Answered step by step

Verified Expert Solution

Question

1 Approved Answer

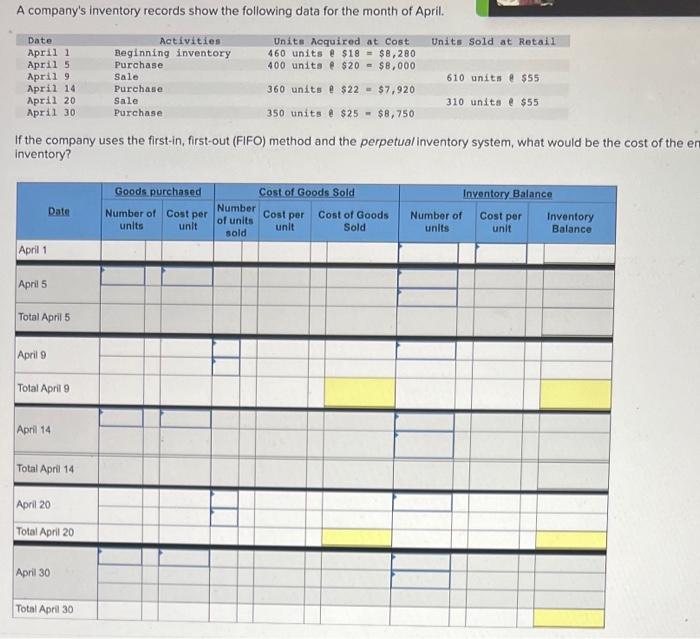

A company's inventory records show the following data for the month of April. Units Acquired at Cost 460 units @ $18 = $8,280 400 units

A company's inventory records show the following data for the month of April. Units Acquired at Cost 460 units @ $18 = $8,280 400 units @ $20 = $8,000 360 units @ $22 = $7,920 350 units @ $25 = $8,750 Date April 1 April 5 April 9 April 14 April 20 April 30 April 1 April 5 If the company uses the first-in, first-out (FIFO) method and the perpetual inventory system, what would be the cost of the en inventory? Date Total April 5 April 9 Total April 9 April 14 Total April 14 April 20 Total April 20 April 30 Activities Beginning inventory Purchase Sale Purchase Sale Purchase Total April 30 Goods purchased Number of Cost per units unit Number of units sold Units Sold at Retail Cost of Goods Sold Cost per unit 610 units @ $55 310 units @ $55 Inventory Balance Cost per unit Cost of Goods Number of Sold units Inventory Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started