Answered step by step

Verified Expert Solution

Question

1 Approved Answer

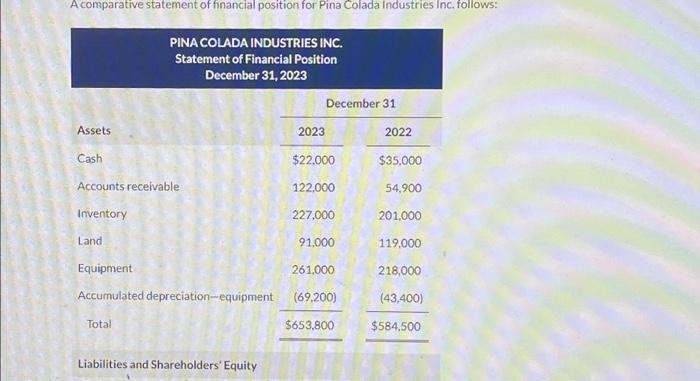

A comparative statement of financial position for Pina Colada Industries Inc. follows: Assets Cash Accounts receivable Inventory Land PINA COLADA INDUSTRIES INC. Statement of Financial

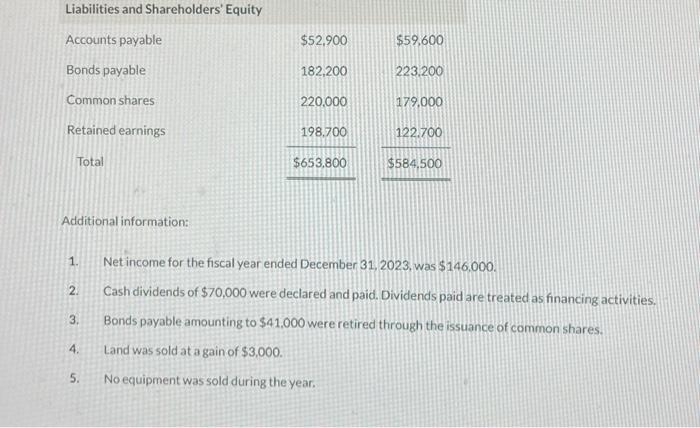

A comparative statement of financial position for Pina Colada Industries Inc. follows: Assets Cash Accounts receivable Inventory Land PINA COLADA INDUSTRIES INC. Statement of Financial Position December 31, 2023 Equipment Accumulated depreciation-equipment Total Liabilities and Shareholders' Equity 2023 December 31 $22,000 122,000 227,000 91,000 261,000 (69,200) $653,800 2022 $35,000 54,900 201,000 119,000 218,000 (43,400) $584,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started