Question

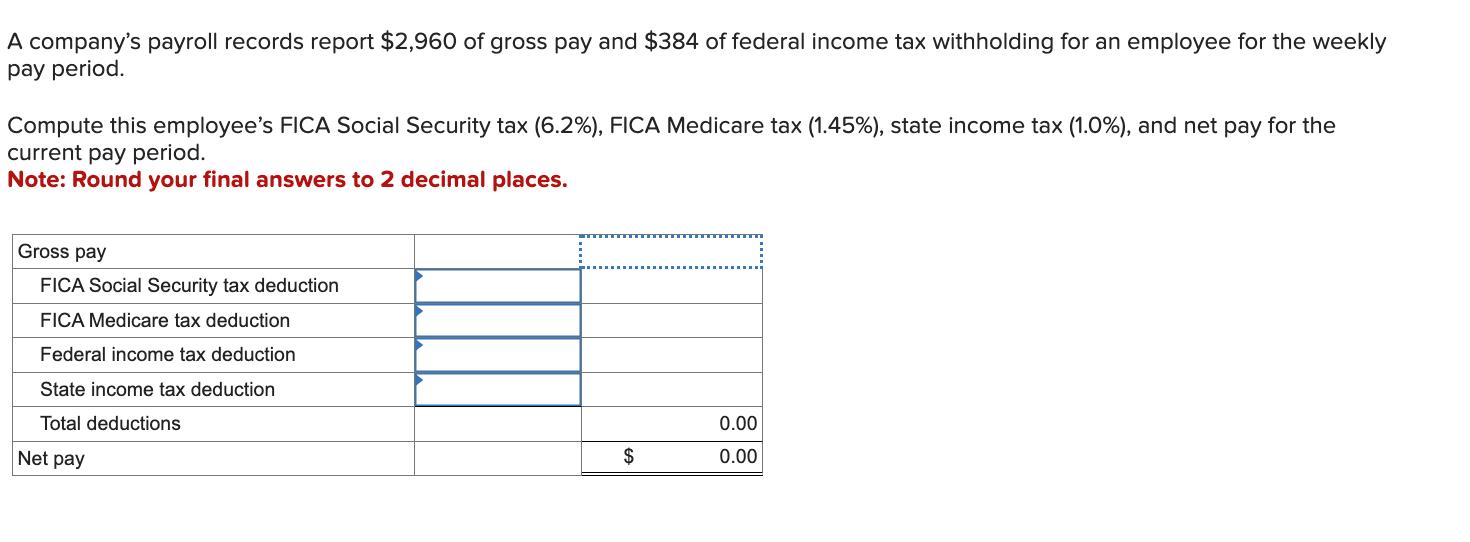

A company's payroll records report $2,960 of gross pay and $384 of federal income tax withholding for an employee for the weekly pay period.

A company's payroll records report $2,960 of gross pay and $384 of federal income tax withholding for an employee for the weekly pay period. Compute this employee's FICA Social Security tax (6.2%), FICA Medicare tax (1.45%), state income tax (1.0%), and net pay for the current pay period. Note: Round your final answers to 2 decimal places. Gross pay FICA Social Security tax deduction FICA Medicare tax deduction Federal income tax deduction State income tax deduction Total deductions Net pay 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the FICA Social Security tax FICA Medicare tax state income tax and net pay we need to fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information for Decisions

Authors: John Wild

7th edition

78025893, 978-0078025891

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App