Answered step by step

Verified Expert Solution

Question

1 Approved Answer

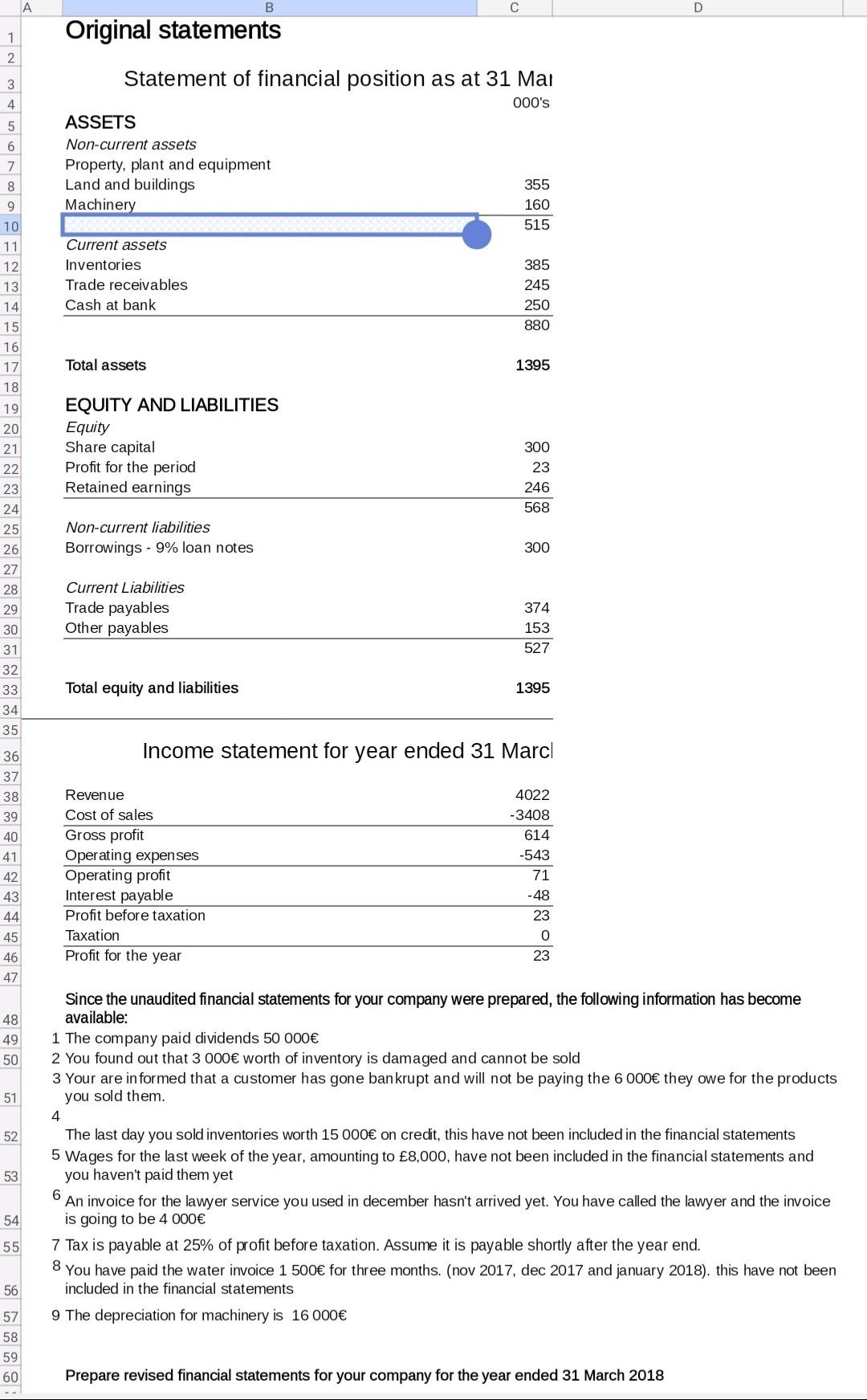

A comprehensive answer would be helpful A D Original statements 1 w N Statement of financial position as at 31 Mai 4 000's 5 6

A comprehensive answer would be helpful

A D Original statements 1 w N Statement of financial position as at 31 Mai 4 000's 5 6 7 ASSETS Non-current assets Property, plant and equipment Land and buildings Machinery 8 9 355 160 515 10 11 12 385 Current assets Inventories Trade receivables Cash at bank 13 14 245 250 880 15 16 17 18 Total assets 1395 19 20 21 EQUITY AND LIABILITIES Equity Share capital Profit for the period Retained earnings 22. 300 23 246 568 23 24 25 26 27 Non-current liabilities Borrowings - 9% loan notes 300 28 29 Current Liabilities Trade payables Other payables 374 30 153 527 31 32 33 34 35 Total equity and liabilities 1395 36 Income statement for year ended 31 Marcl 37 38 39 40 41 42 Revenue Cost of sales Gross profit Operating expenses Operating profit Interest payable Profit before taxation Taxation Profit for the year 4022 -3408 614 -543 71 -48 23 0 23 43 44 45 46 47 48 49 50 51 52 Since the unaudited financial statements for your company were prepared, the following information has become available: 1 The company paid dividends 50 000 2 You found out that 3 000 worth of inventory is damaged and cannot be sold 3 Your are informed that a customer has gone bankrupt and will not be paying the 6 000 they owe for the products you sold them. 4 The last day you sold inventories worth 15 000 on credit, this have not been included in the financial statements 5 Wages for the last week of the year, amounting to 8,000, have not been included in the financial statements and you haven't paid them yet 6 An invoice for the lawyer service you used in december hasn't arrived yet. You have called the lawyer and the invoice is going to be 4 000 7 Tax is payable at 25% of profit before taxation. Assume it is payable shortly after the year end. 8 You have paid the water invoice 1 500 for three months. (nov 2017, dec 2017 and january 2018). this have not been included in the financial statements 9 The depreciation for machinery is 16 000 53 54 55 56 57 58 59 60 Prepare revised financial statements for your company for the year ended 31 March 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started