Question

A company's bond has a par value of $1000 and pays a coupon rate of 4%. The current market price of the bond is

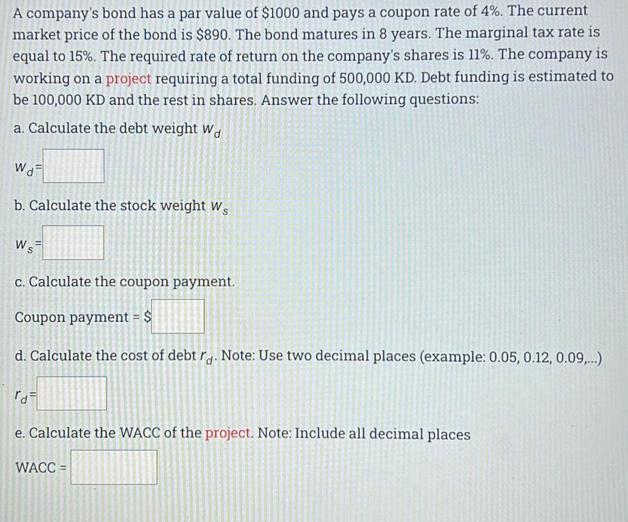

A company's bond has a par value of $1000 and pays a coupon rate of 4%. The current market price of the bond is $890. The bond matures in 8 years. The marginal tax rate is equal to 15%. The required rate of return on the company's shares is 11%. The company is working on a project requiring a total funding of 500,000 KD. Debt funding is estimated to be 100,000 KD and the rest in shares. Answer the following questions: a. Calculate the debt weight Wd Wd b. Calculate the stock weight W Ws c. Calculate the coupon payment. Coupon payment = $ d. Calculate the cost of debt rd. Note: Use two decimal places (example: 0.05, 0.12, 0.09,...) rd e. Calculate the WACC of the project. Note: Include all decimal places WACC =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the required values well use the given information and formulas a Debt weight Wa is cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations Of Finance

Authors: Arthur J. Keown, John H. Martin, J. William Petty

10th Edition

0135160618, 978-0135160619

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App