LandoToys is a profitable, medium-sized, retail company. Several years ago, it issued a 6.5 percent coupon bond,

Question:

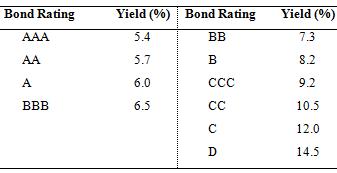

Land’o’Toys is a profitable, medium-sized, retail company. Several years ago, it issued a 6.5 percent coupon bond, which pays interest semiannually. The bond will mature in 10 years and is currently priced in the market as $1,037.19. The average yields to maturity for 10-year corporate bonds are reported in the following table by bond rating.

Periodically, one company will purchase another by buying all of the target firm’s stock. The bonds of the target firm continue to exist. The debt obligation is assumed by the new firm. The credit risk of the bonds often changes because of this type of an event.

Suppose that the firm Treasure Toys makes an announcement that they are purchasing Land’o’Toys. Due to Treasure Toy’s projected financial structure after the purchase, Standard & Poor’s states that the bond rating for Land’o’Toys bonds will change to BB.

a. Compute the yield to maturity of Land’o’Toys bonds before the purchase announcement and use it to determine the likely bond rating.

b. Assume the bond’s price changes to reflect the new credit rating. What is the new price? Did the price increase or decrease?

c. What is the dollar change and percentage change in the bond price?

d. How do the bond investors feel about the announcement?

CouponA coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Finance Applications and Theory

ISBN: 978-0077861681

3rd edition

Authors: Marcia Cornett, Troy Adair