Answered step by step

Verified Expert Solution

Question

1 Approved Answer

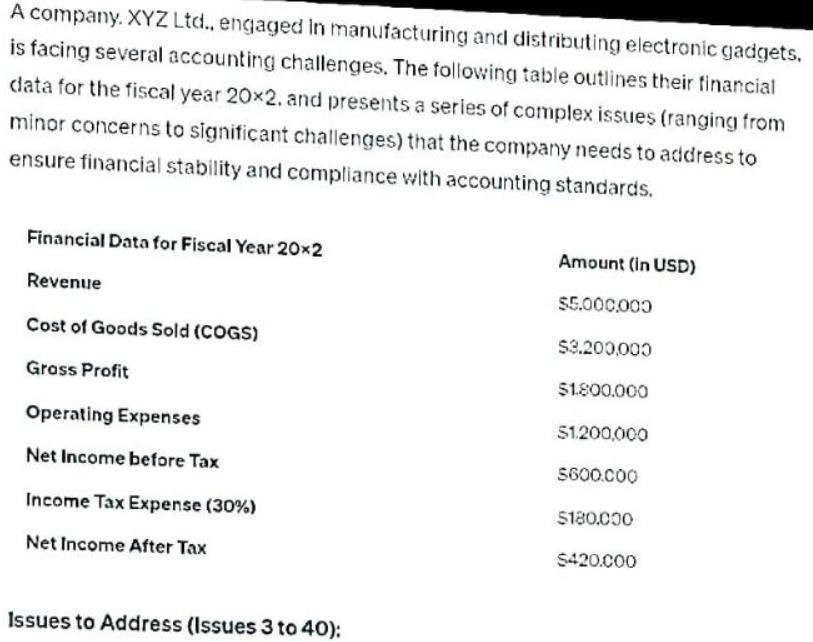

A company. XYZ Ltd., engaged in manufacturing and distributing electronic gadgets. is facing several accounting challenges. The following table outlines their financial data for

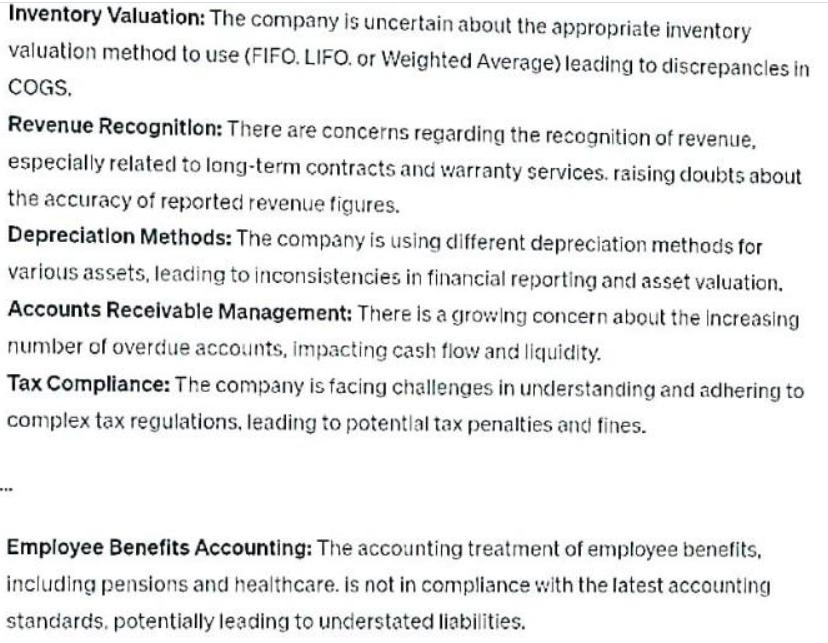

A company. XYZ Ltd., engaged in manufacturing and distributing electronic gadgets. is facing several accounting challenges. The following table outlines their financial data for the fiscal year 20x2. and presents a series of complex issues (ranging from minor concerns to significant challenges) that the company needs to address to ensure financial stability and compliance with accounting standards. Financial Data for Fiscal Year 202 Revenue Cost of Goods Sold (COGS) Gross Profit Operating Expenses Net Income before Tax Income Tax Expense (30%) Net Income After Tax Issues to Address (Issues 3 to 40): Amount (in USD) $5.000.000 $3.200,000 $1.800.000 $1,200,000 $600.000 $180.000 $420.000 Inventory Valuation: The company is uncertain about the appropriate inventory valuation method to use (FIFO. LIFO. or Weighted Average) leading to discrepancles in COGS. Revenue Recognition: There are concerns regarding the recognition of revenue, especially related to long-term contracts and warranty services. raising doubts about the accuracy of reported revenue figures. Depreciation Methods: The company is using different depreciation methods for various assets, leading to inconsistencies in financial reporting and asset valuation. Accounts Receivable Management: There is a growing concern about the increasing number of overdue accounts, impacting cash flow and liquidity. Tax Compliance: The company is facing challenges in understanding and adhering to complex tax regulations, leading to potential tax penalties and fines. Employee Benefits Accounting: The accounting treatment of employee benefits, including pensions and healthcare. is not in compliance with the latest accounting standards, potentially leading to understated liabilities. Instructions: a) Analyze each issue presented in the table (Issues 3 to 40) and provide detailed explanations for the impact of these issues on the company's financial statements and overall financial health. b) Suggest appropriate solutions for each issue to help XYZ Ltd. resolve these challenges, improve financial reporting accuracy, and ensure compliance with accounting standards. c) Discuss the long-term Implications of unresolved accounting issues on the company's financial stability, investor confidence, and regulatory compliance. d) Provide a comprehensive conclusion summarizing the critical importance of addressing these issues promptly and effectively for XYZ Ltd.'s sustainability and growth in the competitive market.

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Analysis of the issues Inventory Valuation The choice of inventory valuation method FIFO LIFO or weighted average significantly impacts the cost of goods sold COGS and in turn the gross profit Discr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started