Answered step by step

Verified Expert Solution

Question

1 Approved Answer

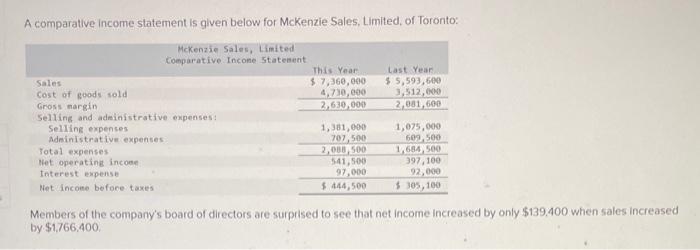

A comparative Income statement is given below for McKenzie Sales, Limited, of Toronto: McKenzie Sales, Limited) Comparative Income Statement Sales This Year $ 7,360,000 Last

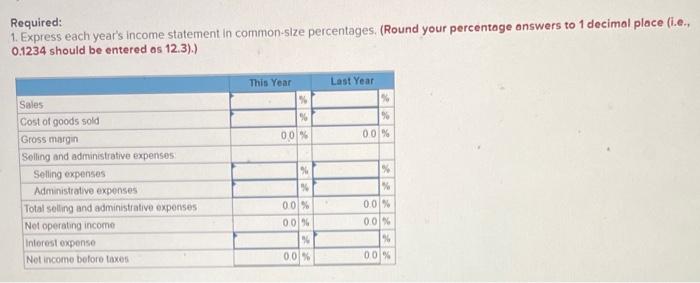

A comparative Income statement is given below for McKenzie Sales, Limited, of Toronto: McKenzie Sales, Limited) Comparative Income Statement Sales This Year $ 7,360,000 Last Year. $ 5,593,600 Cost of goods sold 4,730,000 Gross margin 2,630,000 3,512,000 2,081,600 Selling and administrative expenses: Selling expenses Total expenses Net operating income Interest expense 1,381,000 1,075,000 Administrative expenses 707,500 2,088,500 609,500 1,684,500 Net income before taxes 541,500 97,000 $444,500 397,100 92,000 $305,100 Members of the company's board of directors are surprised to see that net income increased by only $139,400 when sales increased by $1,766,400. Required: 1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) This Year Last Year Sales % Cost of goods sold % % Gross margin 00 % 00 % Selling and administrative expenses: Selling expenses % % Administrative expenses % % Total selling and administrative expenses 00% 0.0 % Net operating income 00% 0.0 % Interest expense % % Net income before taxes 0.0 % 00%

A comparative Income statement is given below for McKenzie Sales, Limited, of Toronto: McKenzie Sales, Limited) Comparative Income Statement Sales This Year $ 7,360,000 Last Year. $ 5,593,600 Cost of goods sold 4,730,000 Gross margin 2,630,000 3,512,000 2,081,600 Selling and administrative expenses: Selling expenses Total expenses Net operating income Interest expense 1,381,000 1,075,000 Administrative expenses 707,500 2,088,500 609,500 1,684,500 Net income before taxes 541,500 97,000 $444,500 397,100 92,000 $305,100 Members of the company's board of directors are surprised to see that net income increased by only $139,400 when sales increased by $1,766,400. Required: 1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) This Year Last Year Sales % Cost of goods sold % % Gross margin 00 % 00 % Selling and administrative expenses: Selling expenses % % Administrative expenses % % Total selling and administrative expenses 00% 0.0 % Net operating income 00% 0.0 % Interest expense % % Net income before taxes 0.0 % 00% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started