and receipts is positive for 25% interest rate, the company will make at least 25% annual return on their investment. Answer: P=$2,634,31S