Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A comparative balance sheet for Alpha Company containing data in for the last recent years is as follows: Required: 1. Prepare the cash flow

A comparative balance sheet for “Alpha” Company containing data in € for the last

recent years is as follows:

Required:

1. Prepare the cash flow statement for “Alpha” Company for this year 20X2,

using the indirect method.

2. Prepare the cash flow statement for “Alpha” Company for this year 20X2,

using the direct method. .

3. How can a firm distribute (finance) a positive (negative) cash component of

earnings? Explain briefly (max: 300 words)

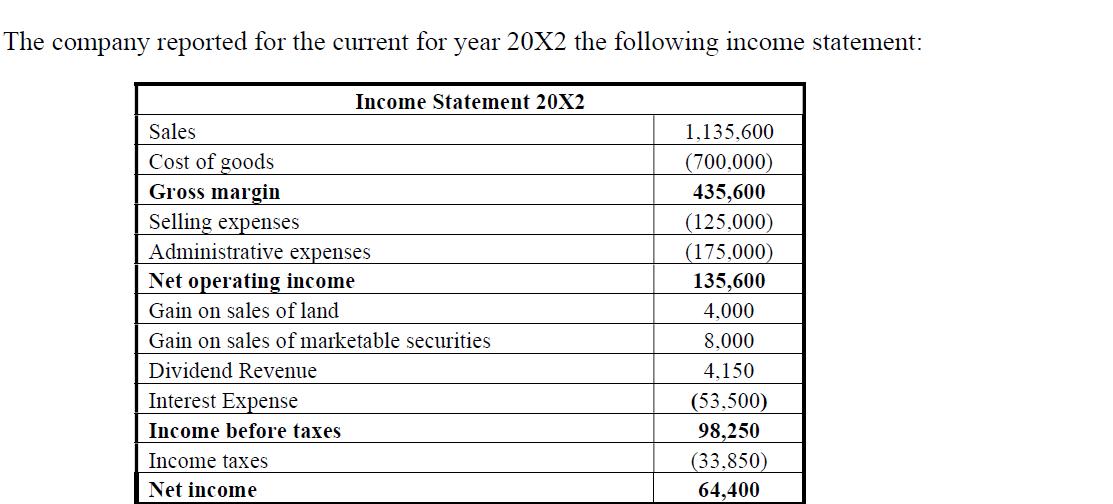

The company reported for the current for year 20X2 the following income statement: Sales Cost of goods Gross margin Selling expenses Income Statement 20X2 Administrative expenses Net operating income Gain on sales of land Gain on sales of marketable securities Dividend Revenue Interest Expense Income before taxes Income taxes Net income 1,135,600 (700,000) 435,600 (125,000) (175,000) 135,600 4,000 8,000 4,150 (53,500) 98,250 (33,850) 64,400

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The cash flow statement for Alpha Company for this year 20X2 using the indirect method Alpha ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started