Question: A company's debt is given by a bond that will mature in two years. After two years the company will terminate all activity. The

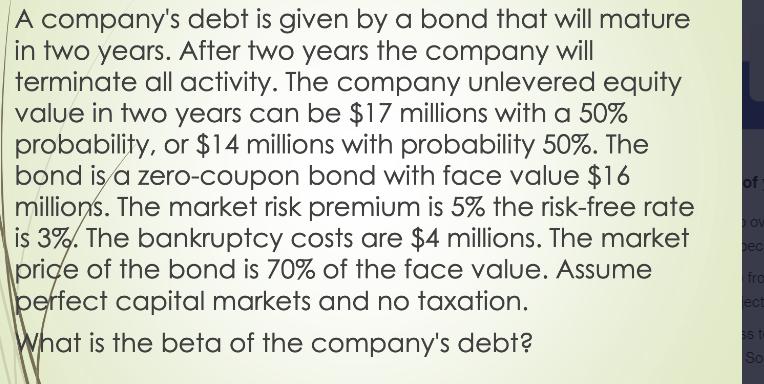

A company's debt is given by a bond that will mature in two years. After two years the company will terminate all activity. The company unlevered equity value in two years can be $17 millions with a 50% probability, or $14 millions with probability 50%. The bond is a zero-coupon bond with face value $16 millions. The market risk premium is 5% the risk-free rate is 3%. The bankruptcy costs are $4 millions. The market price of the bond is 70% of the face value. Assume perfect capital markets and no taxation. What is the beta of the company's debt? of OV Dec from ect s t So

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

To find the beta of the companys debt we need to first calculate the total value of the firm at the ... View full answer

Get step-by-step solutions from verified subject matter experts