Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Compute before and after-tax cost of debt. b) Compute the cost of preferred stock. Using info above, Please show all working steps using Financial

a) Compute before and after-tax cost of debt.

a) Compute before and after-tax cost of debt.

b) Compute the cost of preferred stock.

Using info above, Please show all working steps using Financial Calculator, thanks.

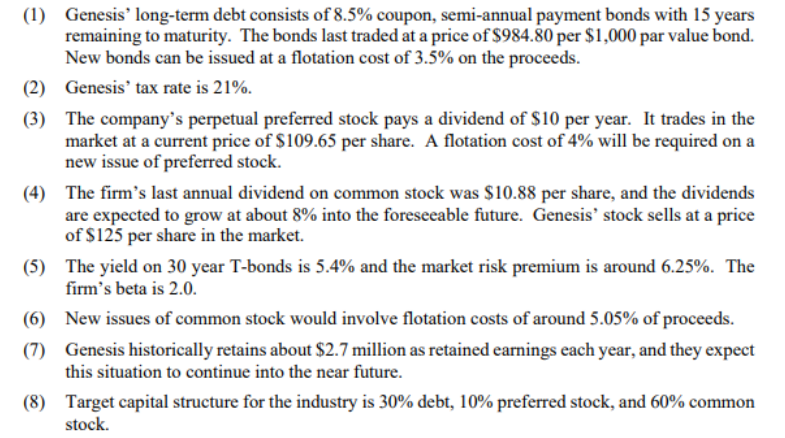

(1) Genesis' long-term debt consists of 8.5% coupon, semi-annual payment bonds with 15 years remaining to maturity. The bonds last traded at a price of $984.80 per $1,000 par value bond. New bonds can be issued at a flotation cost of 3.5% on the proceeds. (2) Genesis' tax rate is 21%. (3) The company's perpetual preferred stock pays a dividend of $10 per year. It trades in the market at a current price of $109.65 per share. A flotation cost of 4% will be required on a new issue of preferred stock. (4) The firm's last annual dividend on common stock was $10.88 per share, and the dividends are expected to grow at about 8% into the foreseeable future. Genesis' stock sells at a price of $125 per share in the market. (5) The yield on 30 year T-bonds is 5.4% and the market risk premium is around 6.25%. The firm's beta is 2.0 . (6) New issues of common stock would involve flotation costs of around 5.05% of proceeds. (7) Genesis historically retains about $2.7 million as retained earnings each year, and they expect this situation to continue into the near future. (8) Target capital structure for the industry is 30% debt, 10% preferred stock, and 60% commonStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started