Answered step by step

Verified Expert Solution

Question

1 Approved Answer

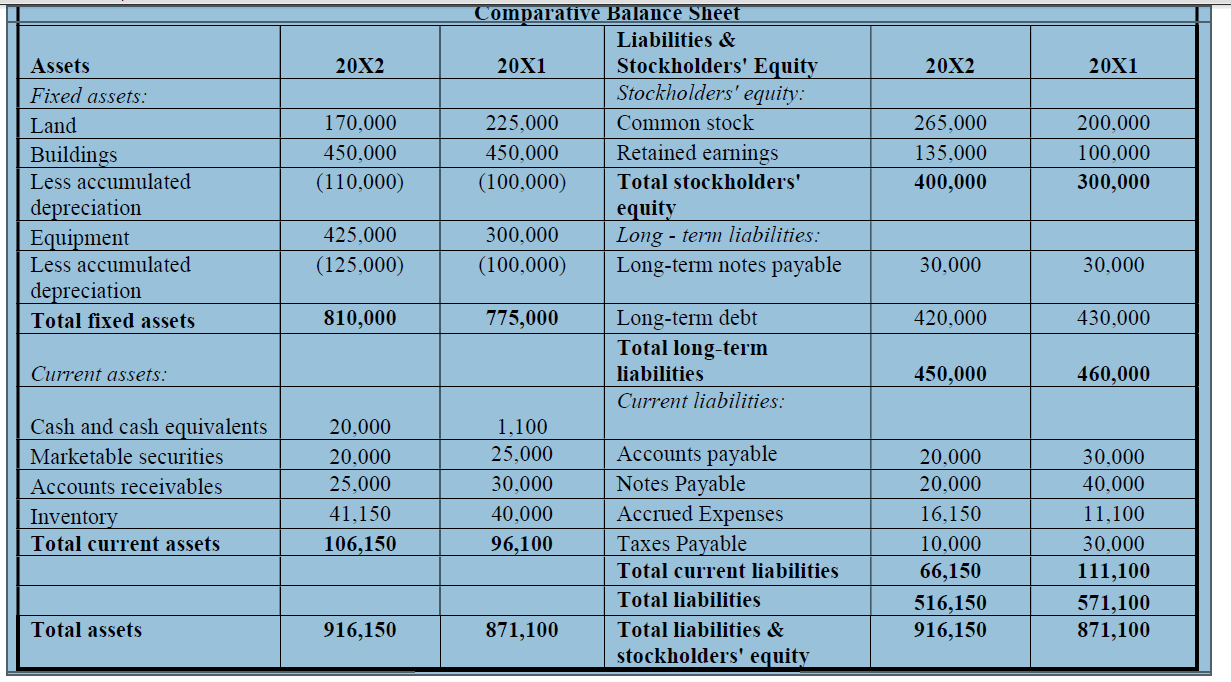

A comparative balance sheet for Alpha Company containing data in for the last recent years is as follows: Required: 1. Prepare the cash flow statement

A comparative balance sheet for Alpha Company containing data in for the last recent years is as follows:

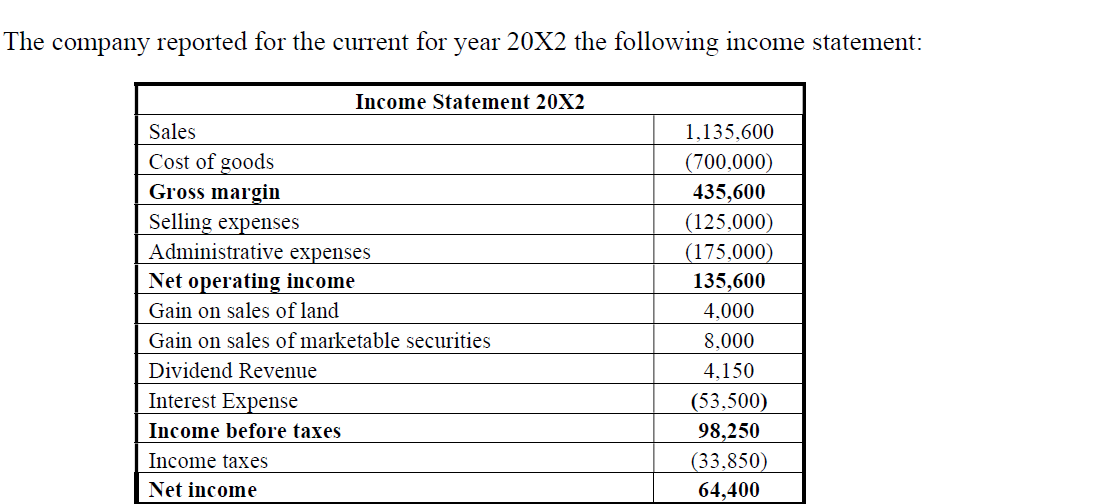

Required: 1. Prepare the cash flow statement for Alpha Company for this year 20X2, using the indirect method. 2. Prepare the cash flow statement for Alpha Company for this year 20X2, using the direct method. . 3. How can a firm distribute (finance) a positive (negative) cash component of earnings? Explain briefly (max: 300 words)

20X2 20X2 20X1 Assets Fixed assets: Land Buildings Less accumulated depreciation Equipment Less accumulated depreciation Total fixed assets 170,000 450.000 (110,000) Comparative Balance Sheet Liabilities & 20X1 Stockholders' Equity Stockholders' equity: 225,000 Common stock 450.000 Retained earnings (100,000) Total stockholders' equity 300.000 Long - term liabilities: (100,000) Long-term notes payable 265,000 135,000 400,000 200.000 100.000 300,000 425.000 (125,000) 30,000 30,000 810,000 775,000 420,000 430,000 Long-term debt Total long-term liabilities Current liabilities: Current assets: 450,000 460,000 ICS Cash and cash equivalents Marketable securities Accounts receivables Inventory Total current assets 20.000 20.000 25,000 41,150 106,150 1,100 25,000 30,000 40,000 96,100 Accounts payable Notes Payable Accrued Expenses Taxes Payable Total current liabilities Total liabilities Total liabilities & stockholders' equity 20.000 20,000 16.150 10,000 66,150 516,150 916,150 30,000 40.000 11,100 30,000 111,100 571,100 871,100 L Total assets 916,150 871,100 The company reported for the current for year 20X2 the following income statement: Income Statement 20X2 Sales Cost of goods Gross margin Selling expenses Administrative expenses Net operating income Gain on sales of land Gain on sales of marketable securities Dividend Revenue Interest Expense Income before taxes Income taxes Net income 1,135,600 (700,000 435,600 (125,000 (175,000 135,600 4,000 8,000 4,150 (53,500) 98,250 (33.850) 64,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started