Answered step by step

Verified Expert Solution

Question

1 Approved Answer

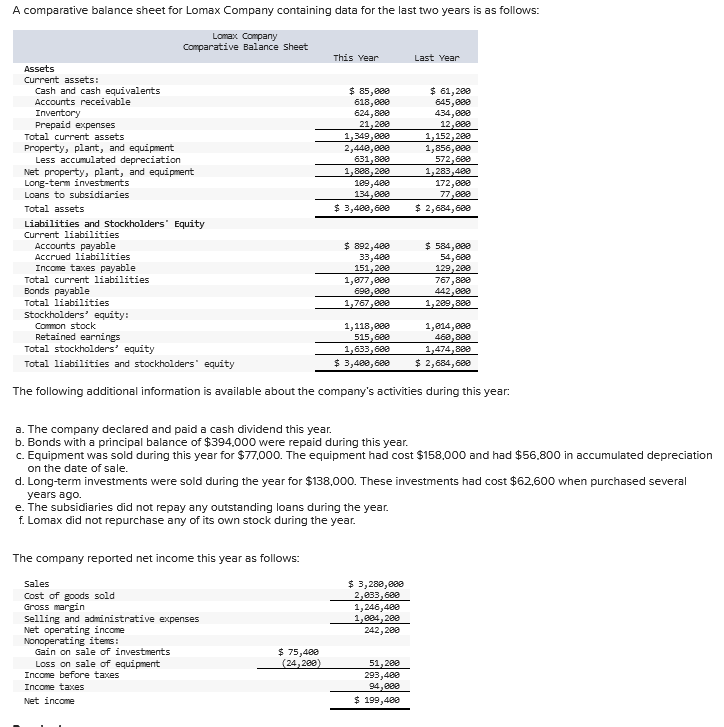

A comparative balance sheet for Lomax Company containing data for the last two years is as follows: Assets Current assets: Lomax Company Comparative Balance

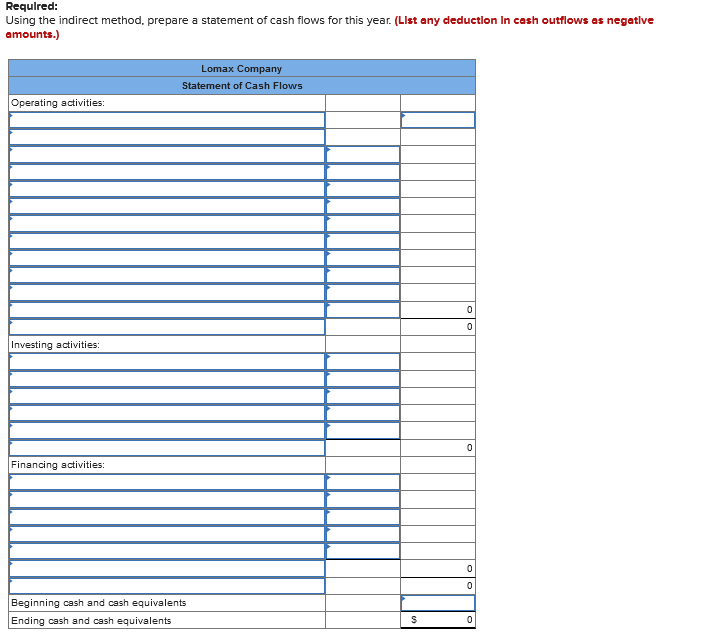

A comparative balance sheet for Lomax Company containing data for the last two years is as follows: Assets Current assets: Lomax Company Comparative Balance Sheet This Year Last Year Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Long-term investments Loans to subsidiaries Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 85,000 618,000 $ 61,200 645,000 624,888 434,000 21,200 12,888 1,349,000 1,152,200 2,440,000 1,856,000 631,800 572,600 1,888,200 109,400 134,000 $ 3,400,600 1,283,400 172,688 77,000 $ 2,684,688 $ 892,400 33,400 151,200 1,077,088 690,000 $ 584,000 54,688 129,288 1,767,000 1,118,888 515,688 1,633,680 $ 3,400,600 767,880 442,000 1,209,880 1,014,000 460,880 1,474,888 $ 2,684,600 The following additional information is available about the company's activities during this year: a. The company declared and paid a cash dividend this year. b. Bonds with a principal balance of $394,000 were repaid during this year. c. Equipment was sold during this year for $77,000. The equipment had cost $158,000 and had $56,800 in accumulated depreciation on the date of sale. d. Long-term investments were sold during the year for $138,000. These investments had cost $62,600 when purchased several years ago. e. The subsidiaries did not repay any outstanding loans during the year. f. Lomax did not repurchase any of its own stock during the year. The company reported net income this year as follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of investments Loss on sale of equipment Income before taxes Income taxes Net income $ 75,400 (24,280) $ 3,280,000 2,033,680 1,246,400 1,004,200 242,200 51,288 293,400 94,088 $ 199,480

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started