Question

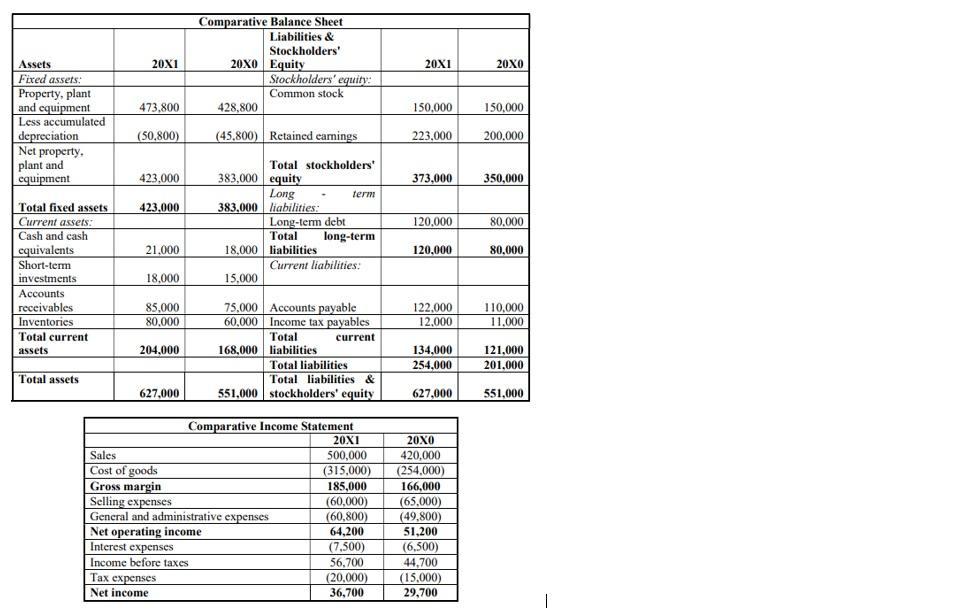

A comparative balance sheet and a comparative income statement for XYZ Company containing data in for the last recent years are as follows: Required:

A comparative balance sheet and a comparative income statement for “XYZ” Company containing data in € for the last recent years are as follows:

Required:

Compute the following ratios for "XYZ" for the year ending in 20X1: current ratio; acid-test ratio; cash ratio; accounts receivable turnover ratio; average collection period of accounts receivable; inventory turnover ratio; average holding period for inventories; accounts payable turnover ratio; an average period for accounts payable outstanding; trading cycle; networking capital ratio; fixed asset turnover ratio; assets turnover ratio and owners’ equity turnover ratio.

Comparative Balance Sheet Liabilities & Stockholders' 20X0 Equity Stockholders' equity: Common stock Assets 20X1 20X1 20X0 Fixed assets: Property, plant and equipment Less accumulated depreciation Net property, plant and equipment 473,800 428,800 150,000 150,000 (50,800) (45,800) Retained eamings 223.000 200,000 Total stockholders' 383,000 equity | Long 383,000 liabilities: Long-term debt Total 423.000 373,000 350,000 term Total fixed assets 423,000 Current assets: 120,000 80,000 Cash and cash long-term equivalents 18,000 liabilities Current liabilities: 21,000 120,000 80,000 Short-term investments 18,000 15,000 Accounts receivables Inventories Total current 75,000 Accounts payable 60,000 Income tax payables Total 168,000 liabilities Total liabilities 85,000 80,000 122.000 12.000 110,000 11.000 current 134,000 254,000 204,000 121,000 201,000 assets Total assets Total liabilities & 627,000 551.000 stockholders' equity 627,000 551,000 Comparative Income Statement 20X1 20X0 Sales 500,000 (315,000) 185,000 (60,000) (60,800) 420,000 (254,000) Cost of goods Gross margin Selling expenses General and administrative expenses 166,000 (65,000) (49,800) 51,200 (6,500) Net operating income Interest expenses Income before taxes 64,200 (7,500) 56,700 (20,000) 44,700 (15,000) 29,700 penses Net income 36,700

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6229fd5806a03_march10.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started