Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A competitor sells a tractor for $14,000. Your company has been working on a new product to enter the market and your marginal cost

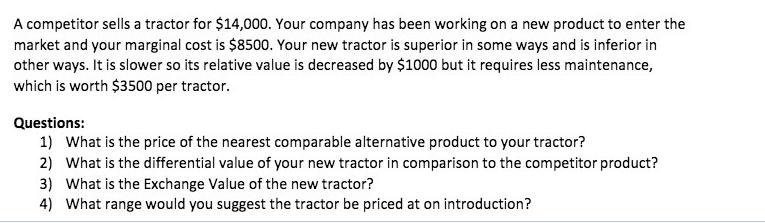

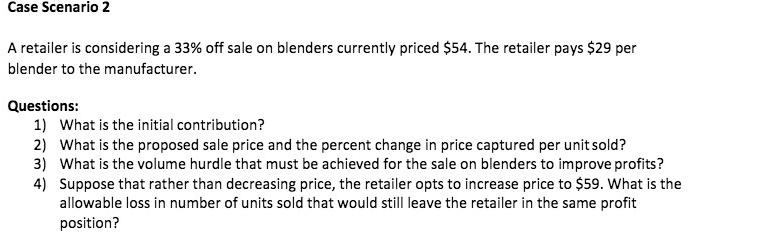

A competitor sells a tractor for $14,000. Your company has been working on a new product to enter the market and your marginal cost is $8500. Your new tractor is superior in some ways and is inferior in other ways. It is slower so its relative value is decreased by $1000 but it requires less maintenance, which is worth $3500 per tractor. Questions: 1) What is the price of the nearest comparable alternative product to your tractor? 2) What is the differential value of your new tractor in comparison to the competitor product? 3) What is the Exchange Value of the new tractor? 4) What range would you suggest the tractor be priced at on introduction? Case Scenario 2 A retailer is considering a 33% off sale on blenders currently priced $54. The retailer pays $29 per blender to the manufacturer. Questions: 1) What is the initial contribution? 2) What is the proposed sale price and the percent change in price captured per unit sold? 4) 3) What is the volume hurdle that must be achieved for the sale on blenders to improve profits? Suppose that rather than decreasing price, the retailer opts to increase price to $59. What is the allowable loss in number of units sold that would still leave the retailer in the same profit position?

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Case Scenario 1 1 To determine the price of the nearest comparable alternative product to your tractor we need to consider the adjustments for both the superior and inferior aspects of your tractor Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started