Answered step by step

Verified Expert Solution

Question

1 Approved Answer

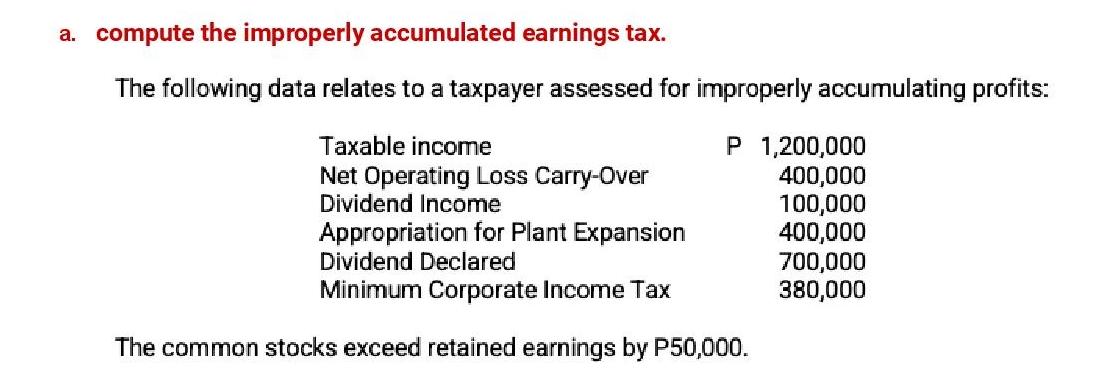

a. compute the improperly accumulated earnings tax. The following data relates to a taxpayer assessed for improperly accumulating profits: Taxable income Net Operating Loss

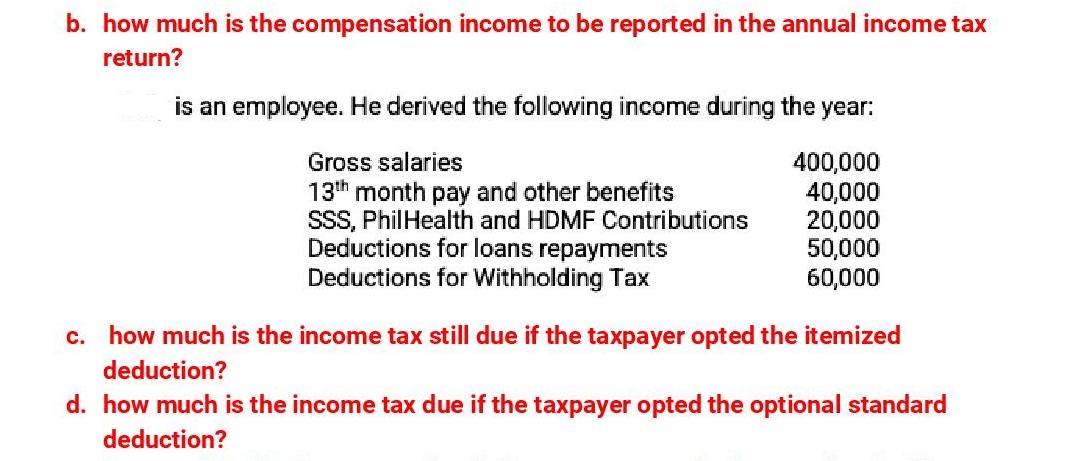

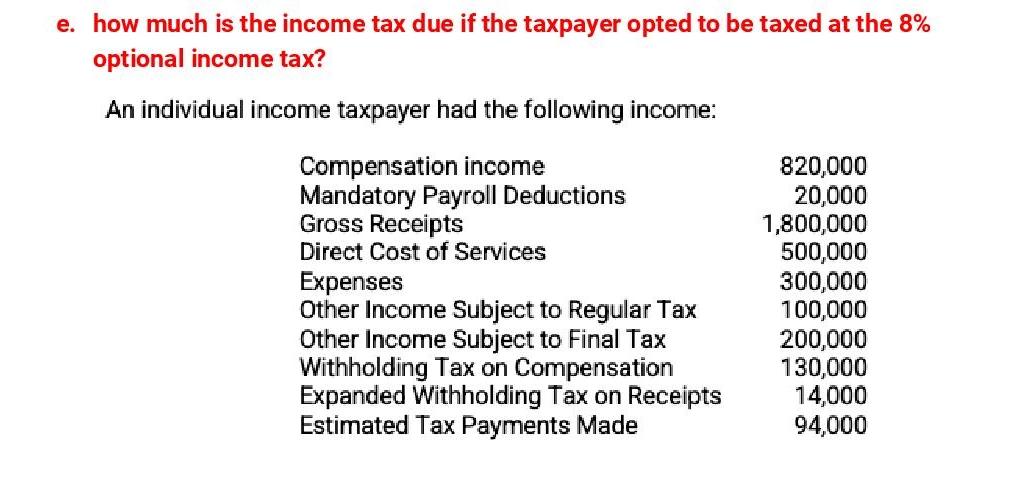

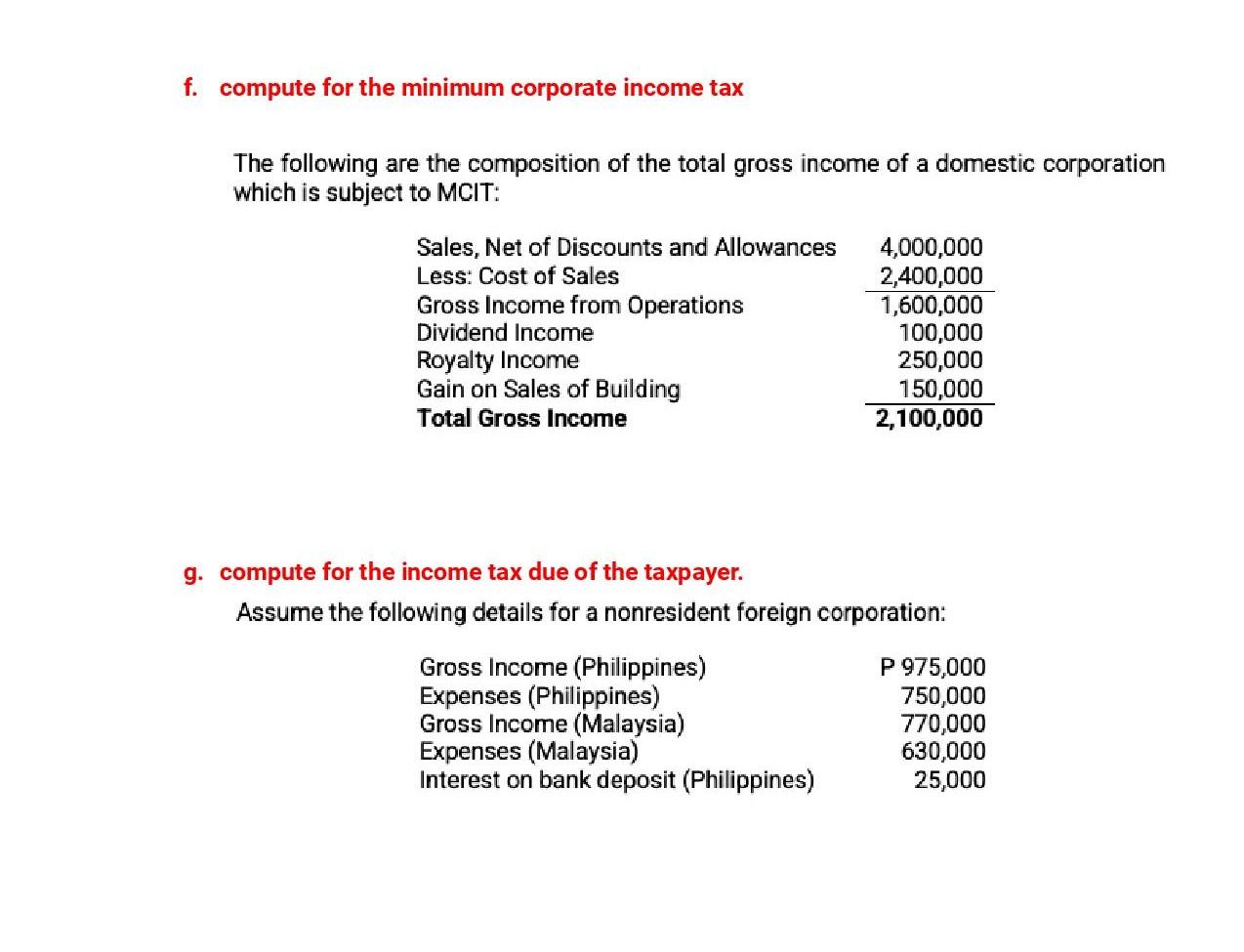

a. compute the improperly accumulated earnings tax. The following data relates to a taxpayer assessed for improperly accumulating profits: Taxable income Net Operating Loss Carry-Over Dividend Income P 1,200,000 400,000 100,000 400,000 700,000 380,000 Appropriation for Plant Expansion Dividend Declared Minimum Corporate Income Tax The common stocks exceed retained earnings by P50,000. b. how much is the compensation income to be reported in the annual income tax return? is an employee. He derived the following income during the year: Gross salaries 13th month pay and other benefits SSS, PhilHealth and HDMF Contributions Deductions for loans repayments Deductions for Withholding Tax 400,000 40,000 20,000 50,000 60,000 c. how much is the income tax still due if the taxpayer opted the itemized deduction? d. how much is the income tax due if the taxpayer opted the optional standard deduction? e. how much is the income tax due if the taxpayer opted to be taxed at the 8% optional income tax? An individual income taxpayer had the following income: Compensation income Mandatory Payroll Deductions Gross Receipts Direct Cost of Services Expenses Other Income Subject to Regular Tax Other Income Subject to Final Tax Withholding Tax on Compensation Expanded Withholding Tax on Receipts Estimated Tax Payments Made 820,000 20,000 1,800,000 500,000 300,000 100,000 200,000 130,000 14,000 94,000 f. compute for the minimum corporate income tax The following are the composition of the total gross income of a domestic corporation which is subject to MCIT: Sales, Net of Discounts and Allowances Less: Cost of Sales Gross Income from Operations Dividend Income Royalty Income Gain on Sales of Building Total Gross Income g. compute for the income tax due of the taxpayer. Assume the following details for a nonresident foreign corporation: Gross Income (Philippines) Expenses (Philippines) Gross Income (Malaysia) 4,000,000 2,400,000 1,600,000 100,000 250,000 150,000 2,100,000 Expenses (Malaysia) Interest on bank deposit (Philippines) P 975,000 750,000 770,000 630,000 25,000

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

answer a To compute the improperly accumulated earnings tax we need to determine the taxable income and the excess accumulated earnings Taxable income Taxable income Net Operating Loss CarryOver Divid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started