Question

A comparative incomplete balance sheet for ABC Company containing data in for the last recent years is as follows: Additional information the accounts receivable

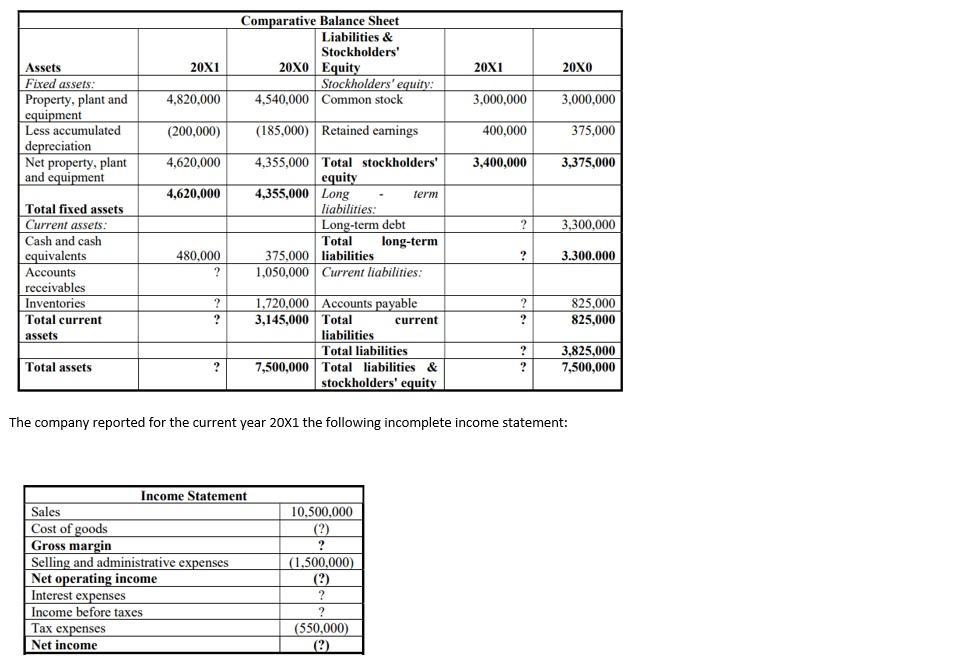

A comparative incomplete balance sheet for “ABC” Company containing data in € for the last recent years is as follows:

Additional information

the accounts receivable turnover ratio for 20x1 is 8 times

all sales are on account

the net profit margin for 20x1 is 14,5%

return on total assets (Don't add back interest expense in the calculation and use net income ) is 20% in 20x1

the current ratio on Dec 31,20x1 is 2.5

the inventory turnover ration (based on cost of goods) for 20x1 is 4.9

Required:

Compute the missing values on the incomplete comparative balance sheet and the incomplete income statement of “ABC” Company.

Comparative Balance Sheet Liabilities & Stockholders' 20X0 Equity Stockholders' equity: 4,540,000 Common stock Assets 20X1 20X1 20X0 Fixed assets: Property, plant and equipment Less accumulated depreciation Net property, plant and equipment 4,820,000 3,000,000 3,000,000 (200,000) (185,000) Retained earnings 400,000 375,000 4,620,000 4,355,000 Total stockholders' 3,400,000 3,375,000 equity 4,355,000 Long liabilities: Long-term debt 4,620,000 term Total fixed assets Current assets: 3,300,000 Cash and cash Total 375,000 liabilities 1,050,000 Current liabilities: long-term equivalents 480,000 3.300.000 Accounts receivables Inventories Total current 1,720,000 Accounts payable 3,145,000 Total 825,000 current ? 825,000 liabilities Total liabilities 7,500,000 Total liabilities & stockholders' equity assets 3,825,000 7,500,000 Total assets ? The company reported for the current year 20X1 the following incomplete income statement: Income Statement 10.500,000 (?) Sales Cost of goods Gross margin Selling and administrative expenses Net operating income Interest expenses Income before taxes expenses Net income (1,500,000) (?) ? (550,000) (?)

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Comparative Balance Sheet Assets 20X1 20X0 Liabilities and Stockholders Equity 20X1 20X...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started