Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Compute net sales, gross profit, and the gross margin ratio for each of the four separate companies. (b) Which company has the better

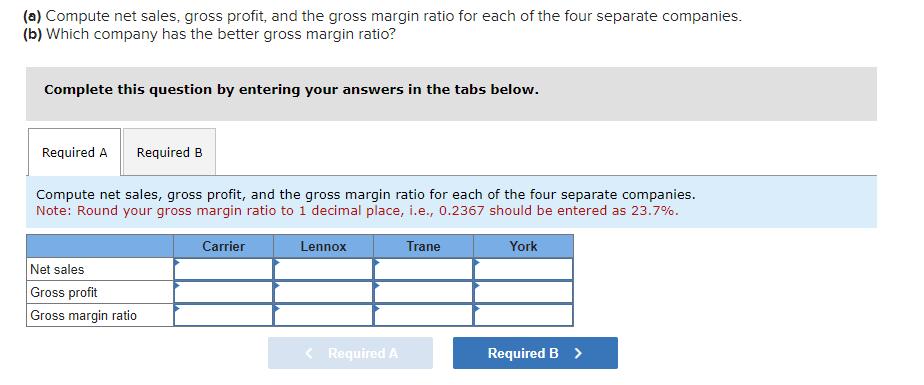

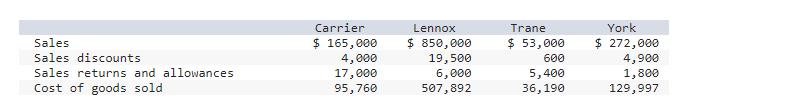

(a) Compute net sales, gross profit, and the gross margin ratio for each of the four separate companies. (b) Which company has the better gross margin ratio? Complete this question by entering your answers in the tabs below. Required A Required B Compute net sales, gross profit, and the gross margin ratio for each of the four separate companies. Note: Round your gross margin ratio to 1 decimal place, i.e., 0.2367 should be entered as 23.7%. Carrier Trane York Net sales Gross profit Gross margin ratio Lennox < Required A Required B > Sales Sales discounts Sales returns and allowances Cost of goods sold Carrier $ 165,000 4,000 17,000 95,760 Lennox $ 850,000 19,500 6,000 507,892 Trane $ 53,000 600 5,400 36, 190 York $ 272,000 4,900 1,800 129,997

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets compute net sales gross profit and the gross margin ratio for each of the four separate com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started