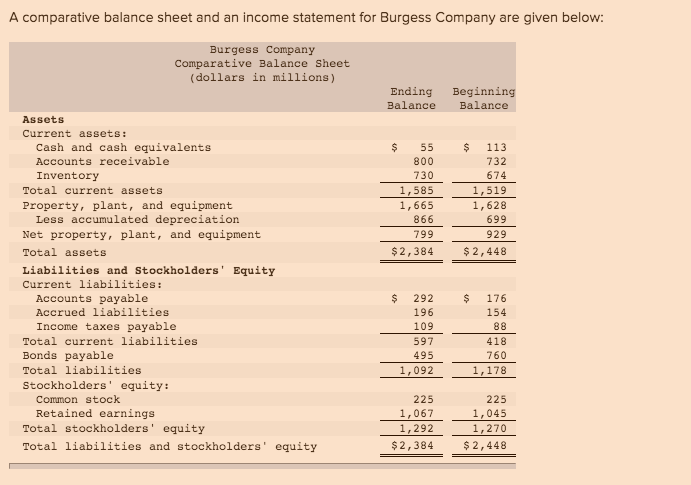

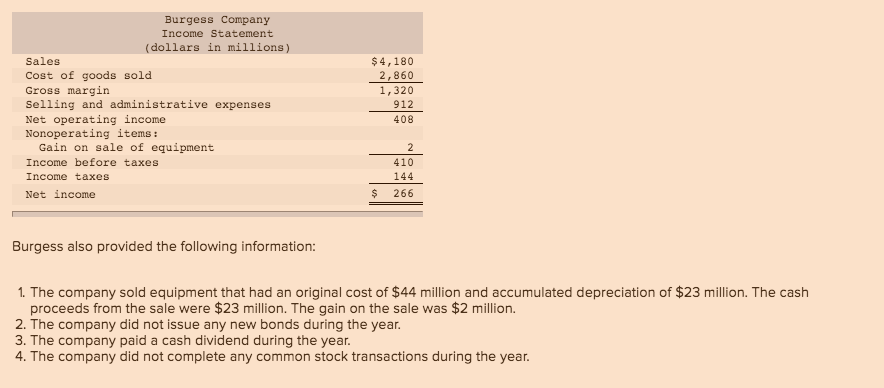

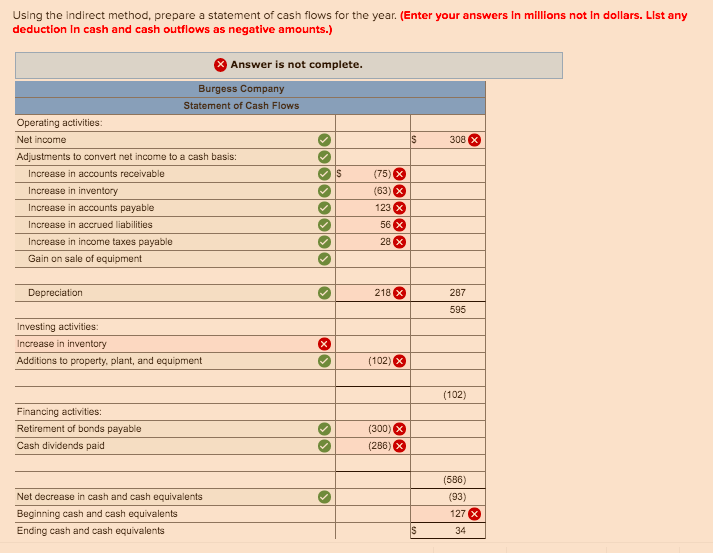

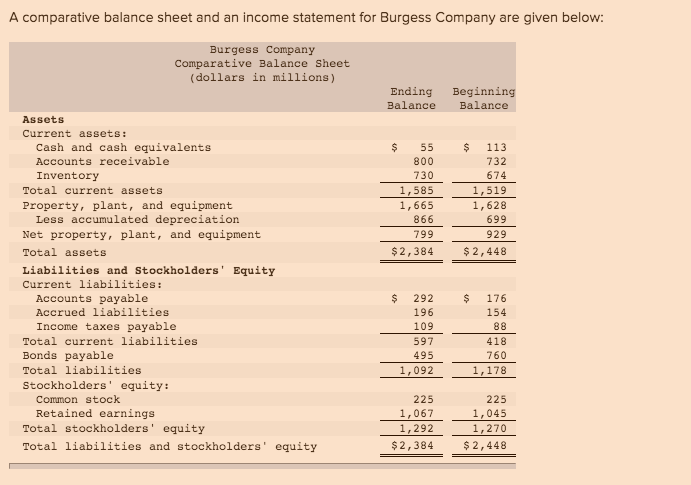

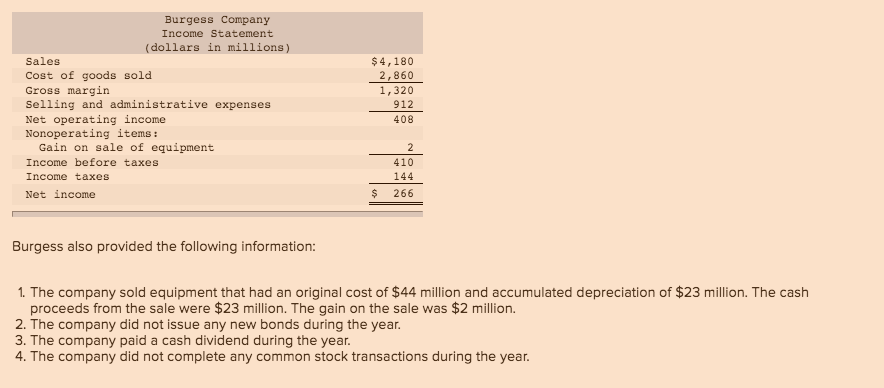

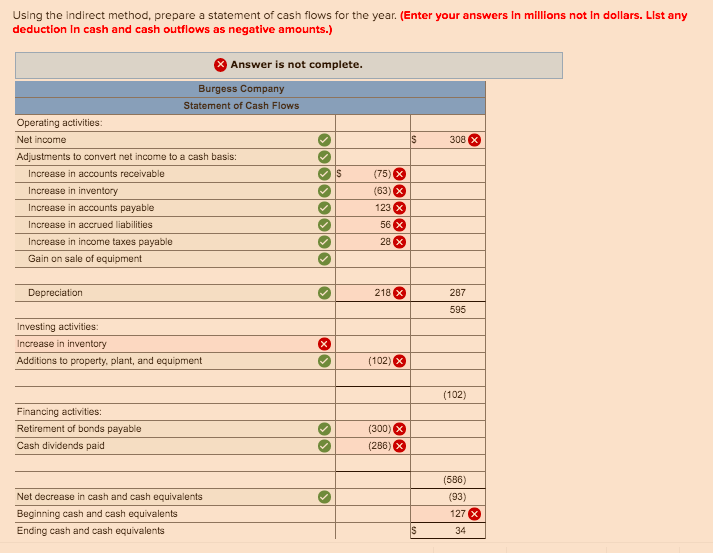

A comparative balance sheet and an income statement for Burgess Company are given below: Burgess Company Comparative Balance Sheet (dollars in millions) Ending Balance Beginning Balance $ $ 113 55 800 732 674 1,519 1,585 1,665 866 1,628 $2,384 $2,448 Assets Current assets: Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ $ 292 196 109 597 176 154 88 418 760 1,178 495 1,092 225 1,067 1,292 $ 2,384 225 1,045 1,270 $2,448 $ 4,180 2,860 320 Burgess Company Income Statement (dollars in millions) Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of equipment Income before taxes Income taxes Net income 912 $ 266 Burgess also provided the following information: 1. The company sold equipment that had an original cost of $44 million and accumulated depreciation of $23 million. The cash proceeds from the sale were $23 million. The gain on the sale was $2 million. 2. The company did not issue any new bonds during the year. 3. The company paid a cash dividend during the year. 4. The company did not complete any common stock transactions during the year. Using the indirect method, prepare a statement of cash flows for the year. (Enter your answers in millions not In dollars. List any deduction In cash and cash outflows as negative amounts.) X Answer is not complete. Burgess Company Statement of Cash Flows Operating activities: Net income Adjustments to convert net income to a cash basis: Increase in accounts receivable Increase in inventory Increase in accounts payable 308 x Increase in accrued liabilities Increase in income taxes payable Gain on sale of equipment Depreciation 218 X 287 595 Investing activities: Increase in inventory Additions to property, plant, and equipment (102) Financing activities: Retirement of bonds payable Cash dividends paid (300) X (286) X (586) (93) Net decrease in cash and cash equivalents Beginning cash and cash equivalents Ending cash and cash equivalents 127 34