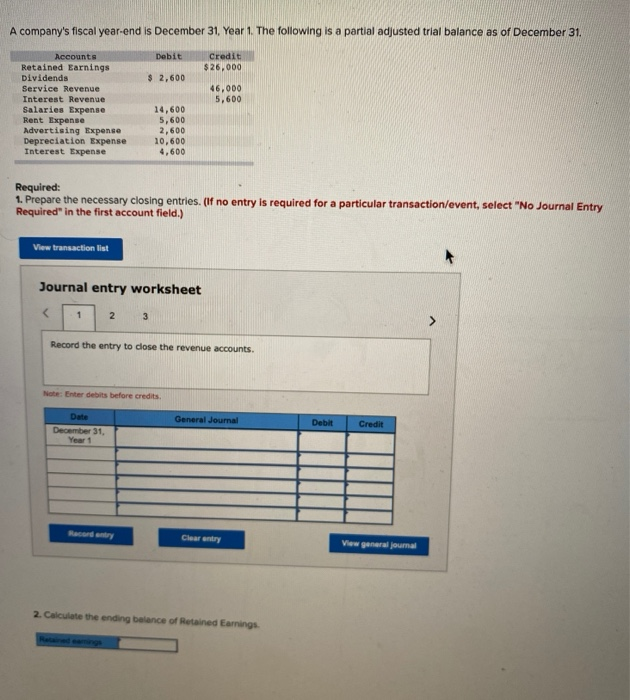

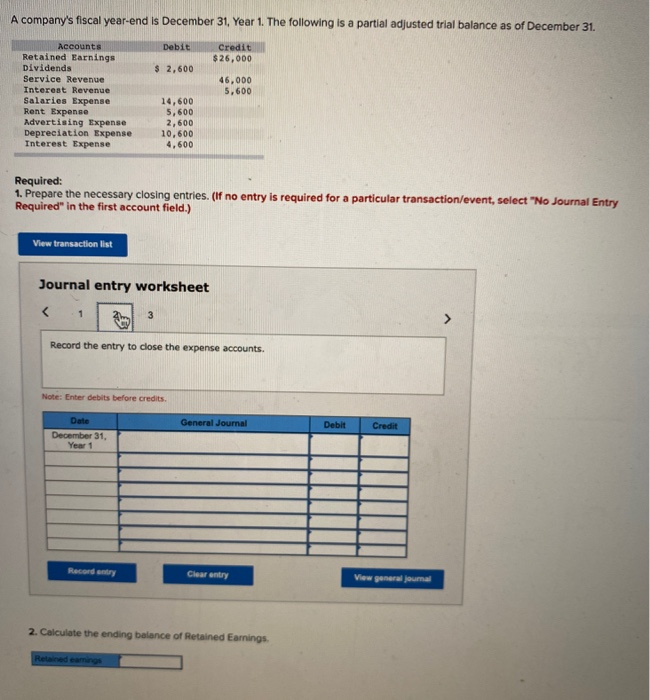

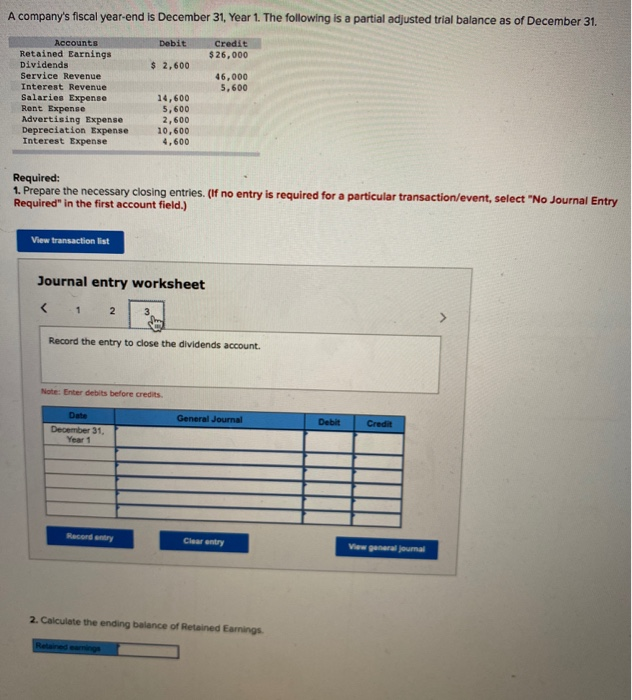

A company's fiscal year-end is December 31, Year 1. The following is a partial adjusted trial balance as of December 31. Debit Credit $ 26,000 $ 2,600 46,000 5,600 Accounts Retained Earnings Dividends Service Revenue Interest Revenue Salaries Expense Rent Expense Advertising Expense Depreciation Expense Interest Expense 14,600 5,600 2,600 10,600 4,600 Required: 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the entry to close the revenue accounts. Note: Enter debits before credits General Journal Debit Credit Date December 31 Year Record Clearn View general joumal 2. Calculate the ending balance of Retained Earnings A company's fiscal year-end is December 31, Year 1. The following is a partial adjusted trial balance as of December 31. Debit Credit $26,000 $ 2,600 46,000 5,600 Accounts Retained Earnings Dividends Service Revenue Interest Revenue Salaries Expense Rent Expense Advertising Expense Depreciation Expense Interest Expense 14,600 5,600 2,600 10,600 4,600 Required: 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3 Record the entry to close the expense accounts. Note: Enter debits before credits General Journal Debit Credit Date December 31, Year 1 Record Clear entry View general journal 2. Calculate the ending balance of Retained Earnings Retained ea A company's fiscal year-end is December 31, Year 1. The following is a partial adjusted trial balance as of December 31. Debit Credit $ 26,000 $ 2,600 Accounts Retained Earnings Dividends Service Revenue Interest Revenue Salaries Expense Rent Expense Advertising Expense Depreciation Expense Interest Expense 46,000 5,600 14,600 5,600 2,600 10,600 4.600 Required: 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the entry to close the dividends account. Note: Enter debits before credits General Journal Debit Date December 31 Year 1 Credit Record Clear entry View general Journal 2. Calculate the ending balance of Retained Earnings Reede