Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A competent U.S. financial manager must understand the way U.S. stock markets are structured and operate. In the United States, the stock markets consist of

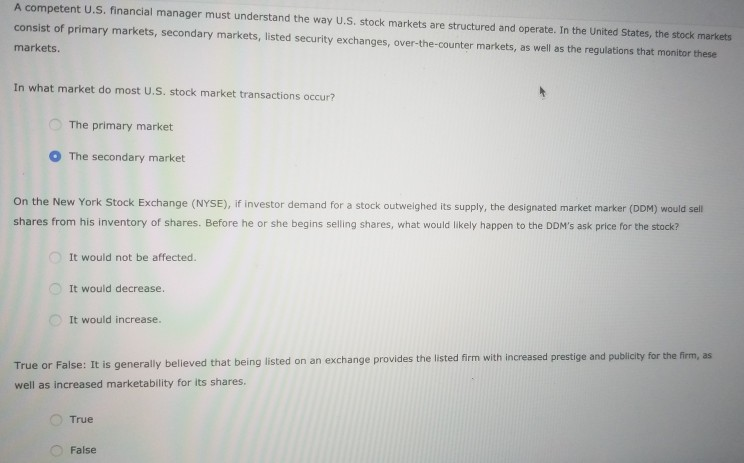

A competent U.S. financial manager must understand the way U.S. stock markets are structured and operate. In the United States, the stock markets consist of primary markets, secondary markets, listed security exchanges, over-the-counter markets, as well as the regulations that monitor these markets. In what market do most U.S. stock market transactions occur? The primary market The secondary market On the New York Stock Exchange (NYSE), ir investor demand for a stock outweighed its supply, the designated market marker (DDM) would sell shares from his inventory of shares. Before he or she begins selling shares, what would likely happen to the DDM's ask price for the stack? It would not be affected. It would decrease. It would increase. True or False: It is generally believed that being listed on an exchange provides the listed firm with increased prestige and publicity for the firm, as well as increased marketability for its shares. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started