Answered step by step

Verified Expert Solution

Question

1 Approved Answer

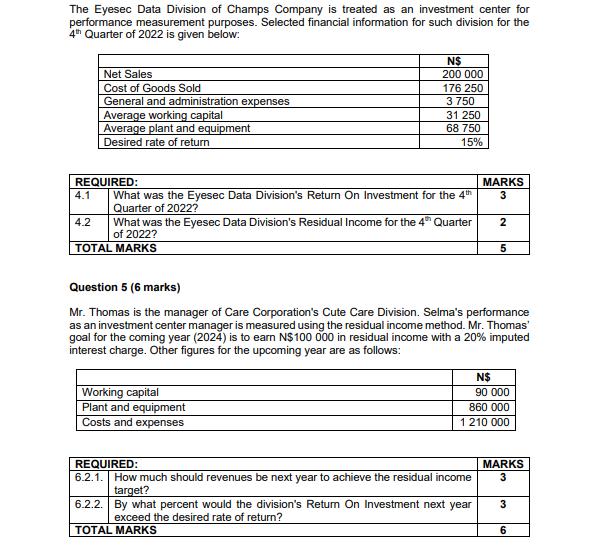

The Eyesec Data Division of Champs Company is treated as an investment center for performance measurement purposes. Selected financial information for such division for

The Eyesec Data Division of Champs Company is treated as an investment center for performance measurement purposes. Selected financial information for such division for the 4th Quarter of 2022 is given below: Net Sales Cost of Goods Sold General and administration expenses 4.2 Average working capital Average plant and equipment Desired rate of return REQUIRED: 4.1 What was the Eyesec Data Division's Return On Investment for the 4th Quarter of 2022? N$ 200 000 176 250 3 750 TOTAL MARKS 31 250 68 750 15% What was the Eyesec Data Division's Residual Income for the 4th Quarter of 2022? Working capital Plant and equipment Costs and expenses MARKS 3 Question 5 (6 marks) Mr. Thomas is the manager of Care Corporation's Cute Care Division. Selma's performance as an investment center manager is measured using the residual income method. Mr. Thomas' goal for the coming year (2024) is to earn N$100 000 in residual income with a 20% imputed interest charge. Other figures for the upcoming year are as follows: REQUIRED: 6.2.1. How much should revenues be next year to achieve the residual income target? 2 6.2.2. By what percent would the division's Return On Investment next year exceed the desired rate of return? TOTAL MARKS 5 860 000 1 210 000 N$ 90 000 MARKS 3 3 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets start by calculating the Return On Investment ROI and Residual Income for the Eyesec Data Division for the 4th Quarter of 2022 Return On Investme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started