Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Compute each of the above ratios for Bao Corporation. b. Summarize the results of these ratios. c. Based on this analysis, would you recommend

a. Compute each of the above ratios for Bao Corporation.

b. Summarize the results of these ratios.

c. Based on this analysis, would you recommend that the loan be approved?

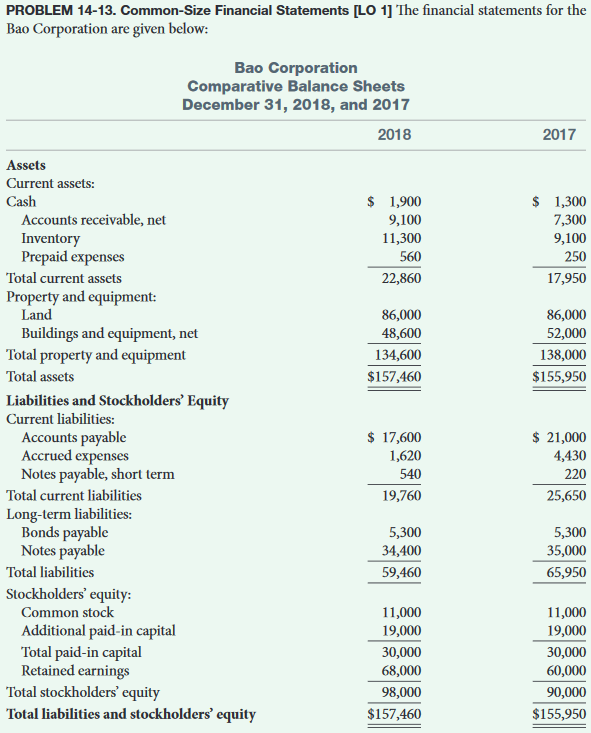

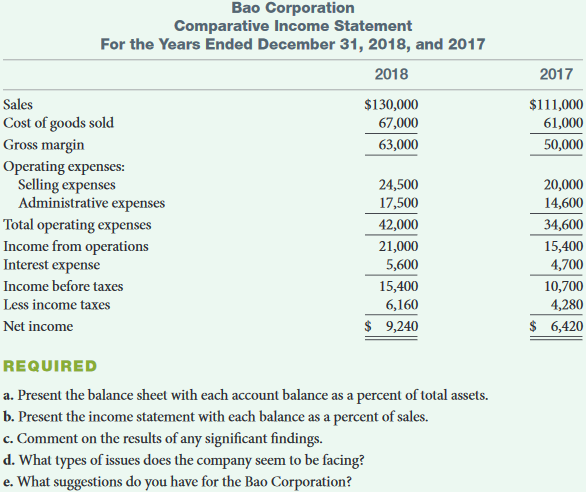

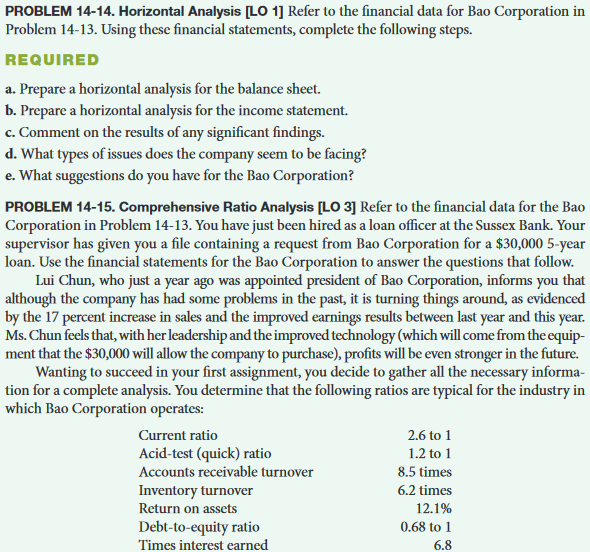

PROBLEM 14-13. Common-Size Financial Statements [LO 1] The financial statements for the Bao Corporation are given below: Bao Corporation Comparative Balance Sheets December 31, 2018, and 2017 2018 2017 Assets Current assets $ 1,300 Cash $1,900 Accounts receivable, net 7,300 9,100 9,100 Inventory Prepaid expenses 11,300 560 250 Total current assets 17,950 22,860 Property and equipment: Land 86,000 86,000 Buildings and equipment, net Total property and equipment 48,600 52,000 134,600 138,000 Total assets $157,460 $155,950 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued expenses Notes payable, short term 21,000 4,430 17,600 1,620 540 220 Total current liabilities 19,760 25,650 Long-term liabilities: Bonds payable Notes payable 5,300 34,400 5,300 35,000 Total liabilities 59,460 65,950 Stockholders' equity: Common stock 11,000 19,000 11,000 19,000 Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 30,000 68,000 30,000 60,000 98,000 90,000 $157,460 $155,950 Bao Corporation Comparative Income Statement For the Years Ended December 31, 2018, and 2017 2018 2017 Sales $130,000 67,000 $111,000 61,000 Cost of goods sold Gross margin Operating expenses: Selling expenses Administrative expenses 63,000 50,000 24,500 17,500 20,000 14,600 Total operating expenses Income from operations Interest expense 42,000 34,600 21,000 15,400 4,700 5,600 Income before taxes 15,400 10,700 4,280 Less income taxes 6,160 $6,420 Net income 9,240 REQUIRED a. Present the balance sheet with each account balance as a percent of total assets b. Present the income statement with each balance as a percent of sales. c. Comment on the results of any significant findings. d. What types of issues does the company seem to be facing? e. What suggestions do you have for the Bao Corporation? PROBLEM 14-14. Horizontal Analysis [LO 1] Refer to the financial data for Bao Corporation in Problem 14-13. Using these financial statements, complete the following steps. REQUIRED a. Prepare a horizontal analysis for the balance sheet. b. Prepare a horizontal analysis for the income statement. c. Comment on the results of any significant findings d. What types of issues does the company seem to be facing? e. What suggestions do you have for the Bao Corporation? PROBLEM 14-15. Comprehensive Ratio Analysis [LO 3] Refer to the financial data for the Bao Corporation in Problem 14-13. You have just been hired as a loan officer at the Sussex Bank. Your supervisor has given you a file containing a request from Bao Corporation for a $30,000 5-year loan. Use the financial statements for the Bao Corporation to answer the questions that follow. Lui Chun, who just a year ago was appointed president of Bao Corporation, informs you that although the company has had some problems in the past, it is turning things around, as evidenced by the 17 percent increase in sales and the improved earnings results between last year and this year. Ms. Chun feels that, with her leadership and the improved technology (which will come from the equip- ment that the $30,000 will allow the company to purchase), profits will be even stronger in the future Wanting to succeed in your first assignment, you decide to gather all the necessary informa- tion for a complete analysis. You determine that the following ratios are typical for the industry in which Bao Corporation operates: Current ratio 2.6 to 1 1.2 to Acid-test (quick) ratio Accounts receivable turnover 8.5 times Inventory turnover 6.2 times Return on assets 12.1% Debt-to-equity ratio Times interest earned 0.68 to 1 6.8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started