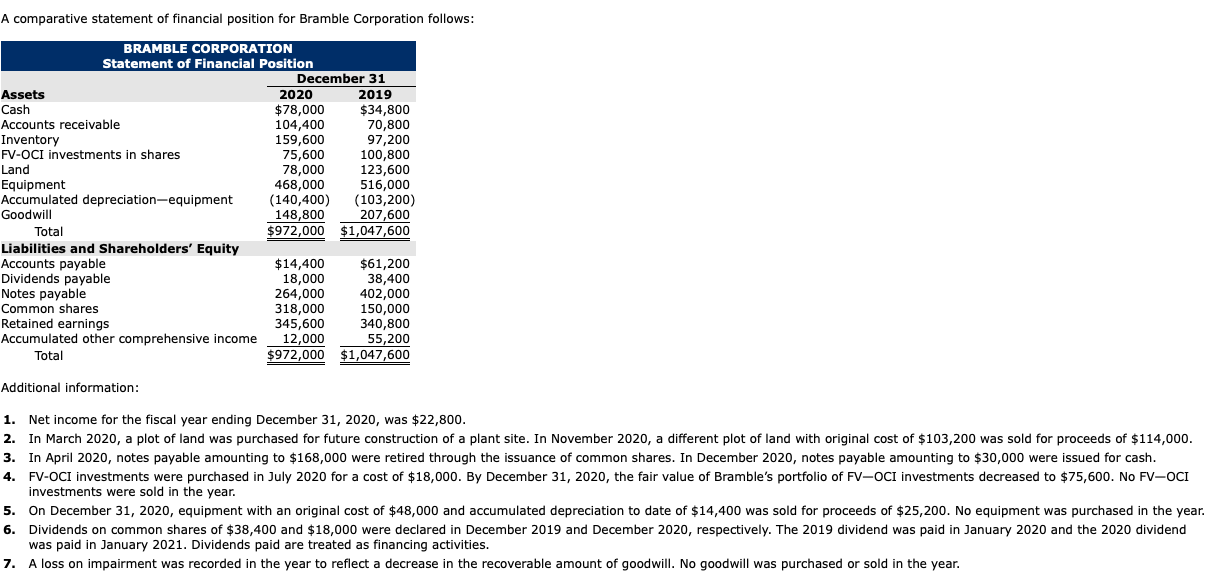

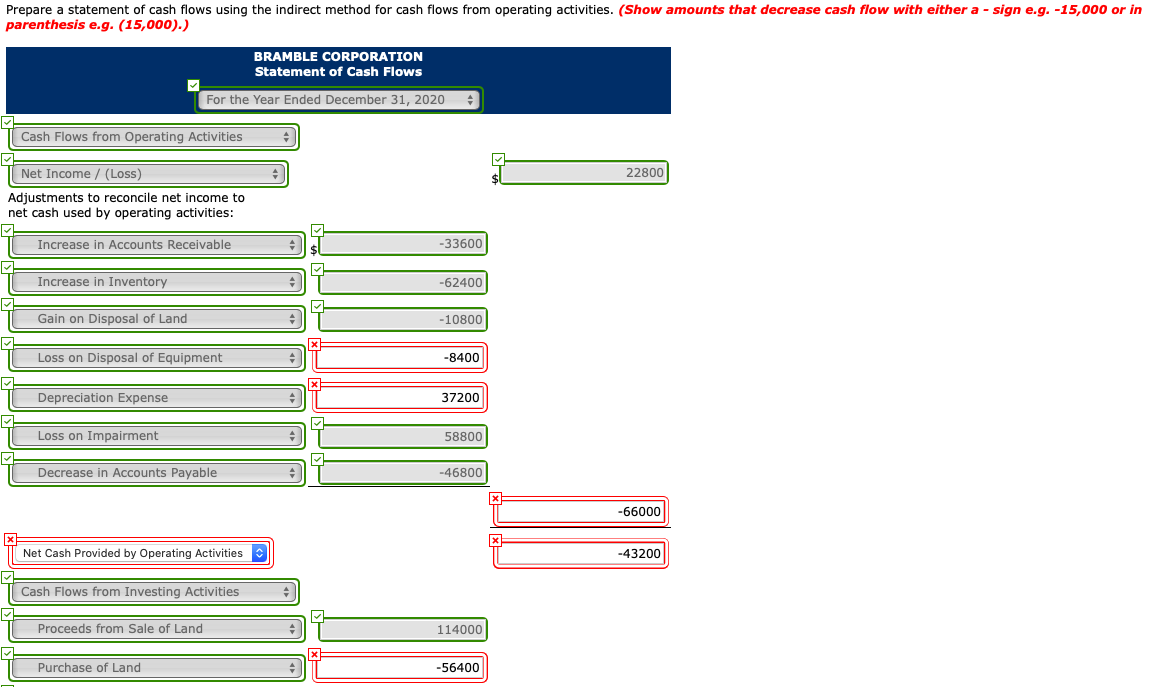

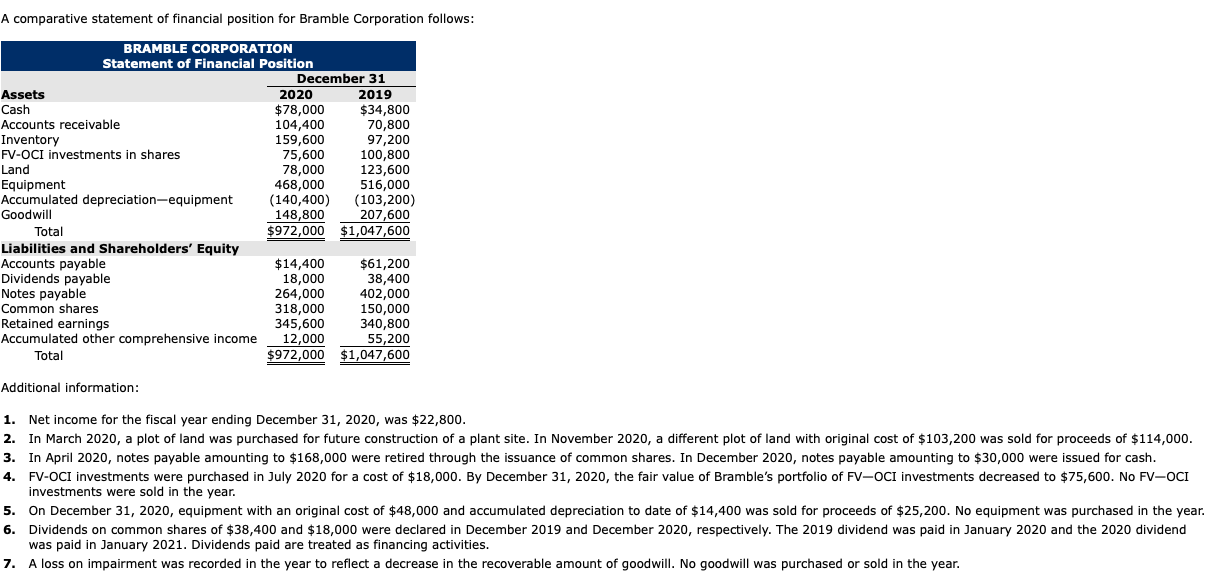

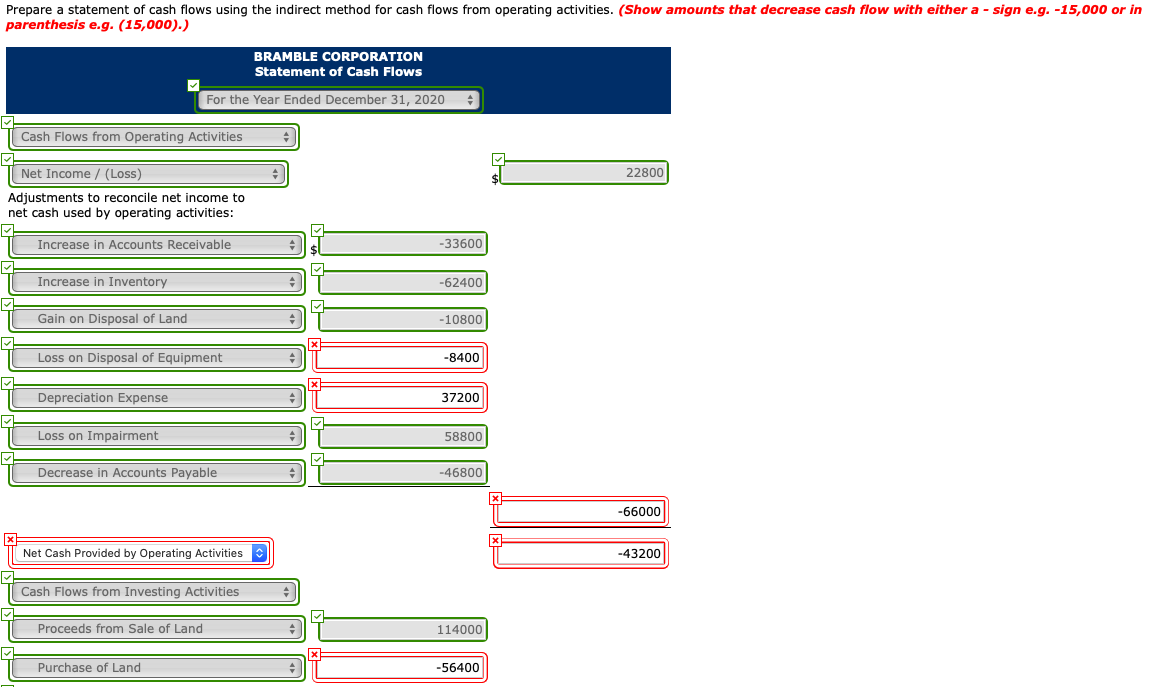

A comparative statement of financial position for Bramble Corporation follows: BRAMBLE CORPORATION Statement of Financial Position December 31 Assets 2020 2019 Cash $78,000 $34,800 Accounts receivable 104,400 70,800 Inventory 159,600 97,200 FV-OCI investments in shares 75,600 100,800 Land 78,000 123,600 Equipment 468,000 516,000 Accumulated depreciation-equipment (140,400) (103,200) Goodwill 148,800 207,600 Total $972,000 $1,047,600 Liabilities and Shareholders' Equity Accounts payable $14,400 $61,200 Dividends payable 18,000 38,400 Notes payable 264,000 402,000 Common shares 318,000 150,000 Retained earnings 345,600 340,800 Accumulated other comprehensive income 12,000 55,200 Total $972,000 $1,047,600 Additional information: 1. Net income for the fiscal year ending December 31, 2020, was $22,800. 2. In March 2020, a plot of land was purchased for future construction of a plant site. In November 2020, a different plot of land with original cost of $103,200 was sold for proceeds of $114,000. 3. In April 2020, notes payable amounting to $168,000 were retired through the issuance of common shares. In December 2020, notes payable amounting to $30,000 were issued for cash. 4. FV-OCI investments were purchased in July 2020 for a cost of $18,000. By December 31, 2020, the fair value of Bramble's portfolio of FV-OCI investments decreased to $75,600. No FV-OCI investments were sold in the year. 5. On December 31, 2020, equipment with an original cost of $48,000 and accumulated depreciation to date of $14,400 was sold for proceeds of $25,200. No equipment was purchased in the year. 6. Dividends on common shares of $38,400 and $18,000 were declared in December 2019 and December 2020, respectively. The 2019 dividend was paid in January 2020 and the 2020 dividend was paid in January 2021. Dividends paid are treated as financing activities. 7. A loss on impairment was recorded in the year to reflect a decrease in the recoverable amount of goodwill. No goodwill was purchased or sold in the year. Prepare a statement of cash flows using the indirect method for cash flows from operating activities. (Show amounts that decrease cash flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) BRAMBLE CORPORATION Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities 22800 Net Income / (Loss) Adjustments to reconcile net income to net cash used by operating activities: Increase in Accounts Receivable -33600 Increase in Inventory -62400 Gain on Disposal of Land -10800 x Loss on Disposal of Equipment -8400 X Depreciation Expense 37200 Loss on Impairment 58800 M Decrease in Accounts Payable -46800 -66000 x Net Cash Provided by Operating Activities -43200 Cash Flows from Investing Activities Proceeds from Sale of Land 114000 Purchase of Land -56400