Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) Compute the book value of the equipment at the end of the project. show work B) Compute the after-tax salvage value. C) Compute the

A) Compute the book value of the equipment at the end of the project. show work

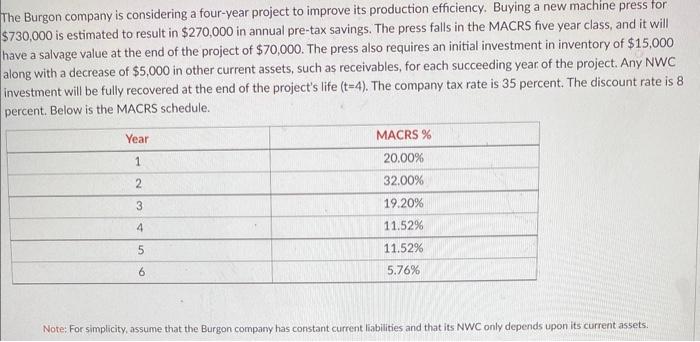

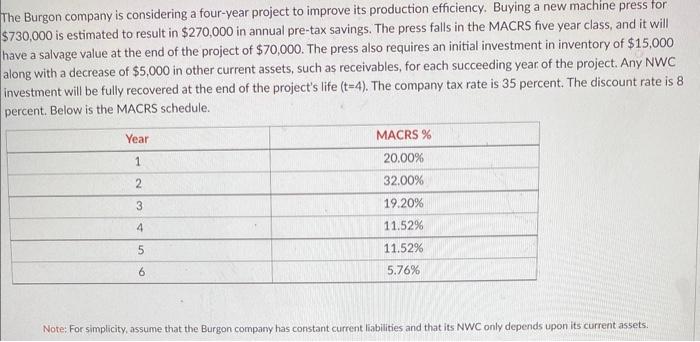

The Burgon company is considering a four-year project to improve its production efficiency. Buying a new machine press for $730,000 is estimated to result in $270,000 in annual pre-tax savings. The press falls in the MACRS five year class, and it will have a salvage value at the end of the project of $70,000. The press also requires an initial investment in inventory of $15,000 along with a decrease of $5,000 in other current assets, such as receivables, for each succeeding year of the project. Any NWC investment will be fully recovered at the end of the project's life (t=4). The company tax rate is 35 percent. The discount rate is 8 percent. Below is the MACRS schedule. Note: For simplicity, assume that the Burgon company has constant current liabilities and that its NWC only depends upon its current assets B) Compute the after-tax salvage value.

C) Compute the Operating Cash Flows for the Burgon Company for Year 1 through Year 4.

D) Does the firm face any Opportunity Cost from investing? explain and show work

E) Construct the Total Cash Flows of Investment for Year 0 through Year 4

F) Should the project be accepted or rejected? Calculate the NPV of the project. Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started